Quick take

By Philipp Carlsson-Szlezak and Paul Swartz

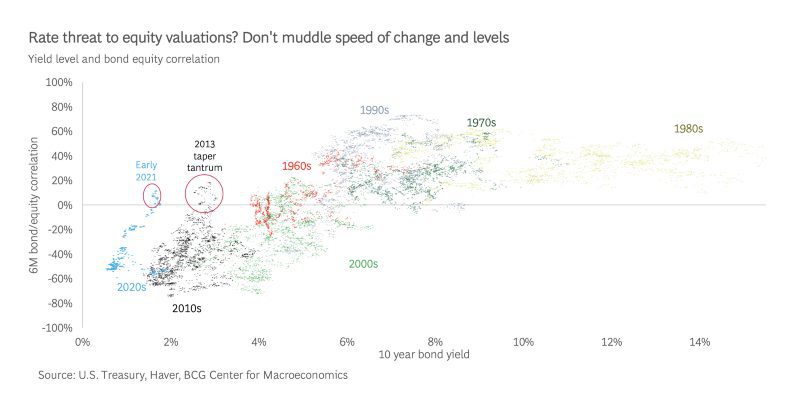

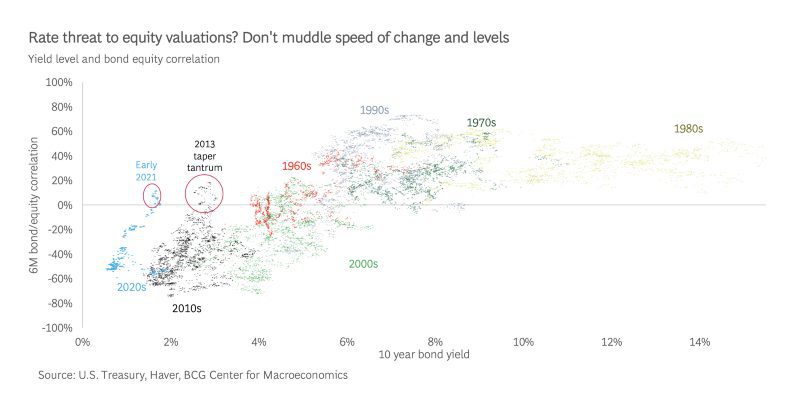

Are equity prices too high and a painful comeuppance in the offing? The risk of rising interest rates is a dominant market fear, as demonstrated earlier this year when rates spiked and equity markets shuttered. Yet, as rates stabilized equity markets notched new highs — so should we fear rising rates or not? We use two key visuals to illustrate the long-term dynamics of bond-equity correlations and why rate levels and their speed of change are two very different threats to equities.

Read more

About the authors

Philipp Carlsson-Szlezak is a partner and managing director in BCG’s New York office and chief economist of BCG. He can be reached at Carlsson-Szlezak.Philipp@bcg.com

Paul Swartz is a director and senior economist in the BCG Henderson Institute, based in BCG’s New York office. He can be reached at Swartz.Paul@bcg.com