In a recent discussion on uncertainty, an executive shared with me her concern that although increasing uncertainty requires that we focus on resilience to the unknown, and multiple risks currently abound, we need to avoid the waste and paralysis of planning for all possible unknowns. She had a point. Resilience is always in relation to some specific disruptive force. A company might be fully hedged and resilient with respect to interest rates, but highly vulnerable to say reputation risk. And it’s true that risks abound: the recent IMF global economic update was as much a treatise on multiple intersecting risks as it was a specific forecast for economic growth.

Fortunately, there are several strategies to avoid modeling everything.

1. Design resilience principles into systems. As we have written about previously, resilient systems share a number of common characteristics. They exhibit redundancy– buffers against the unexpected, diversity — different ways of thinking and acting for new situations, modularity — firebreaks to contain damage, evolvability — learning and adapting to new situations, prudence — design for surviving foreseeable downside scenarios, and embedding — coherence with higher level systems, like society and the natural ecosystems. By designing these principles into strategies and systems, one can avoid the need to model all relevant scenarios. For example, an evolvable system can learn in the face of both anticipated and unanticipated events.

2. Treat scenarios as learning exercises. A scenario is not a forecast, but rather a stress test around a plausible and coherent set of possibilities. Systems and risks are often highly connected so that when one variable is stressed, it creates knock-on effects on other variables. By observing how the company reacts, and what follows from what, one can gain an understanding that extends beyond the specific target variable. Such learnings constitute a large part of the value of a scenario exercise.

3. Seek out and learn from stressed environments. One does not have to wait for the perfect storm. Any business faces customers, segments, competitors and markets that put the business model under stress. By focusing on these or even proactively seeking them out, one can learn valuable hands on lessons about how resilient a company is. For example, by conducting a “maverick” exercise, where it is assumed that challengers that are betting against a company’s business model become successful, one can both narrow down the terms of the threat and also think though its potential effects before facing full-on competition in the market place.

4. Focus on variables that break first. Take note of the current levels for each risk factor and imagine the impact of doubling or tripling the level of that risk. For example, double tariff rates, or double interest rates, and see what breaks first in the business model. Focus further attention on those variables and aspects of the business. While many scenarios are theoretically possible, each business usually has a handful of critical risks that are both plausible and of high sensitivity.

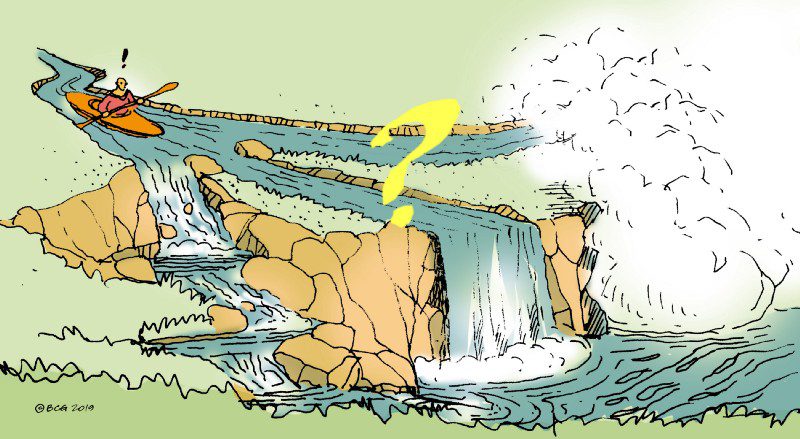

5. Focus on agility. Forecasts in complex times are usually wrong. But just as cardiologists often focus on recovery time after stress as an indicator of heart health, so can the recovery time from unexpected business stress be a powerful indicator of resilience. It’s usually not hard to figure out whether you recover from industry stresses, like drops in demand or new regulations, faster or slower than your competitors. And there are many measures that can be taken to reduce complexity and increase agility to enhance your resilience.

6. Train on resilience thinking. Managers are usually so well-trained to maximize short-run efficiency and financial outcomes that they may find it hard to think about the trade-offs with resilience. Fortunately, resilience thinking and system thinking are eminently trainable.

It’s therefore possible to prepare for the unexpected without boiling the ocean, and it’s increasingly worthwhile to do so. We don’t usually think of resilience as a basis for competitive advantage, but when companies compete not only on how good their current game is, but now long that game lasts, resilience can separate companies that thrive from those that languish and decline.