Data suggests that the majority of companies are preoccupied with reacting to the disruption caused by COVID-19 and readying themselves for a possible recession.[1]BCG survey of more than 300 companies’ COVID-19 response actions as of 15 April But there is also competitive advantage in adversity for those who seek it. Previous shocks created lasting shifts in the business environment, and COVID-19 will likely do so as well. Companies that can reimagine their business models to capture the resulting new opportunities will come out ahead. For many firms, this reimagination will require a growth-focused transformation: previous research identified that the majority of value in successful transformations comes from growth and a growth orientation is a key success factor.

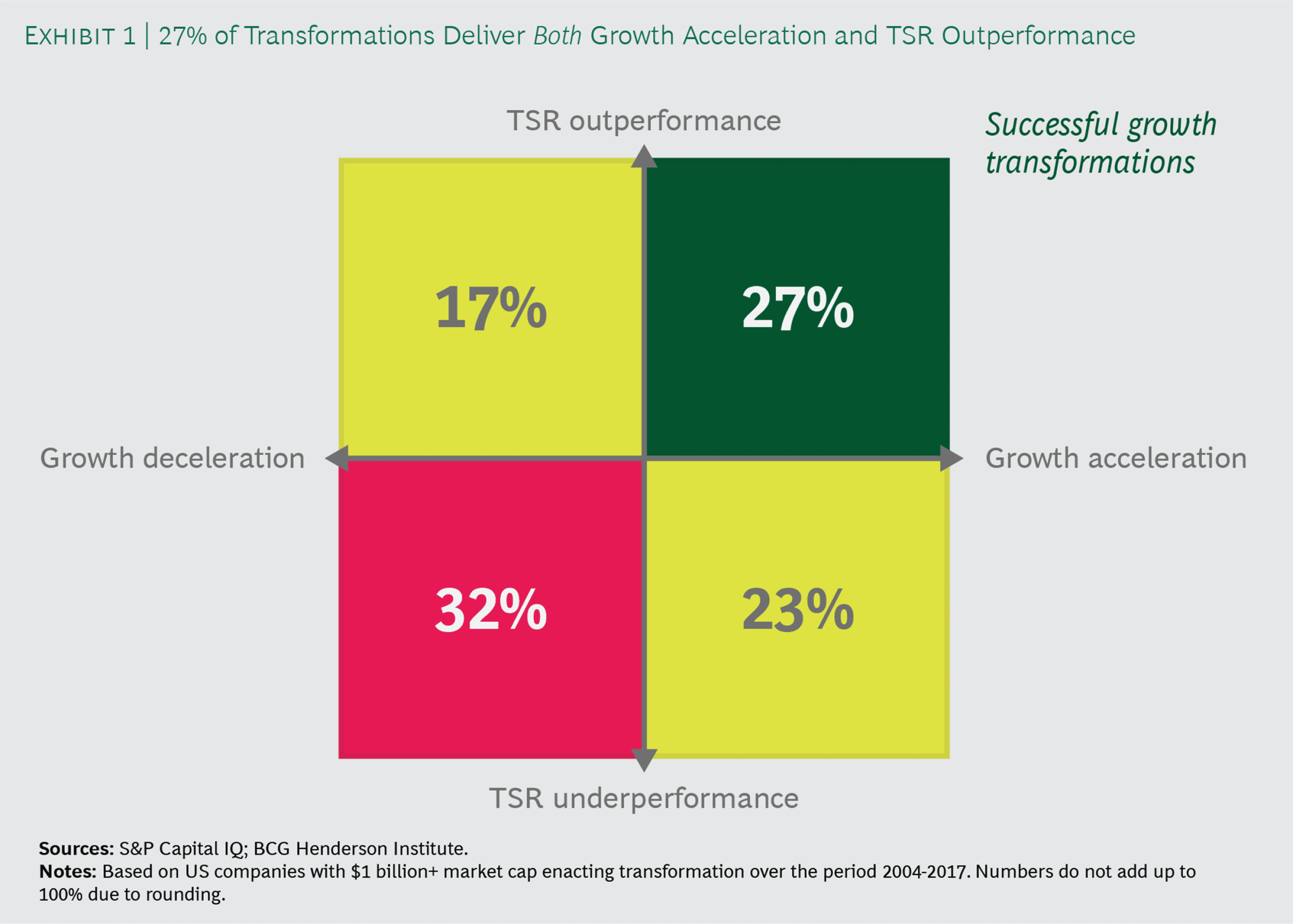

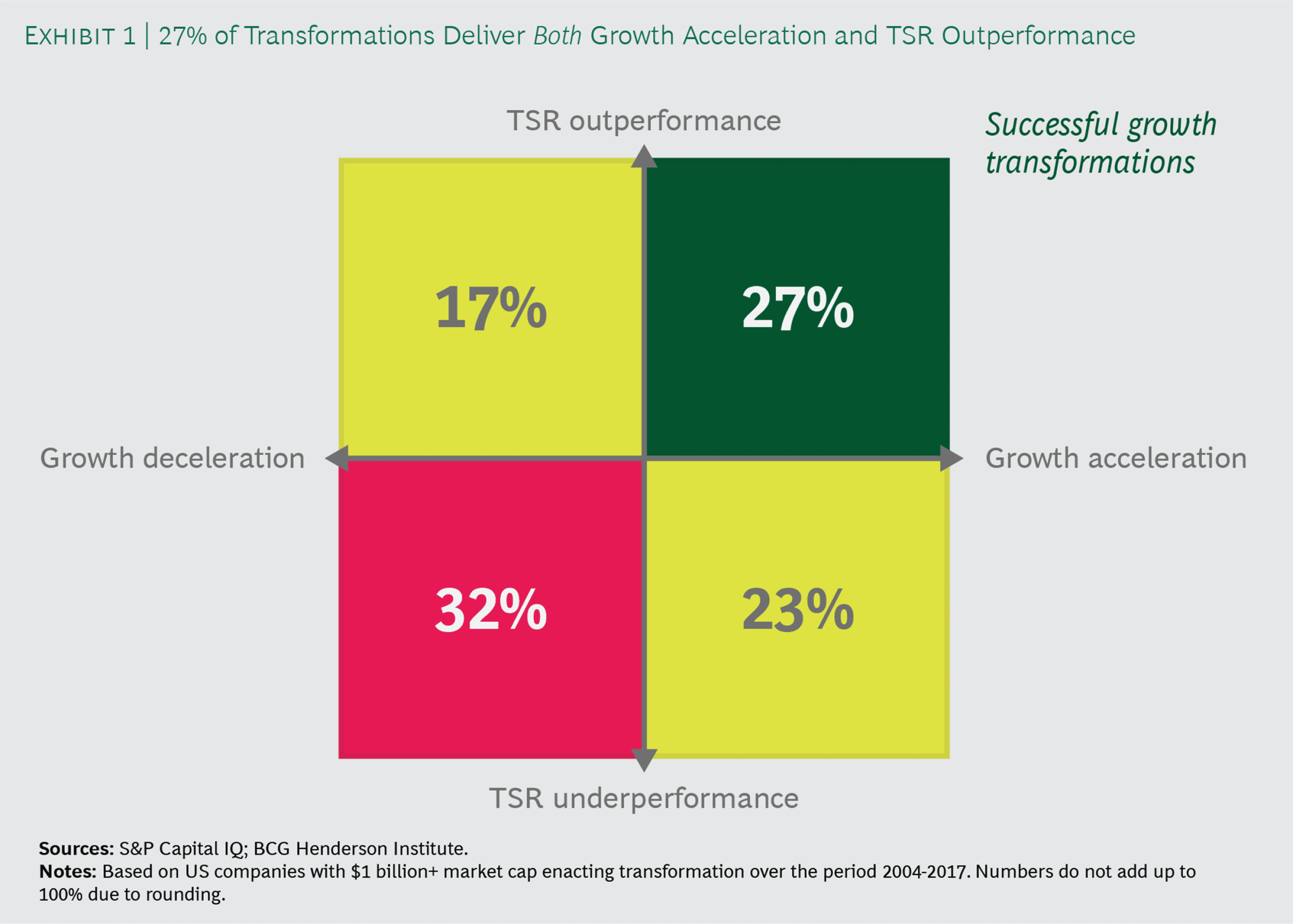

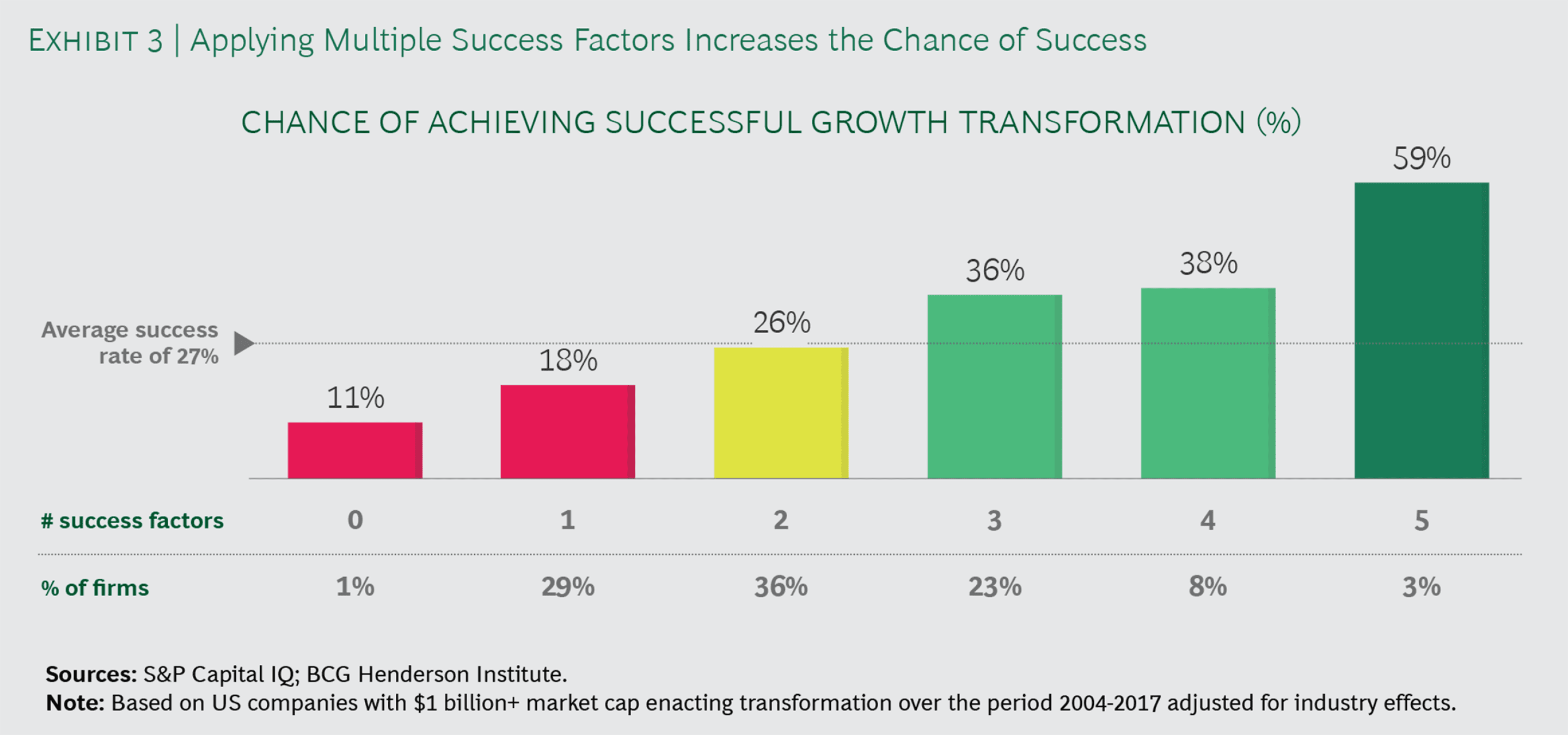

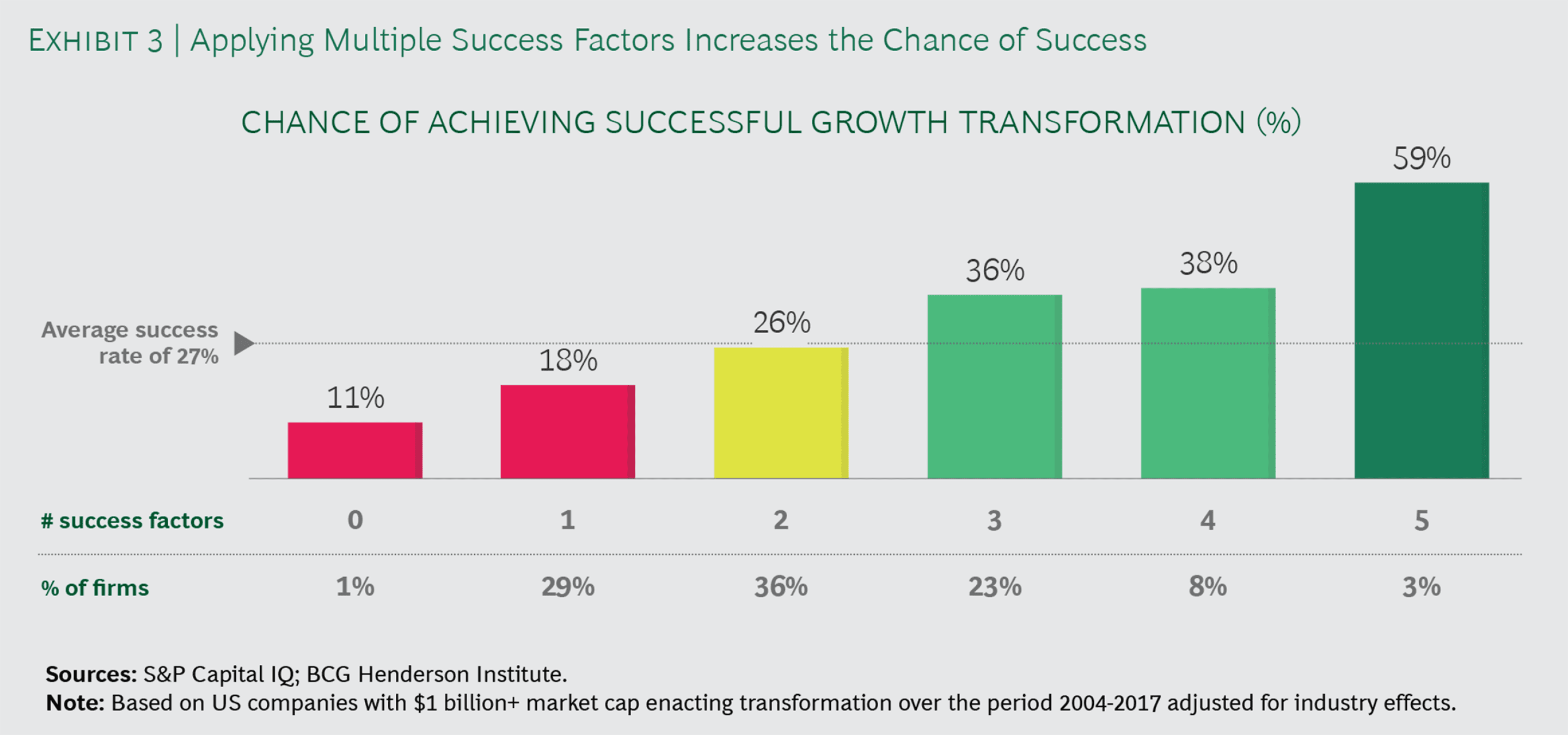

However, successfully transforming for growth is hard. Only 27% of transformations both sustainably accelerate growth and outperform in creating shareholder value. To help companies increase their odds of successfully transforming for growth, we applied an evidence-based approach to identify and study 735 US transformations. Our analysis identified seven success factors spanning leadership, strategy and culture that can serve as the starting point for a growth transformation playbook.

Long odds of success

A successful growth transformation is one that both sustainably accelerates growth and generates shareholder value. We measure growth acceleration as the improvement in a company’s annualized revenue growth rate in excess of industry average over the five years after a transformation is launched, compared to its growth rate before the transformation; and we measure shareholder value as the total shareholder return outperformance (TSRO) the company delivers in excess of industry average over the five years after a transformation is launched. (See below for more details on methodology).

Transforming for growth is difficult. Only 27% of the transformations in our sample were successful (See Exhibit 1). This difficulty stems from the need to grow in a way that also creates shareholder value — 23% of transformations actually managed to accelerate growth but failed to generate TSRO. However, those that were successful generated significant value. Successful growth transformations generated 11ppts more growth acceleration and 12 ppts more TSRO than an ‘average’ transformation.

The economic stress caused by COVID-19 should not dissuade companies from pursuing growth. During the 2008–2009 financial crisis 35% of transformations led to successful growth, 8 ppts higher than average. Though the COVID-19 crisis brings many challenges, firms that can reimagine their business models for the post-COVID world may yet find opportunities to transform for growth.

Seven ways to increase your chance of success

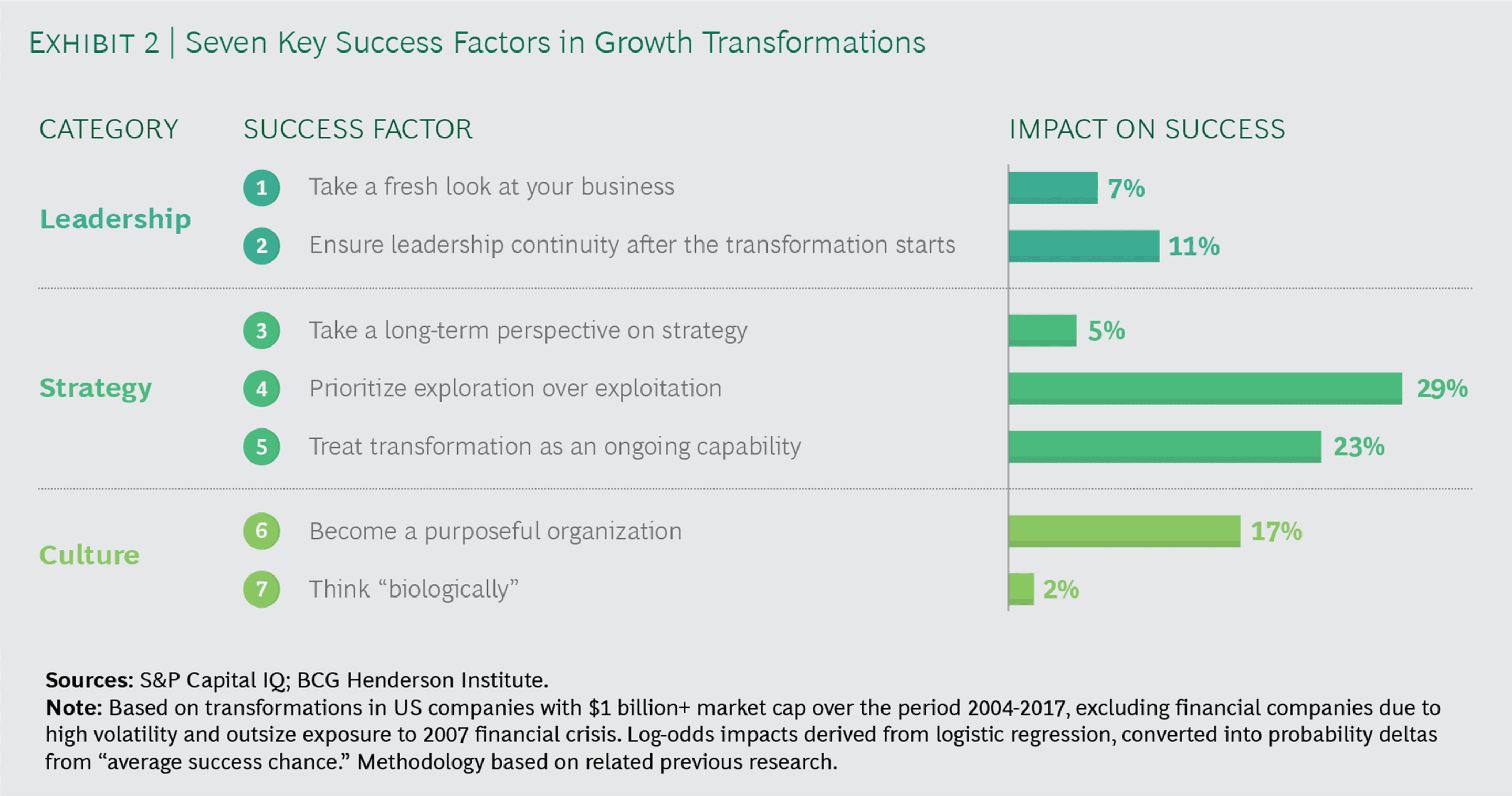

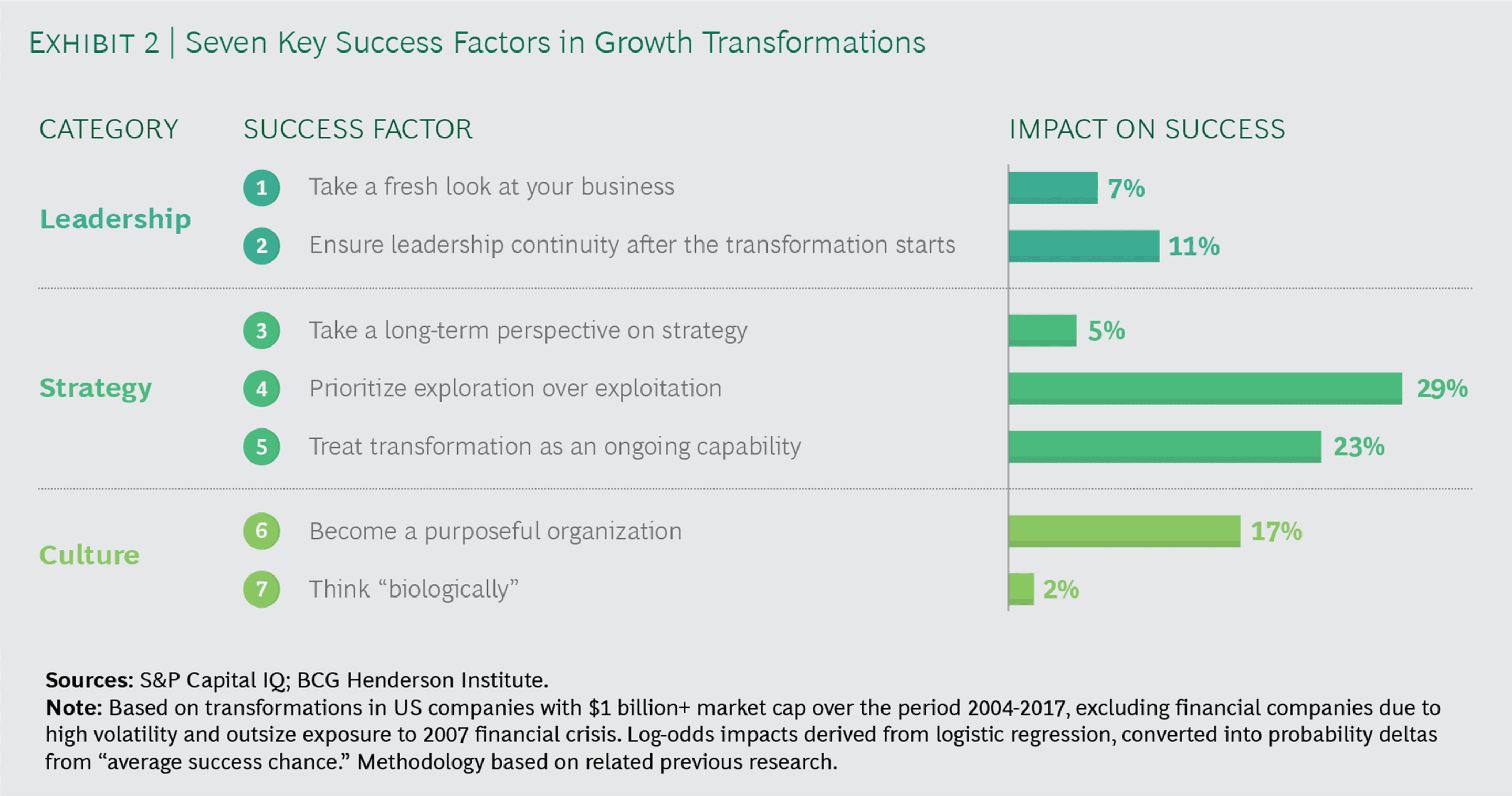

Given the long odds of success for growth transformations, it is important to understand what can be done to improve them. We identified seven factors spanning leadership, strategy and culture that characterize successful growth transformations, and measured their impact on success.

Leadership

CEOs play an important role in a transformation’s success. They can bridge business silos, allocate resources, and role model necessary cultural changes. This is particularly important for growth transformations, which can often take companies into unfamiliar territory in the pursuit of new revenue opportunities.

Take a fresh look at your business

Transformations are infrequently accompanied by a CEO change. Only 14% of transformations coincide with a change in top management, barely higher than the 11% CEO churn in an average year. However, in line with our earlier research, we found that starting with a new CEO can boost the odds of a successful growth transformation by 7ppts, rising to 10ppts if the new CEO is also an external hire.

Many incumbent CEOs do lead successful transformations — our finding describes an aggregate pattern, not a rule. But this pattern suggests that an outsider’s perspective can be helpful when identifying growth opportunities and impediments. Incumbent CEOs who want to add an outsider’s perspective to their toolbox can take actions to break free of their traditional processes and mental models, such as using strategy games to explore an expanded range of possibilities that do not exist today.

Case study — Microsoft 2014: How a new CEO can unlock growth potential

Satya Nadella, who was hired as Microsoft’s CEO in 2014, described himself as an “Insider-Outsider” due to his background in the company’s Cloud and Enterprise group rather than the then-dominant Windows division. This outsider perspective helped him identify Microsoft’s existing Windows-first strategy and internal silos as obstacles to the growth potential new offerings, which led him to initiate a transformation of Microsoft to Cloud/Mobile-first and to increase internal collaboration. Since his appointment, Nadella has accelerated Microsoft’s revenue growth from 8% to 14% and tripled its share price.

Ensure leadership continuity after the transformation starts

Though new leadership at the start of a transformation increases its chance of success, we found that CEO churn during a transformation is linked to an 11ppt lower chance of success.

A CEO change during a transformation can lead to a sense of directionless that can reduce the odds of a growth transformation being successful. In addition, a change during a transformation can send a negative signal that erodes investor confidence and stakeholder buy-in, further decreasing the odds of success.

There is another way to view our leadership continuity finding. Only 7% of the companies we studied changed their CEO during a growth transformation. As CEOs are unlikely to leave a company voluntarily during a major transformation, these CEO changes are likely involuntary and perhaps a response to an already badly off-track transformation. Thus, our finding could actually be read as evidence that when a transformation is off-track, a new CEO is unlikely to be able to rescue it within the original schedule. This underscores the importance of finding the right leadership at the start of the transformation process.

Strategy

While specific strategies for growth vary heavily by company and context, we found three lessons that apply broadly: taking a long-term view on strategy, taking an exploratory approach to growth, and investing in a company’s ongoing transformation capabilities all increase the chances of achieving a successful growth transformation.

Take a long-term perspective on strategy

To understand the extent to which companies take a long-term perspective on strategy rather than focusing on immediate issues, we used a proprietary natural language processing algorithm to score the degree of long-term thinking expressed in companies’ annual reports. We found that companies that take a long-term perspective on strategy are 5ppts more likely to successfully transform for growth.[2]Above industry average long-term-orientation over the five years after the transformation was launched

Firms that take a long-term perspective prioritize sustainable growth and shareholder value over short-term returns and make strategic decisions on multiple timescales simultaneously. These firms understand that an ‘optimal’ growth transformation may take several years to come to fruition and don’t seek growth through a sequence of short-term initiatives.

Case study — Activision Blizzard 2008: Increasing long-term orientation in the business model to drive valuable growth

In 2008 most major computer game companies used a cyclical business model: they developed a game, sold it to customers for a one-time fee and worked towards their next launch. Activision saw an opportunity to grow customer lifetime value by switching to a subscription model based around smaller monthly payments and more frequent, incremental, updates to games from their main franchises. They did so through a merger with Blizzard, one of the few companies operating a game subscription service at the time. The newly formed Activision Blizzard turned its subscribers into a dedicated fan base by developing spinoff products that ranged from virtual card games through to novels and a Hollywood movie. The steps it took to increase its customer lifetime value paid off. Between 2008 and 2018 the company grew its annual revenue by 10% (+2ppts compared to industry) while delivering an average annual TSR of 19%.

Prioritize exploration over exploitation

Companies can pursue growth in different ways. They can exploit existing products and services, for example by selling more of them to existing and new customers, or they can explore new revenue opportunities. CAPEX investments generally suggest a company has the intention of exploiting existing opportunities by expanding capacity. In contrast, R&D is generally focused on exploring new possibilities and generating new product and service offerings.

We found that growth transformations accompanied by high CAPEX spend vs industry are 11ppts less likely to succeed, whereas those with high R&D spend vs industry are 29ppts more likely to succeed.[3]Above industry average cumulative R&D or CAPEX (respectively) as a percentage of cumulative revenue over the five years after the transformation was launched

Our finding suggests that a growth-oriented company should generally think beyond increasing the sales of its existing products. Firms should invest in developing new offerings and find ways to continually reinvent themselves. Though exploration can seem riskier than exploitation, companies willing to explore can reap significant rewards.

Case study — Bristol Myers Squibb 2011: Growing in new area by increasing focus on R&D

The biopharma company Bristol Myers Squibb initiated a transformation from a diversified health care company into biopharma pure play with a strong focus on R&D. As part of the overall transformation, BMS identified immuno-oncology as a major growth opportunity that a shift in their R&D approach could unlock. Not only did BMS increase R&D spending (from 17% of sales in 2011 to 23% of sales in 2019), it undertook several initiatives to empower the R&D function as not only an originator of new drugs but also as a decision maker responsible for making tradeoffs in the pipeline. As a result, BMS increased growth from -5% in 2010–12 to 6% annually and delivered 10% annual TSR between 2012 and 2019.

Treat transformation as an ongoing capability

45% of firms in our sample undertook multiple transformations between 2006 and 2019. We found that firms with a track record of at least one successful growth transformation were 23ppts more likely see their subsequent growth transformations succeed.

Our finding suggests that companies should think of transformation as an ongoing capability, especially as the basis of competitive advantage is changing faster than ever. This means that it is important to lay the groundwork for future transformations by creating an adaptive firm that embraces change and responds quickly to new opportunities as they emerge, embracing an ‘always on’ approach to transformation. It also means that firms should build up a knowledge base of successful change strategies and replace anecdotal or heuristic approaches with the emerging science of organizational change.

Case study — Equifax Inc. 2008 and 2010s: Stacking successful growth transformations amid controversy

Consumer credit reporting agency Equifax successfully transformed for growth in 2008 and again in the early 2010s. During the first transformation, the company delayered the organization and improved company processes to increase agility and created a growth council to encourage an innovative mindset, making the company better at responding to change. As a result, Equifax was able to transform digitally and develop strong data and analytics capabilities accelerating growth by serving new customer needs. In 2017 Equifax suffered a data breach that exposed its weak cybersecurity and led to a 34% decline in share price. Amid this controversy, Equifax relied on its transformation capabilities to quickly launch a security overhaul with the goal of restoring trust and so growing revenue and shareholder value. So far, the company’s share price has recovered, and its revenue continues to grow.

Culture

Culture shapes companies’ abilities to respond to change by influencing how individual employees take decisions. Cultures that instill a sense of purpose and think holistically about change increase the odds of a successful growth transformation.

Become a purposeful organization

Our analysis suggests that companies that have a stronger sense of purpose are 17ppts more likely to successfully transform for growth. As a quantitative proxy for ‘purpose’ we use an aggregate ESG score that measures companies’ commitment to a range of environmental, social and governance themes.[4]Above industry average Eikon Combined ESG score over the five years after the transformation was launched This result is in line with previous research found that purposeful organizations have higher growth rates and total shareholder returns.

A strong purpose can improve the odds of a successful growth transformation by increasing employees’ engagement with a transformation, as well as how effectively they can execute it. If employees are motivated by purpose and believe that a growth transformation is in service of their mission, they are more likely to embrace the disruption and uncertainty that can accompany a change program. In addition, if employees’ individual sense of mission is well aligned with their employer’s business model, then they are more likely to take actions that lead to positive business outcomes even without managerial oversight.

Case study — Ecolab 2011: Utilizing purpose and sustainability to drive transformation

The cleaning company Ecolab identified a concern among customers about access to clean water, which was a complementary input to Ecolab’s cleaning products, and saw clean water as an emerging customer need. In 2011, Ecolab acquired the water treatment company Nalco, starting its transformation into a global leader in water management and water treatment services. At the same time, Ecolab rebranded itself with a strong sustainability profile focusing on how much water the company saves globally with its solutions. This created a strong purpose within the organization, as the company was seen as a leader in sustainability and preserving water resources. The results have been impressive, as Ecolab has increased revenue growth from 0% to 10% annually and delivered 18% annual TSR between 2011 and 2019.

Think “biologically”

Historically, managers have tended to view their organizations ‘mechanistically’ and rely on simple cause-and-effect models to guide their thinking. However, organizations are actually embedded in a dynamic, complex world in which outcomes are inherently unpredictable. Success in such an environment can mean augmenting a traditional ‘mechanical’ approach with a ‘biological’ mindset that acknowledges the uncertainty and complexity of business problems and so addresses them indirectly.

We found that companies that think biologically were 2ppts more likely to successfully transform for growth.[5]Above industry average biological thinking over the five years after the transformation was launched Companies were scored on their degree of biological thinking using a proprietary machine learning algorithm that looks for evidence of this kind of approach in annual reports.

One approach that many biologically minded companies use to harness the dynamism and complexity of their external environment is leveraging ecosystems. By collaborating with partners and orchestrating an ecosystem around their businesses, companies can shape their environment to create mutual benefits and stay connected to emerging opportunities. This requires a culture of openness that is receptive to collaboration and exploration.

Case study — Microsoft 2014 revisited: Adopting biological thinking to foster collaboration

Microsoft was an early entrant into cloud, but despite its relative head start and ubiquity in the enterprise market, by 2014 its market share was just 11%, far lagging market leader Amazon’s 29%.[6]https://www.srgresearch.com/articles/aws-market-share-reaches-five-year-high-despite-microsoft-growth-surge Cloud success requires an ecosystem of partners to ensure access to the widest pool of technological innovation in a rapidly evolving space. At the time Microsoft’s culture was closed to external ideas (one senior leader famously called a major open source technology “a cancer”). Recognizing this, Nadella made a pivot towards a culture of curiosity, openness and learning as a central part of his Cloud First transformation. By 2019 the majority of Azure’s usage was to deploy non-Windows technologies, and Azure had achieved an average growth rate of 117%, twice that of Amazon Web Services.[7]Microsoft Annual Report 2016–2019 Azure growth rates from reportable segments vs AWS revenue CAGR derived from https://www.statista.com/statistics/233725/development-of-amazon-web-services-revenue/

Leveraging multiple factors to ensure success

Not only do the factors identified individually improve the chances of success, but their effects are additive: companies that applied more factors had a correspondingly higher chance of successfully accelerating growth and achieving TSR outperformance — rising from 11% for companies with none of the factors to 59% for the small minority that applied five. (See Exhibit 3.)

This suggests that the starting point to a growth transformation program should combine several factors, such as making sure that the right leadership is in place with a fresh perspective, considering the long-term and investing in R&D, and adopting a larger purpose and a holistic approach to change. Transformation programs are inherently risky, but by adopting evidence-based practices, companies can tilt the odds in their favor.

Structuring a growth transformation

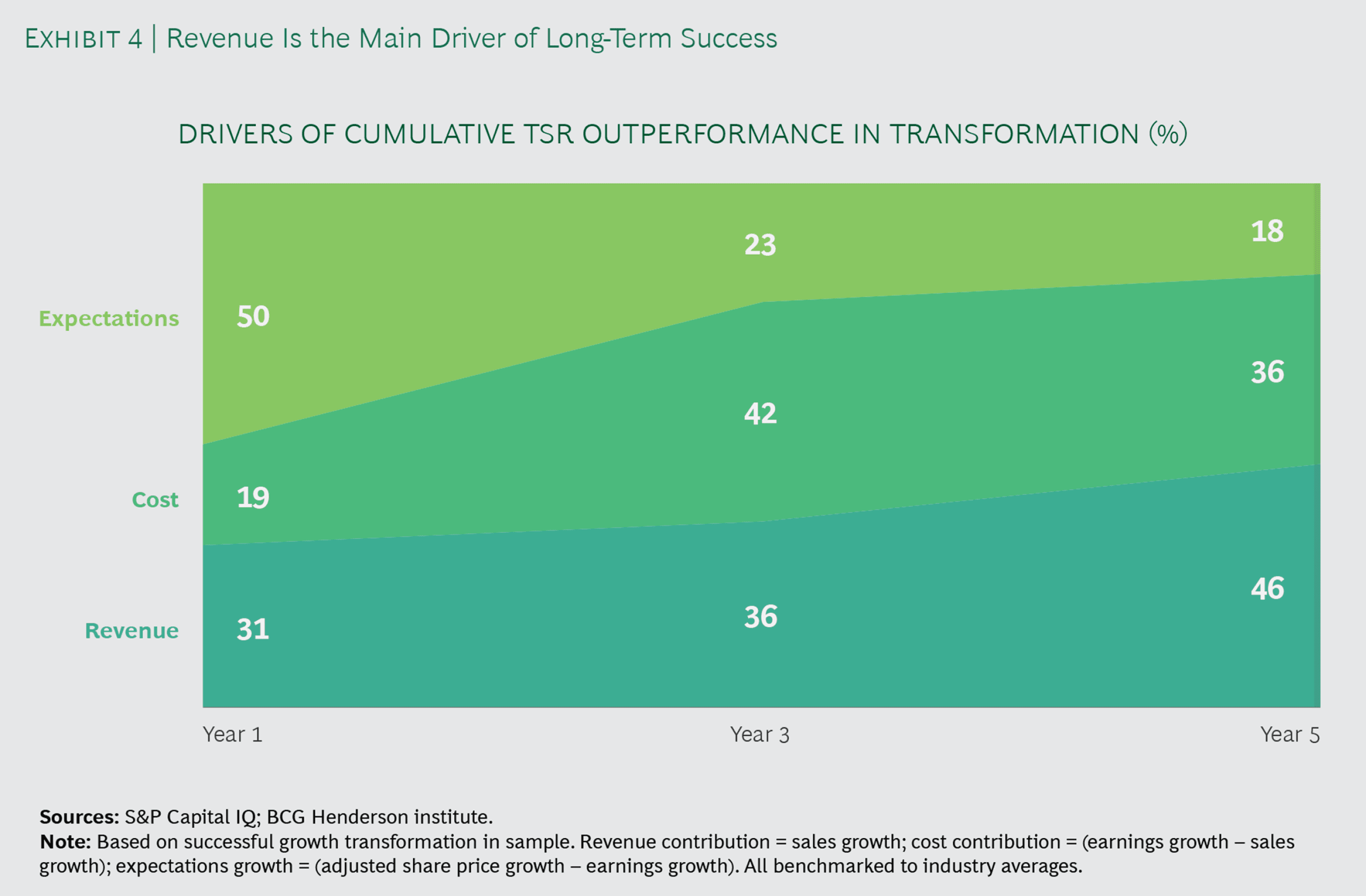

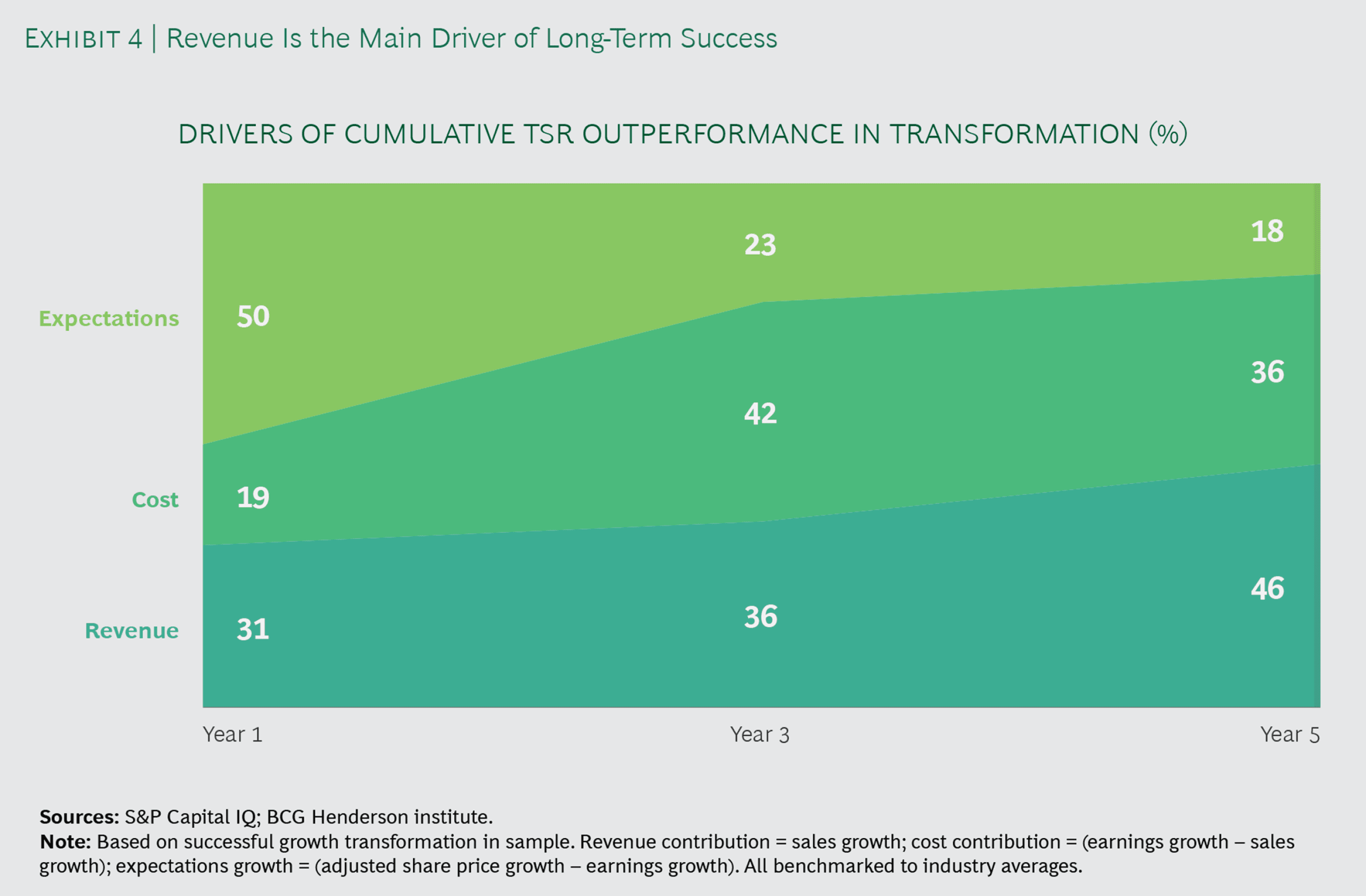

Decomposing total shareholder value growth into its revenue, cost, and expected future revenue contributions can tell us how and when successful growth transformations create value.

Only 4% of our successful growth transformations relied solely on revenue growth to generate TSR growth. The remainder generated value through a balance of revenue, cost and/or expectations. This suggests that companies attempting growth transformations should beware of a narrow focus on growth, if it comes at the expense of long-term profitability or future growth opportunities.

Successful growth transformations tend to deliver on each of revenue, cost and expectations at different points in the transformation journey. (See Exhibit 4.)

On average, in the year a transformation is launched most of the TSR generated is expected value (corresponding to increased P/E multiple), suggesting that successful companies are able to convince investors of their growth stories. However, one third of year one TSR is generated through revenue growth, perhaps representing tangible progress that demonstrates growth ventures are on the right track. By year three, cost reduction is responsible for the largest portion of TSR growth as companies refocus their portfolios and free up funding for growth investments. By year five revenue growth is the largest driver of TSR growth.

Transforming for growth is hard to do, but valuable if done right. By taking an empirical approach to change and learning from previously successful growth transformations companies can improve their odds of transforming for growth successfully.

Detailed methodology

Our analysis is based on 735 transformations occurring in US companies with $1bn+ market cap over the period 2004–2017. As in our previous research, transformations were identified by annual restructuring costs in excess of 0.5% of revenue.

We defined a successful growth transformation as one that both accelerates growth and delivers positive total shareholder return outperformance.

A company’s growth acceleration is the difference between its industry adjusted growth rate in the five years after its transformation starts and its industry adjusted growth rate in the three years before its transformation starts. Industry adjusted growth rate is a company’s annualized growth rate over a time period less the median annualized industry growth rate over that same period.

Total shareholder return outperformance is the annualized total shareholder return a company delivers over the five year period after its transformation starts in excess of median industry total shareholder return over the same period.

Candidate success factors were identified on the basis of literature review and case studies. These factors were translated into quantitative proxies and analyzed using logistic regression, a statistical model that predicts the probability of a successful outcome while accounting for multiple competing effects.