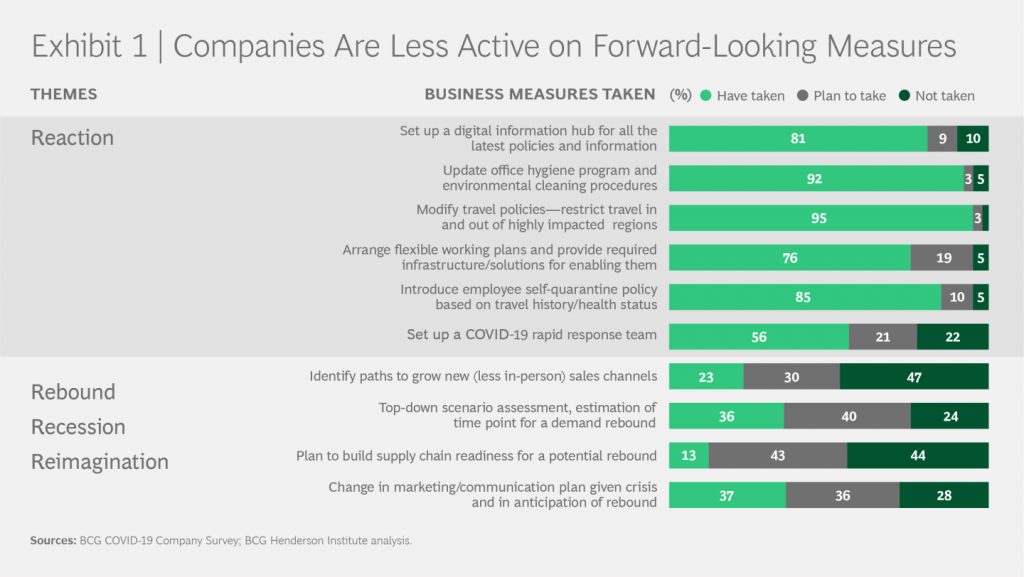

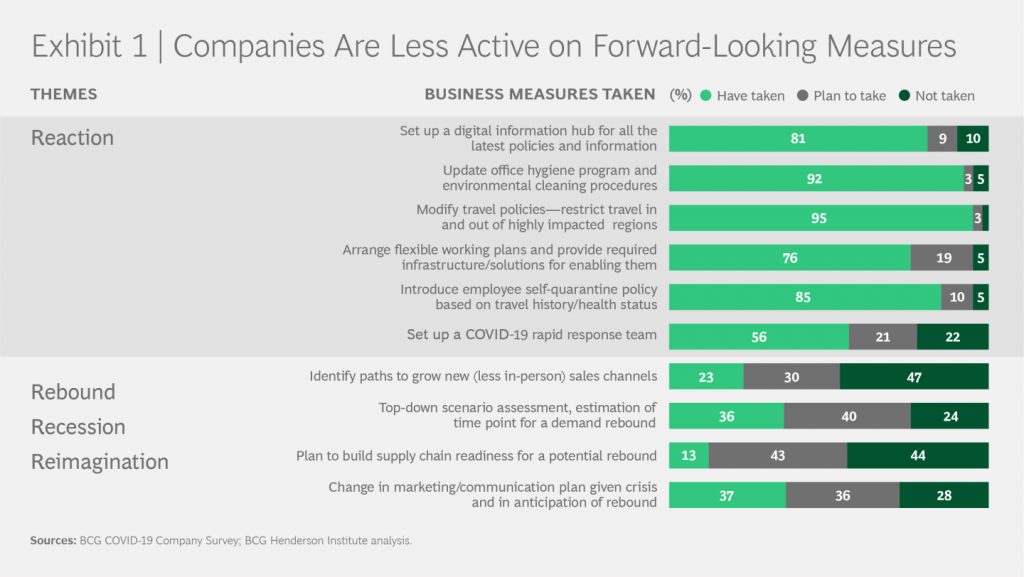

SARS is credited with being one of the accelerators for the adoption of e-commerce in China and the rise of Alibaba. We should not expect that the resolution of the Covid-19 epidemic will be a return to a 2019 reality. Many organizations are understandably focused on reacting to and coping with the short term challenges presented by the unfolding epidemic. (See Exhibit 1.) But in addition to Reaction, they need to focus attention on 3 more important R’s: Rebound, Recession and Reimagination. Beyond individual companies, there is also an opportunity for society as a whole to reimagine norms, behaviors and platforms for coordination and collaboration.

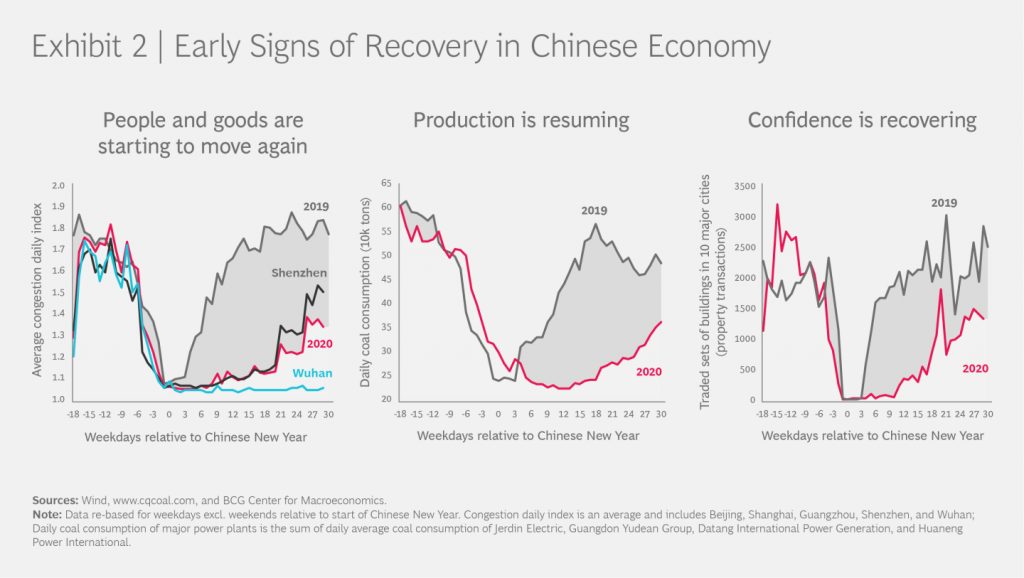

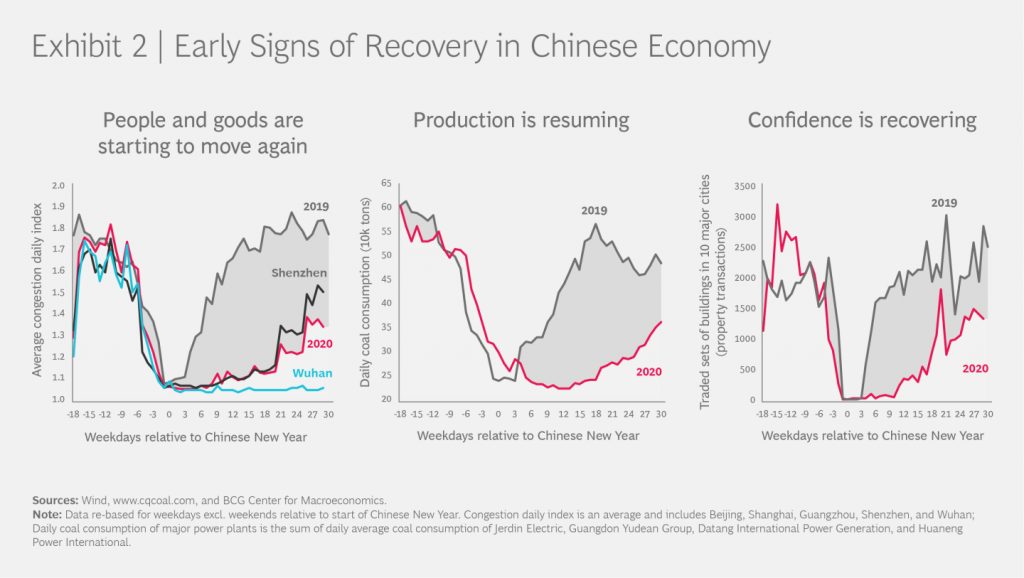

A rebound of demand is inevitable, and using high-frequency data proxies for the movement of goods and people, production and confidence, we can see that it is already beginning to happen in China. (See Exhibit 2.) Given the complexity of rebooting companies and supply chains at different speeds in different places, the time to begin preparing a rebound strategy is now.

Over the past 100 years, epidemics have only temporarily deflected the economic cycle with short, sharp shocks. Of course, this time could be different. A bear market (technically a 20% decline) does not guarantee a recession but indicates a high probability of one. The most recent expansionary cycle has been one of the longest in recent economic history and signs of vulnerability were already showing in trade relations, political instability, corporate debt and other areas. The shock to demand and confidence could easily tip the global economy into a recession.

Prudent companies will prepare for this possibility. Our analysis shows that 14% of companies across all sectors actually grow top and bottom lines during recessions and downturns. Those who flourish share the common traits of preparation, preemption, growth orientation and long term transformation. They take a long term view and place growth bets when competitors are retrenching.

And even after the epidemic recedes, and even in the case of recession, there will be opportunities and needs to reimagine business and operating models and also the portfolio of offerings. For the average company, the first causality of a crisis is imagination. But those shape and benefit from the future will be those who can imagine it.

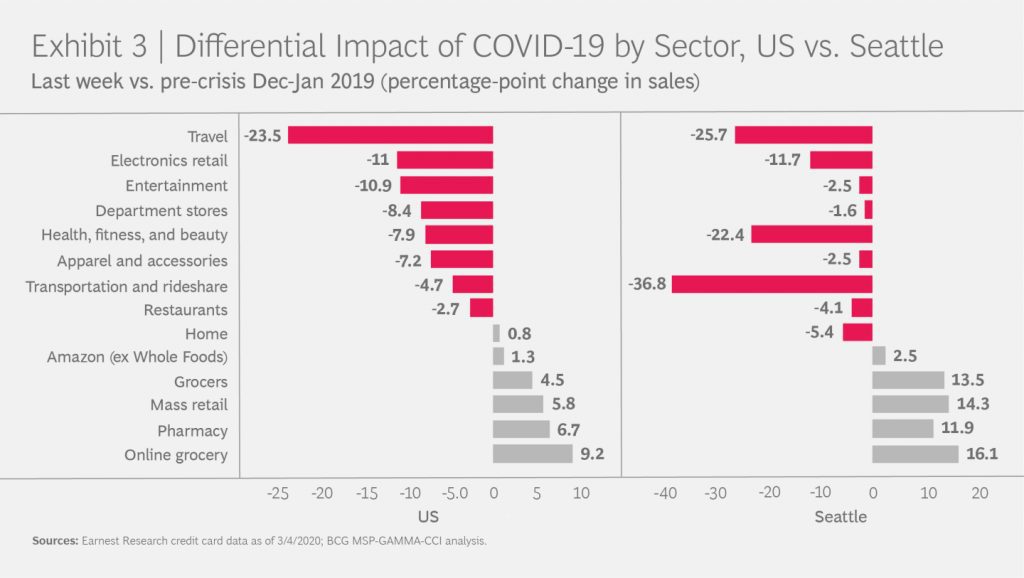

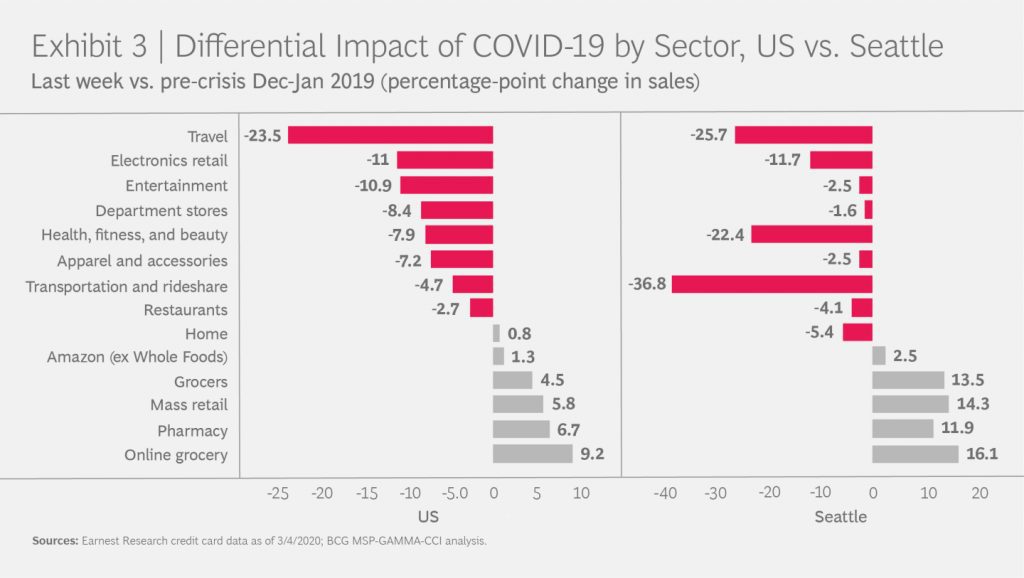

We can already see hints of the post-crisis future in shifts in consumer behaviors, which are driving diverging patterns of consumption and stock price recovery across different sectors. (See Exhibit 3.)

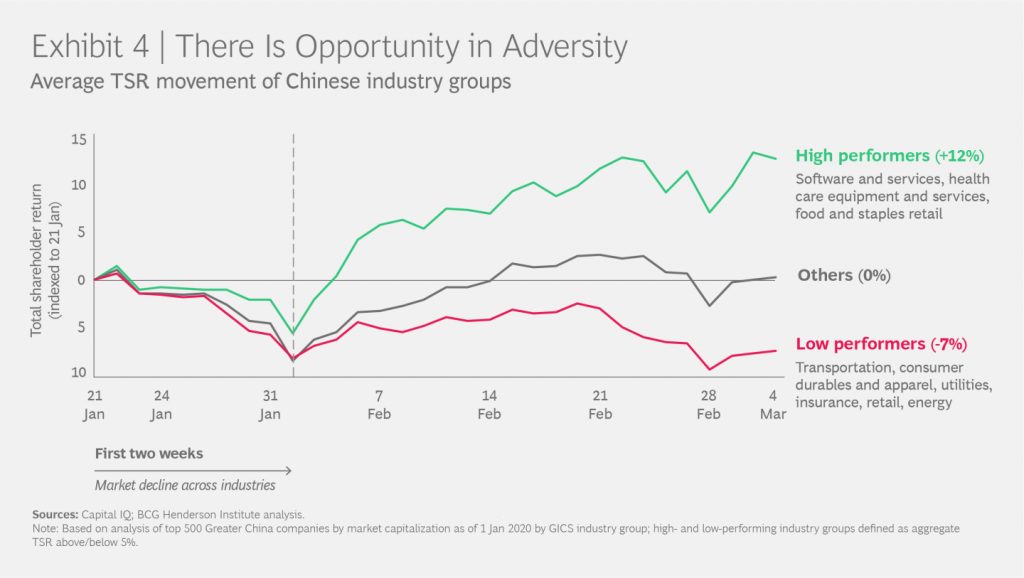

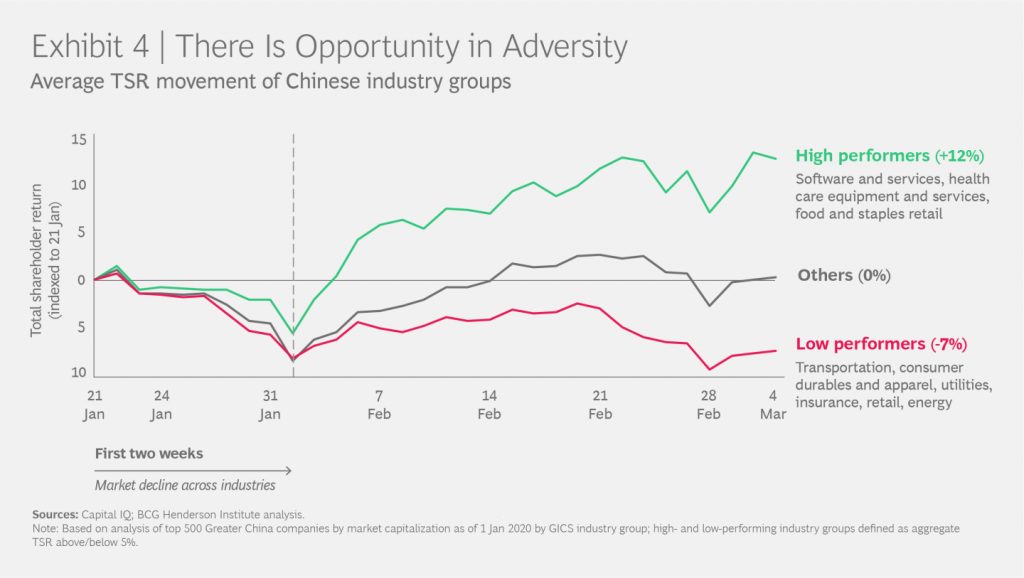

In China, the stock indices of all sectors dipped sharply in parallel, but after this initial shock, different sectors recovered at different speeds. Some, such as transportation and consumer durables, continue to be depressed; most are already recovering to pre-crisis levels; and others, like software and healthcare equipment and services, have already exceeded their pre-crisis levels. (See Exhibit 4.)

In anticipating this new post-crisis world and seizing opportunity in adversity, we need to think consider several shaping forces: new learnings, new attitudes, new habits and new needs.

A crisis is like a receding tide — it reveals the rocks beneath the surface that were there all along. While some organizations will likely resume operations after the crisis without looking back, others will be carefully examining lessons learned and regarding them as opportunities to improve their organizational effectiveness. They will find opportunities to improve foresight, agility and resilience through improvements in market intelligence, risk assessment, scenario planning, crisis management, communications, remote working, workforce redeployment, supply chain resilience, cross company collaboration, IT infrastructure and many other areas. And each of these will in turn generate opportunities for the suppliers of software, hardware and services to enable these enhanced capabilities.

The crisis will also shift consumer attitudes, creating elevated awareness of altered beliefs about personal and environmental hygiene, health, social relations, travel and crisis preparedness. This is already driving up demand for sanitizers, antibacterial cleaning products, healthcare advice, healthcare insurance, disaster preparation products, O2O (online to offline) delivery and other many other categories.

Some new behaviors forced by the crisis will likely stick as new habits after the epidemic has receded. These may include remote working and home shopping, which will drive opportunities for connectivity, distance learning, video conferencing, home office equipment, e-commerce, delivery services and the like. Corporations and employees too may see opportunities to reduce travel and physical colocation on an ongoing basis, having been forced to master the art of effective remote collaboration.

And some unmet needs will be revealed, which can become targets for innovation. Already we see Chinese companies, who have had more time to adapt to the crisis, creating new types of health insurance, and new types of online to offline business models. We will likely see innovations sprouting in home shopping, collaboration, health information, health and hygiene products and cleaning products, and hygiene benefits being created for all manner of services and products.

How can companies grow into and shape these emerging opportunities? We suggest 6 key success factors:

- An “opportunity in adversity” mindset. Macroeconomics is not fate. Economics deals with aggregates and averages, whereas strategy is about creating deviations from these averages. Companies which will flourish during and beyond the crisis believe in and seek out advantage in adversity. And the evidence is that such opportunities exist in every sector.

- Looking ahead. While the average company will likely be focused on the crisis itself, some are looking ahead at the inevitable rebound in demand, at the possibility of recession and at the opportunities to innovate and rethink their business models. They are prepared for different scenarios, but are actively shaping their own fate.

- Picking up weak signals. Many companies, experiencing a shock to demand and chaos in their supply chains will be mainly preoccupied with managing immediate challenges. Those who look at at a more granular level, will see that the demand for some categories is increasing, that customers are asking for things that are not currently available or that companies in their own or other sectors are innovating how they do business. In fact, within your own organization, there are likely multiple groups which are departing from standard procedures in order to manage new circumstances. Learning organizations are asking, what those innovations are and how they can be codified and amplified. Picking up weak signals means first and foremost, having access to signals, through access to high frequency (daily), granular data on shifting patterns of beliefs, behaviors and demand and by listening very closely to customers.

- De-averaging the portfolio. Many companies see crises as things to be coped with. More enlightened companies also focus on the longer term and create a strategy — namely an advantaged end state and a path and plan to reach it. The most enlightened companies do this in a de-averaged fashion, by creating different priorities and strategies for different parts of the business. In particular they identify and supporting new emerging growth pillars.

- Moving fast. One of the main characteristics of this epidemic is that it is developing and changing faster than most organizations can easily track, let alone think ahead of. A daily clock speed is necessary to keep up with events. But this applies not only to crisis management, but also to innovation and new business build activities. The weak signals of demand shifts and new needs are already present and waiting to be read, interpreted and actioned by agile companies

- Transform. The long term transformation agenda for a company does not go away during a crisis, but attention can easily be drawn away from it. In fact, the long term agenda likely requires renewal, since the end state may have shifted. Our research suggests that companies which flourish during a crisis are those using it as an opportunity to double down on their long term transformation plans.

At the level of society too we have an opportunity to reimagine travel, healthcare systems, the role of technology and the supra -national coordinating institutions like the WHO, who play a critical role in crisis management.

There is opportunity in adversity in every business. It may seem callous to stress opportunity in the midst of a humanitarian crisis, but leaders have an obligation to look ahead, to anticipate and meet new customer needs, to evolve their strategies and organizations, and in so doing sustain the prosperity of their enterprises.