As 2019 begins, there is increasing concern about the health of the global economy. Leading indicators have weakened; economists and policymakers generally expect growth to slow; the stock market has been increasingly volatile; and geopolitical risks are multiplying. In addition to preparing for the next downturn, it is good for business leaders to remind themselves that adversity is an opportunity for competitive advantage.

Historically, though, companies have tended to underestimate the urgency, scale and breadth of responses necessary to cope with and thrive in a downturn. An additional consideration is that the character and impact of the next downturn will likely be very distinct from prior ones — not only due to new macroeconomic conditions, but also because today’s business environment is very different. For leaders seeking to prepare their companies for what is next, we offer a list of 10 actions to survive and thrive in this downturn.

The next downturn will bring both challenges and competitive opportunities

The predominant view is that the global economy is likely to experience a downturn but not a recession. Many advanced economies are at or beyond their cyclical peaks and economic policy is becoming less supportive, pointing toward slowing growth but not a deeper recession. There are, however, downward risks to this outlook: Getting economic policies right to engineer a ‘soft landing’ has historically proven tricky, and a range of other political and economic risks lurk in the shadows. In such a climate, it is prudent for business leaders to prepare for a range of potential circumstances.

How do economic downturns affect businesses on aggregate? In studying more than 5,000 U.S. companies across the last five downturns, we found that the average company saw revenue decline by 1% annually during the downturn, compared to 8% annual growth over the three prior years. Similarly, profit margins and Total Shareholder Return also declined for the majority of companies.[1]Based on analysis of U.S. economy since 1979 and U.S.-based public companies with revenues of at least $50M. Downturns include recessions (periods of negative GDP growth) as well as periods in which … Continue reading Lower performance increases companies’ exposure to the threat of investor activism — which has risen more than threefold since the last downturn — as well as outright failure.

Historically, companies’ typical reactions have been defensive, delayed, and often insufficient. For example, according to a BCG survey of 439 global companies in March 2009, companies prioritized short-term actions over longer-term initiatives. They also tended to act reactively rather than proactively — waiting until their own business was directly affected by the downturn before taking mitigating actions — and were reluctant to take bold steps to protect against the downsides or take advantage of the eventual recovery.

But downturns also present opportunities — and to realize them, companies must go beyond a defensive stance. Competitive volatility increases during downturns (for example, the rate at which businesses jump into or fall out of the Fortune 100 each year rises by 50%), reflecting an opportunity to use the downturn to your competitive advantage. Investment opportunities, including mergers and acquisitions, generally become cheaper. And some companies use the opportunity to unleash major internal change. For example, American Express was severely threatened in the 2008 financial crisis by rising default rates and falling consumer demand. After cutting costs and divesting noncore businesses to stay viable through the downturn, the company refocused on new partnerships and embracing digital technology. Its stock price has risen by more than 1,000% in the decade since.

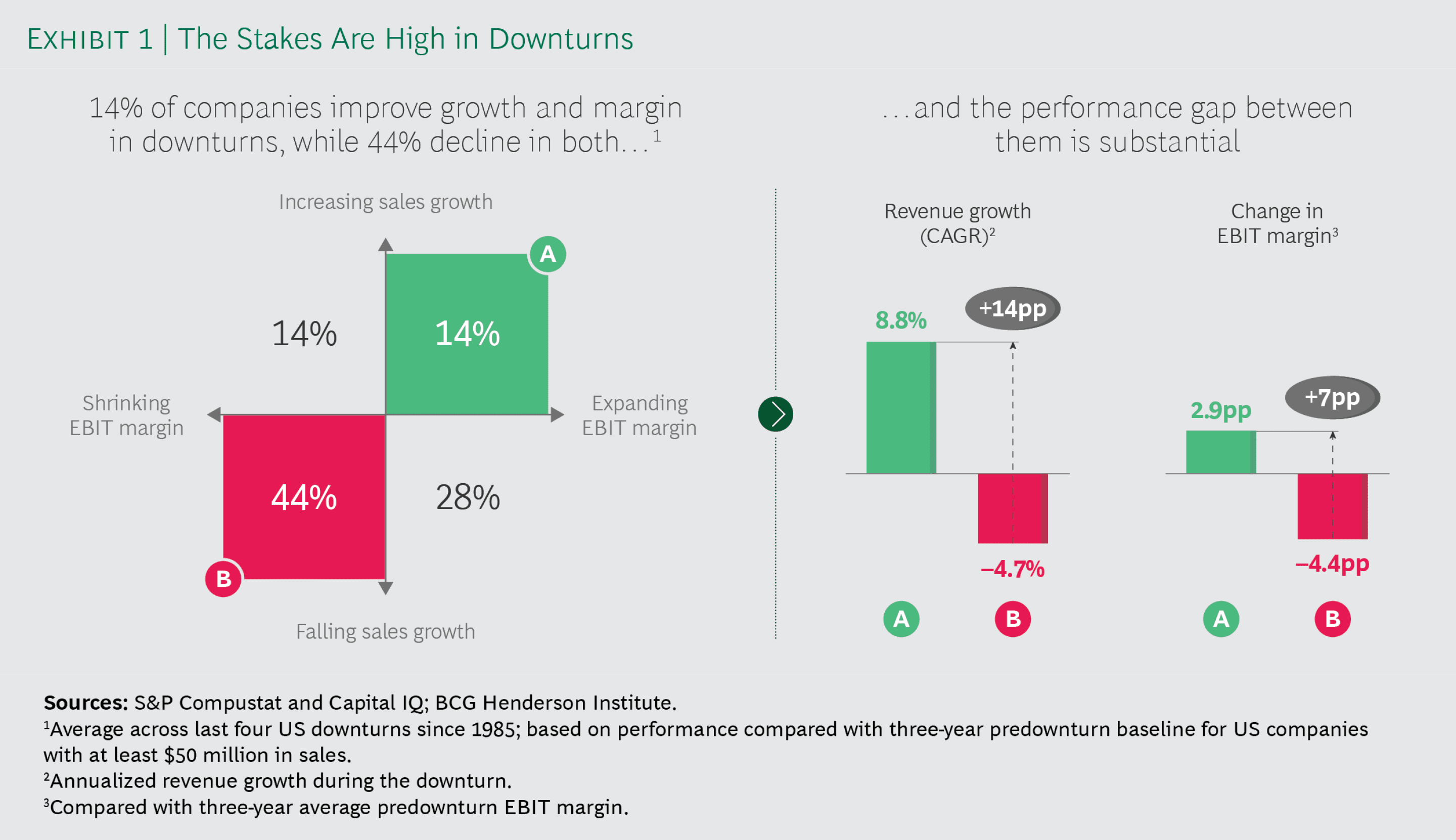

The competitive stakes in downturns are high. In the last four downturns, an average of 14% of companies increased both their sales growth rate and EBIT margin despite the challenging circumstances. During downturns, those companies grew revenue by 14pp more and improved EBIT margin by 7pp more than the 44% of companies that declined in both metrics. [See Exhibit 1.]

When the next downturn comes, how can your company be one of the few that comes out stronger?

How to take advantage of the next downturn

The impact of the next downturn — and therefore what it takes to win — will naturally vary by industry and company. For example, slowing economic momentum tends to have the strongest impact on industrial goods producers, while consumer goods companies are generally less affected (and often not until later stages, when the downturn hits employment).

However, the evidence reveals some general rules that apply more broadly — giving leaders a starting point to tailor plans for their own companies. Our analysis of impact patterns and success factors in downturns builds on our empirical research on large-scale change, identifying ten ways leaders can take advantage of the next downturn:

1. Prepare for the next downturn, not past ones. Nearly a decade has passed since the last significant global downturn, and the business environment has changed dramatically since then. Some advice for weathering downturns is evergreen, but companies need to tailor their strategies to the unique aspects of today’s context.

First, the economic environment is different than it was in 2008. The most probable scenarios point to a less severe downturn; meanwhile, corporate profits are strong and cash on hand is at historically high levels. However, the rewards are increasingly earned by a smaller fraction of companies that are achieving breakaway valuations and profits. Therefore, there will be more opportunities for offensive moves but also more heterogeneity across firms in their optimal strategies and responses. For many fundamentally healthy companies the constraint to successfully navigate a downturn may be not cash, but the wisdom to invest it against the right opportunities.

Secondly, technological change and new competitors are rapidly reshaping industries. This has already caused competitive volatility to rise: though only one in three companies successfully navigates disruptive shifts, those that do often emerge stronger than before. The next economic downturn will likely increase the potential risks and rewards even more — but it will still be only one dimension of disruption among several. Therefore, companies will need to continue pursuing their long-term digital agenda to keep up with the accelerating pace of technology.

Finally, the political and social environment is less stable. With interest rates already low and public debt levels historically high in most major economies — and with polarization causing political gridlock — governments will have less capacity to respond to the next downturn. Increased social scrutiny will put businesses’ actions during the next downturn under a stronger microscope. And an economic downturn may further inflame political and social tensions. Therefore, leaders need to ensure that their businesses create social as well as economic value, as well as playing a proactive role in shaping key social and political issues, to keep the game of business going.

2. Anticipate a wide range of scenarios. Economic forecasting is well-known to be very imprecise. The range of realistic scenarios is especially wide today, reflecting several sources of uncertainty that are increasingly affecting the global economy — including trade tensions, political shocks, and the dynamism of complex and interconnected financial markets. In circumstances where many plausible outcomes exist, resilience against a range of scenarios is more important than a single point forecast and plan.

Economic scenarios can be prepared around a baseline projection. Then, for each of those scenarios, determine the likely impacts on your specific industry and company. Through this exercise, you can stress-test your plans and measure if your company is robust to different outcomes — allowing you to identify the biggest potential risks and create rapid response options where necessary.

Similarly, due to the unpredictable nature of competition within many industries, scenario-based approaches are also valuable tools to identify and guard against the risk of disruption. The true range of possible outcomes is often wider than you may think. Accordingly, you need to stretch your counterfactual thinking of “what could be” — for example, by using strategy games to widen the scope of competitive scenarios and identify overlooked vulnerabilities. With a wider view of the possibilities, you can assess your exposure to disruption, taking actions to increase resilience as necessary.

3. Act early. Many companies may understandably be reluctant to take major actions until they see clear evidence that they are affected by economic headwinds. However, the history of company responses to downturns shows that the out-performers tend to anticipate the impact and make the first moves, such as reducing their cost base.[2]See Exhibit 1, Collateral Damage Part 6: Underestimating the Crisis (BCG, 2009) https://www.bcg.com/documents/file15472.pdf Companies that wait longer to shore up their businesses are more likely to overcompensate when they are finally forced to act — which puts them in a weaker position to take advantage of the eventual recovery.

Beyond survival-focused defensive actions like cost-cutting, companies are also well-advised to act preemptively when making the fundamental changes that will enable them to thrive in the long run. Our research shows that the most important observable success factor in corporate transformation is how early the program was initiated. To preemptively recognize threats, leaders need to pay attention to early warning signals of disruption — whether in the macro economy or from direct or indirect competitors. And they need to instill a sense of urgency within their organizations to ensure the necessary actions are taken before major financial or competitive deterioration.

4. De-average reactions across your portfolio. In harsh environments that threaten the viability of your business, such as an economic downturn, companies need to economize resources by cutting costs and preserving capital in order to survive and grow. But these actions should not necessarily be taken indiscriminately across the business — leaders should also have an eye on renewal, understanding what their future growth engines will be and de-averaging accordingly. In other words, during the downturn, companies should protect the budgets of businesses or geographies that still have attractive growth opportunities, while making the necessary cuts elsewhere. In many cases they will need to both rationalize and reinvest within the same business.

De-averaging your response to a downturn has obvious benefits, yet many companies still find it hard to achieve in the heat of a crisis. For example, according to BCG’s survey in the 2009 recession, less than one-third of the companies that reduced costs in some parts of the business also added employees or capacity in another area. To successfully de-average strategy in various parts of the business, you need to develop strategic ambidexterity — for example, by structurally separating business units that require different approaches to strategy and implementation.

5. Adopt a long-term, competitive perspective. By threatening short-term performance and survival, downturns present an operational challenge. At the same time, however, they present competitive opportunities — which some companies will seize to emerge stronger. All companies must attend to short-term concerns to ensure viability, but those who are able to also focus on the long run have the most success.

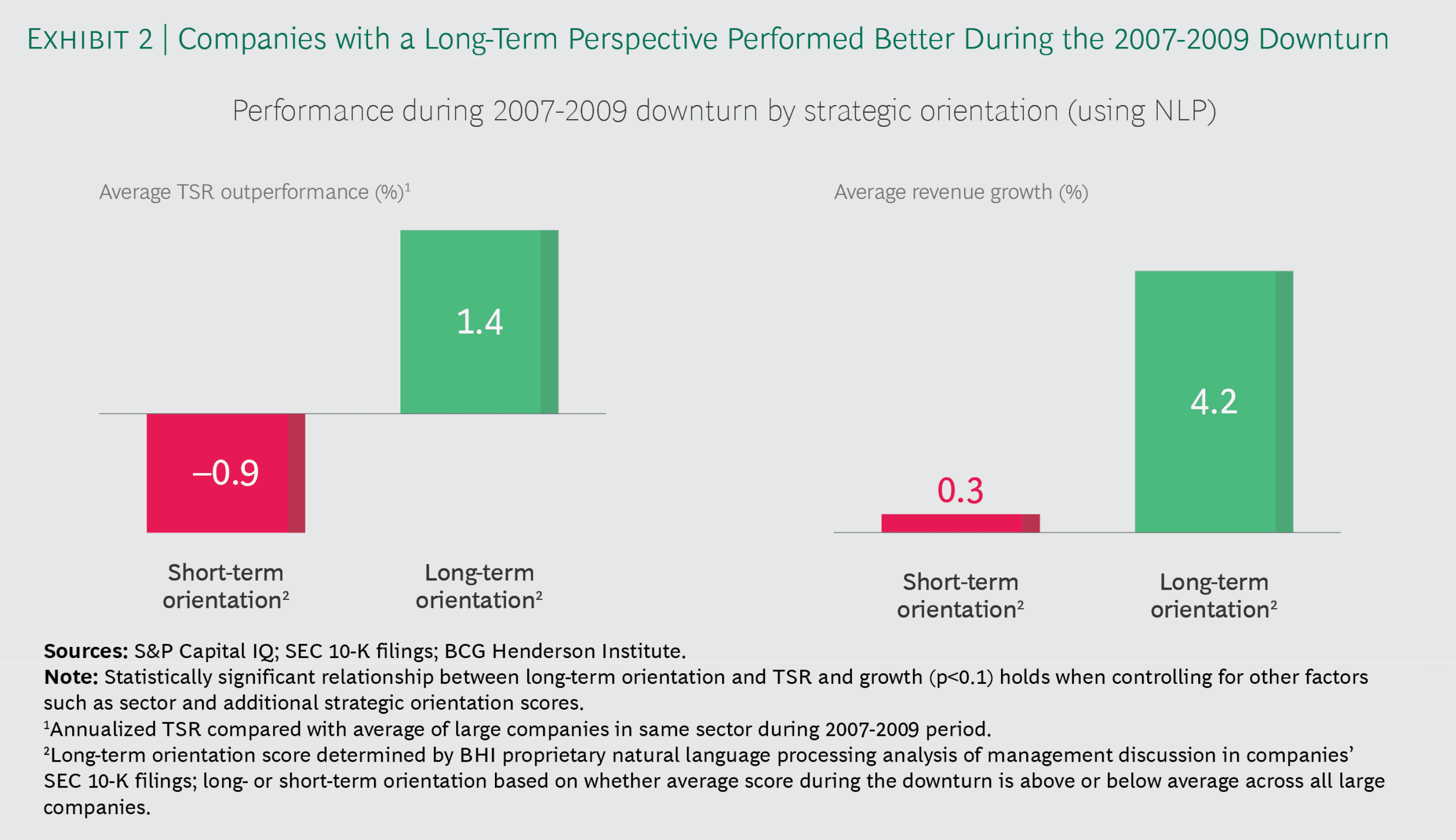

To assess long-term orientation, we used natural language processing algorithms to analyze the strategy statements in companies’ SEC filings. Long-term focus is predictive of long-run growth in the aggregate, but one might plausibly believe that economic downturns represent a unique environment where a different logic applies. However, during the 2007–09 downturn, companies with a long-term orientation still achieved higher annual growth (+4pp) and TSR (+2pp).[3]Among companies with $5B+ market cap at start of downturn; TSR represents outperformance compared to sector average [See Exhibit 2.]

6. Use the downturn to accelerate large-scale change. Even when companies recognize the disruptive threats and the need to transform, they often underestimate the full scope of changes that are necessary. However, downturns can shine a spotlight on the long-term viability of the business — which farsighted leaders can leverage to ensure the change effort is sufficiently ambitious. This is indeed likely to pay off in the long run: our research shows that transformation programs with larger investment are more likely to succeed.

For example, Apple released its first iPod in 2001 — the same year the U.S. economy experienced a recession, contributing to a 33% drop in the company’s total revenue. Still, Apple continued to transform its product portfolio, investing in innovation and increasing R&D spending by double digits. As a result, the company launched the iTunes music store in 2003 and new iPod models in 2004, sparking an era of high growth.

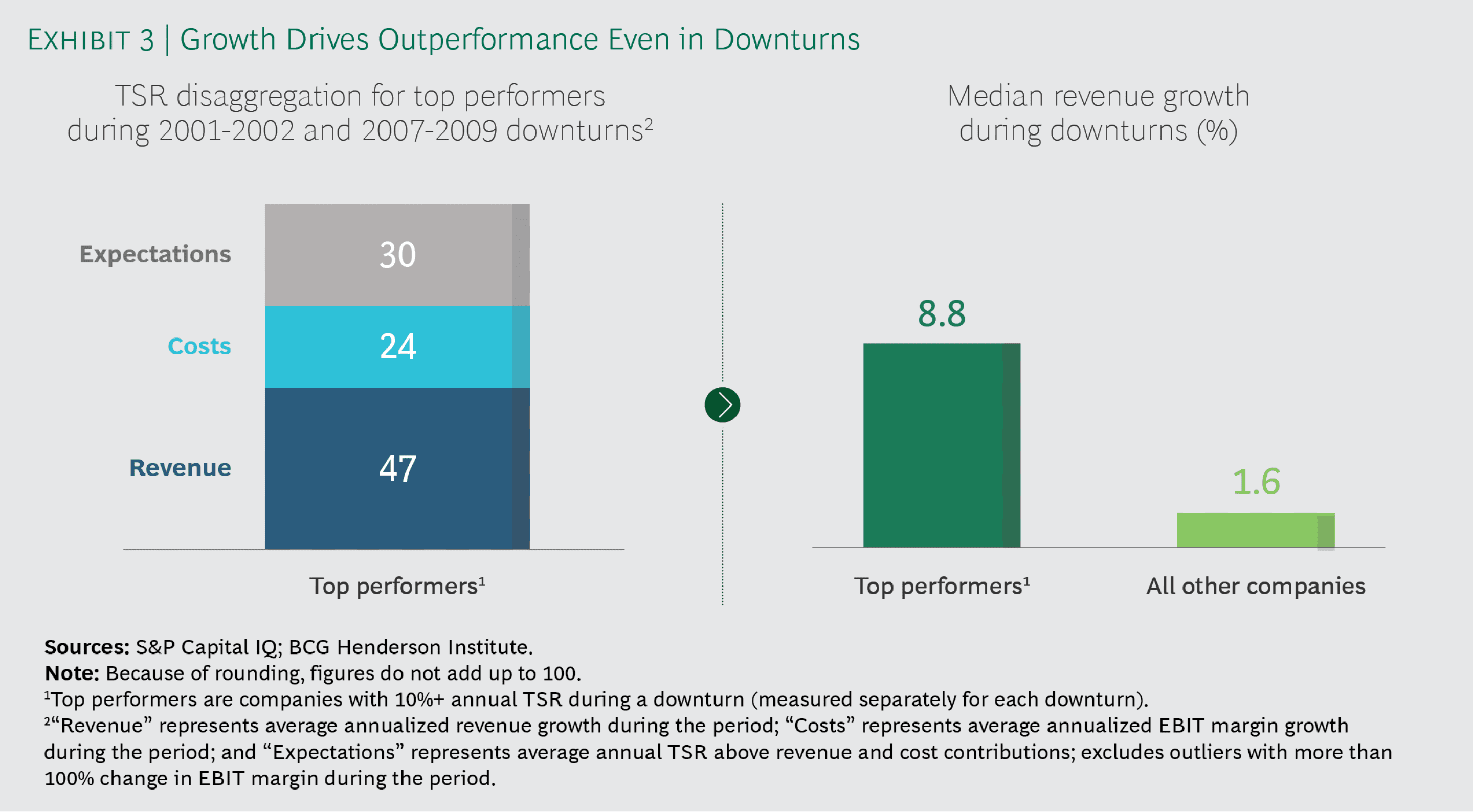

7. Invest in growth engines. Defensive actions may be necessary for some companies to survive the downturn — but to thrive, leaders need to also consider the top line. In the last two downturns, the most successful companies[4]Companies that achieved 10%+ annualized TSR in the 2001–02 or 2007–09 downturn did indeed pursue efficiencies, improving their profit margins. But revenue growth was the largest driver of their performance, accounting for nearly 50% of TSR (twice as large as the impact from cost reductions). [See Exhibit 3.]

Furthermore, growth during a downturn appears to have competitive benefits that continue to pay off in the future: the companies that grew more during downturns also continued to achieve higher post-downturn growth. To successfully grow over the long term, companies need to invest in R&D and other innovative capacities, and maintain a balanced “portfolio of bets” across different timescales. A downturn should not undermine the capacity for long term growth.

8. Articulate a compelling investor story. After revenue growth, the next-largest driver of TSR in recent downturns was investors’ expectations — which also had a greater impact than cost reductions. And with activist campaigns becoming more frequent and targeting even the largest companies, the risk to leaders of not managing investors’ expectations is larger than ever. Because downturns on average reduce TSR and profitability — two conditions that increase the threat of activism — leaders will need to make sure they maintain credibility. This involves “thinking like an activist”: optimizing financial policies and current performance, while also building strong relationships with major investors and ensuring the long-term strategy is understood.

Formalized, publicly announced transformation programs are often one component of a compelling story. Internally, such programs can help building support for change throughout the organization. But our research also shows that they help build credibility with investors: underperforming companies that announced a formal transformation program were more likely to see a short-run boost in investor expectations, as well as a long-run improvement in financial performance.

9. Opportunistically pursue M&A. “The time to buy is when there’s blood in the streets,” said Baron Rothschild after the Battle of Waterloo. M&A has become a larger part of many companies’ strategy, with deal volumes trending upward for several years. Overall activity fell in the last two downturns, which means there will likely be cheaper buying opportunities for the select companies who have the will to pursue it — and have maintained strong enough cash positions to afford it.

However, the set of available targets they face will include more poor-performing companies in need of a turnaround, rather than thriving companies who can give the buyer an immediate boost. Our research of nearly 3,000 turnaround M&A deals reveals several important empirical lessons for choosing these deals and making them work. The most successful turnaround deals involved companies of the same sector and with similar cultures,[5]Companies were considered to have similar cultures if they scored similarly on Environmental, Social, Governance issues. more ambitious synergy targets, and a rapidly initiated turnaround program after the deal closed.

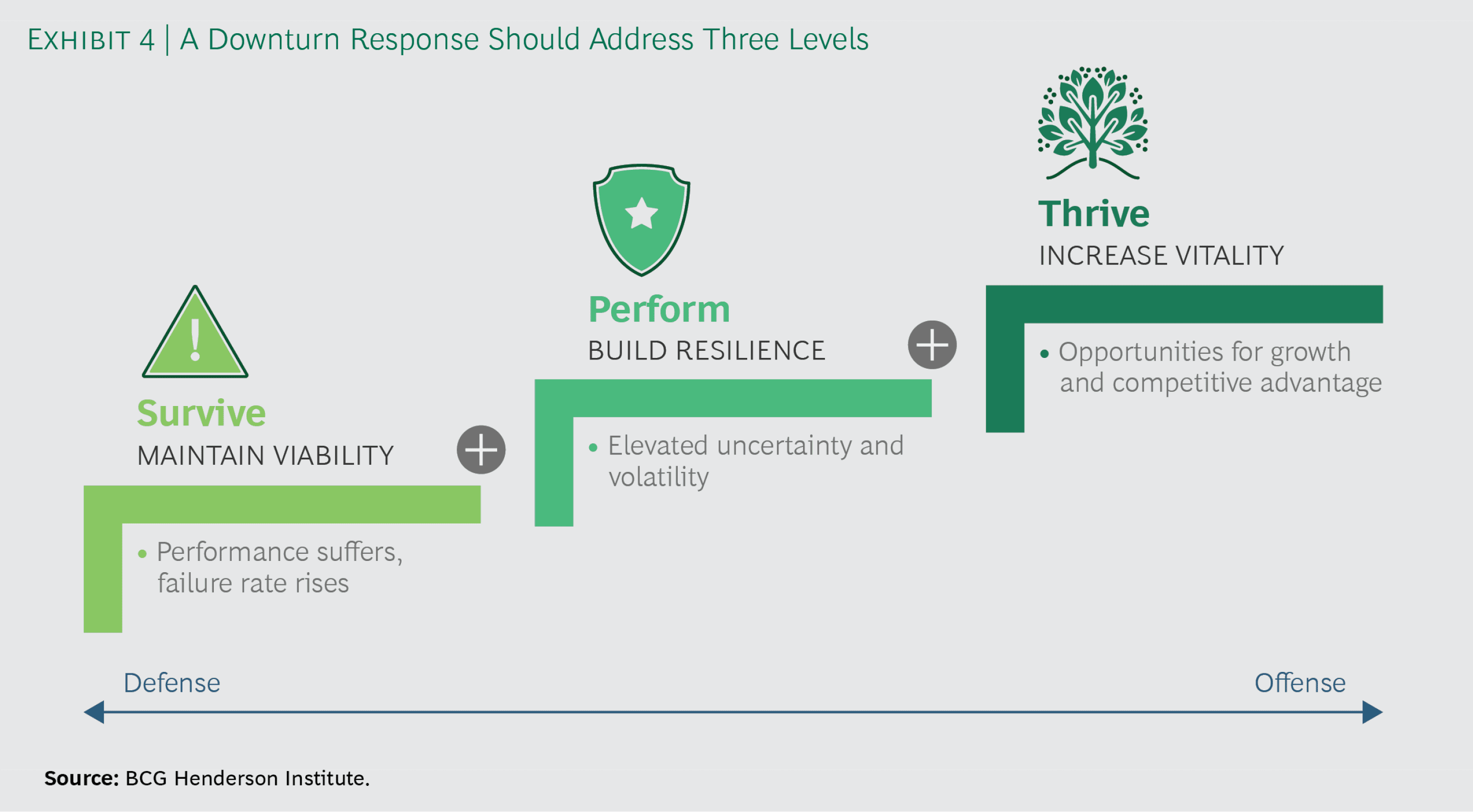

10. Structure your downturn response across three levels. To prepare for a downturn, leaders should consider their response across three layers ranging from defensive to offensive moves. The necessary focus on each level may depend on the company’s specific situation, but those who come out of a downturn strongest will have addressed all three in their preparation and response. [See Exhibit 4.]

- Maintaining viability: Downturns present an increased risk of failure, and staying alive is already more challenging for companies of all sizes and in all sectors. Companies need to make sure their business remains viable in the event of a downturn — for example, by reducing inventory and managing receivables and payables more aggressively to protect cashflow; streamlining the core business to increase efficiency and flexibility; and reassessing the long-term viability of businesses, divesting or closing some if necessary.

- Building resilience: The next downturn is likely to be accompanied by very high uncertainty along a number of dimensions. In order to perform well in unpredictable conditions, leaders must build resilience in their businesses — for example, by keeping financial buffers to be able to respond to unanticipated opportunities or threats; shrinking planning cycles to increase adaptiveness; and hiring talent with a range of backgrounds and implementing enabling factors to promote a diversity of ideas, increasing resilience to the unknown.

- Increasing vitality: “[Defense] should be used only so long as weakness compels, and be abandoned as soon as we are strong enough to pursue a positive object,” said military theorist Carl von Clausewitz. The companies that outperform in downturns generally seek growth rather than playing only defense. However, growth is especially difficult to achieve today. Companies need to increase their vitality, the ability to explore new options and grow sustainably in the long run — for example, by assessing competitors’ vulnerability and capitalizing on weaknesses by investing in new capacity or M&A; Implementing metrics to measure the company’s capacity for future growth; and adopting a forward-looking, long-term agenda to “Win the ’20s.”

The next downturn will test many companies, but it will greatly advantage the few who are able to adopt a strategic approach. By maintaining a long-term strategic perspective, investing selectively, and pursuing transformative change, leaders can help their companies come out from the next downturn competitively stronger than they entered it.