Executive summary

Businesses and societies today increasingly face the challenge of strategizing across multiple timescales. As artificial intelligence makes it possible to act in seconds or milliseconds, and social and environmental issues that develop over decades become more pressing, the relevant timescales are being expanded in both directions — faster and slower — making the challenge of managing trade-offs across timescales more critical.

The traditional toolkit does not seem to be up to this challenge. Businesses have traditionally considered a narrow set of issues that operate at a consistent clock speed; but an expanding range of relevant timescales and the increased expectation that businesses will behave in a socially responsible manner mean that these simplifications are no longer appropriate. New approaches are needed.

Many phenomena across a wide range of fields exhibit the general problem of making trade-offs or balancing action on different timescales. These diverse phenomena and the solutions that have been developed against them can help to achieve a better understanding of the nature of the problem and potential elements of a more successful approach.

By synthesizing insights across different fields and perspectives, we identify two fundamental issues to be addressed by a multi-timescale strategy, and a common set of principles upon which solutions can be developed:

Different timescales are often intertwined — what happens on one timescale affects what can be done on other timescales. Furthermore, long-term phenomena are often highly uncertain. As a result, multi-timescale problems generally cannot be separated into a set of single-timescale problems and solved independently. Emerging strategies that can address multi-timescale problems holistically include:

- Embrace contradiction.

- Leverage simple rules for “good enough” outcomes.

- Design decision architectures that promote a balanced focus on different scales.

- Map and understand the dynamics of the larger systems within which you operate.

- Use adaptive strategies.

- Make decisions with progressive commitment.

Long-term problems are generally collective problems — many of the challenges on longer timescales that businesses face, such as maintaining sustainability of the environmental or economic context, cannot be sufficiently addressed by individual organizations alone. Instead, cooperation and collaboration are required. Emerging strategies that can address this issue include:

- Don’t treat the “prisoners’ dilemma” as inevitable — collective action problems can become coordination games instead.

- Create better metrics of progress toward long-term goals.

- Leverage financial markets to illuminate and amplify existing beliefs.

- Articulate compelling goals and narratives.

- Pursue bottom-up approaches.

Introduction: Why strategizing on multiple timescales is increasingly critical

Environmental and social trends are stretching societies and creating new challenges. For example, cities have traditionally been designed for immediate convenience and amenities, but climate change and its effects have brought additional considerations into play, such as managing future flood risk. Many high-risk areas are starting to reconsider their approach to development to address these risks.[1]“Waterfront designers rise to the challenge of flood risk” (FT, 2021) But perceptions about risks and solutions differ, and whereas the benefits of mitigation will generally not be realized for decades, its costs are realized today — so action has varied widely across cities. Similarly, recent power outages driven by extreme weather events have sparked a discussion about whether and how to invest in weather-proofing electricity grids in Texas and elsewhere, albeit at a cost in the present.

Many businesses are also grappling with the challenge of figuratively “weather-proofing” their organizations against future risks. Covid-19 has highlighted the impact of unpredictable shocks, as well as the long-term value of business resilience. And companies are increasingly committing to take action on pressing societal issues such as decarbonization. But such actions similarly have uncertain future benefits and the potential to contradict near-term goals.

These problems are all examples of a common challenge: how to strategize across multiple timescales. Businesses and societies generally must deal with phenomena that operate on different timescales (from the near term to the long term), often involving trade-offs. Actions that address one timescale may undercut effective action on another (for example, development in a fragile area may be desired in the short run but may increase the potential long-term damage of floods). Systems optimized for one timescale may not be effective for another (for example, a company designed to maximize efficiency in the short run may be less resilient to long-term risks). And resources spent against one phenomenon cannot be used against another (for example, investing in decarbonization may reduce a business’ capacity to invest in developing its next product).

Businesses and societies have always had to manage across multiple timescales, but the challenge has become much more important and complex today. Whereas social and environmental issues that operate over decades could once be treated as constants in the short run for later consideration, many such shifts (such as climate change, rising inequality within many nations, and falling biodiversity) have progressed to the point where they are becoming relevant in the present. And whereas very short timescales of seconds and milliseconds could once be considered irrelevant, the increased speed and reach of artificial intelligence and digital platforms have brought these into focus.

Our existing toolkit does not appear to be up to the challenge of managing this expanded range of timescales. Business strategy has traditionally considered a narrow set of issues (such as customer needs, operating model effectiveness, and competitive advantage), a limited range of timescales (most notably the annual planning process) and a limited number of stakeholders (customers, employees, competitors). Such simplification may have made sense when contextual change was slow, and when the only expectation of businesses was that they would aim to maximize their own financial performance. But with technological and contextual change accelerating, and with a greater expectation that businesses behave in a socially responsible manner, leaders need to expand the range of timescales and stakeholders they consider — which will require new approaches to managing trade-offs between them.

Seeking inspiration from a range of perspectives

Managing across multiple timescales is a general challenge that can be found in many fields: though the details vary, a number of phenomena demonstrate the problem of making trade-offs or balancing action on different timescales. By seeing the challenge through these different perspectives and synthesizing them, we can better understand the nature of the problem and identify some common solution elements.

To explore these different perspectives, we assembled a dozen minds from different fields in science and business for a wide-ranging discussion of multi-timescale problems. The discussion was hosted by the BCG Henderson Institute, Boston Consulting Group’s think tank dedicated to exploring and developing valuable new insights from business, technology, economics, and science.

- Perspectives from evolutionary and systems science were shared by Stephanie Forrest, Professor of Computer Science at Arizona State University and director of the Biodesign Center for Biocomputation, Security and Society; and Simon Levin, the James S. McDonnell Distinguished University Professor and Director of the Center for BioComplexity at Princeton University.

- Perspectives from psychology and economics were shared by Peter Turchin, an evolutionary anthropologist at the Complexity Science Hub Vienna and the University of Connecticut; and Elke Weber, the Gerhard R. Andlinger Professor in Energy and the Environment and Professor of Psychology and Public Affairs at Princeton University and founder and director of the Behavioral Science for Policy Lab.

- Perspectives from capital markets and economics were shared by Philipp Carlsson-Szlezak, BCG’s Chief Economist and a Managing Director and Partner in the firm’s New York office; Anne Maria Eikeset, an ecologist and evolutionary biologist and a researcher at Norges Bank Investment Management with a particular focus on climate and environmental change and their impact on investments; Peter Hancock, the former President and CEO of AIG; and Nick Silitch, Chief Risk Officer of Prudential Financial.

- Perspectives from business and innovation were shared by Maria Hancock, an angel investor who has two decades of experience in technology, risk management and asset management; and Martin Reeves, Chairman of the BCG Henderson Institute and a Senior Partner and Managing Director in BCG’s San Francisco office.

- Perspectives from sustainability were shared by Georg Kell, Chairman of the Board of Arabesque (a technology company that uses AI and big data to assess sustainability performance relevant for investment analysis and decision making) and the founding Director of the United Nations Global Compact; and David Young, a Senior Partner and Managing Director in the Boston Office of BCG and a Fellow of the BCG Henderson Institute studying the role of the corporation in society and sustainable business model innovation.

This paper presents a summary of key multi-timescale phenomena and solution ideas from these specific fields and concludes with a synthesis of insights that we hope can provide inspiration for leaders to develop strategies to meet this challenge.

Five perspectives on multi-timescale strategies

Phenomena and solution ideas from evolutionary and systems science

Multi-timescale phenomena: One type of multi-timescale problem is observed in cancer management. Treatments that kill tumor cells, such as aggressive chemotherapy, can be effective in the short run. However, in the longer term such treatments may shorten the period over which the drug is likely to be effective by applying selection pressure across the different genotypes comprising a tumor and selecting for those that are resistant to treatment. Analogous problems can be found in pest management, where pesticides can reduce infestation in the short run but select for resistant types over time,[2]https://link.springer.com/article/10.1007/s13593-015-0327-9 or in the use of antibiotics to treat human or animal diseases.

Trade-offs between timescales must also be made in cybersecurity. If the reaction against a short-term threat is too strong, it risks accelerating the arms race with cyber-attackers, bringing forward new threats.

Evolution poses another type of multi-timescale problem: the trade-off involved in maintaining capabilities when they are not needed immediately. Sometimes, genetic lines lose traits that are not useful (for example, many insect species on secluded islands have lost the ability to fly).[3]Harrison, R. G. (1980) ‘Dispersal polymorphism in insects’, Annual Review of Ecological Systematics, 11, pp. 95–118. But many traits are maintained even when they are not immediately useful, sometimes for long-term benefit. For example, aspen trees in Yellowstone National Park typically use vegetative reproduction; but after major forest fires created new conditions that could only be reforested via seeds, aspen trees made surprisingly rapid recoveries, demonstrating that they had retained germination capabilities.

Solutions: Treatment regimes have been developed that address multiple timescales simultaneously. For example, adaptive cancer therapy does not aim to eliminate a tumor, but instead aims to merely keep it from growing and metastasizing, reducing the risk of unwanted selection pressure for resistant cells.[4]https://www.nature.com/articles/s41467-017-01968-5 Similarly, adaptive pest management and antibiotic therapy aim to balance the short-term benefits to individuals against the long-term risks of resistance to individuals and societies.

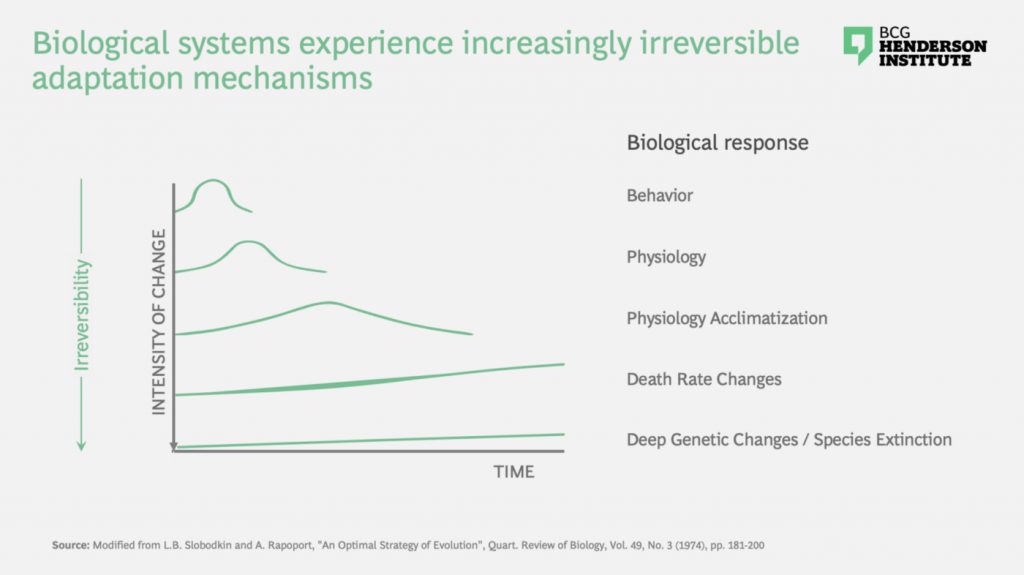

In evolution, organisms often adopt a strategy of progressive irreversibility — when a change to the environment is detected, organisms will take reversible actions first (such as shivering in response to the cold), and only later moving to progressively more irreversible actions (such as ultimately evolving over generations to become inherently better-suited for cold weather).[5]Slobodkin, L. B. and Rapoport, A. (1974) ‘An optimal strategy of evolution’, Quarterly Review of Biology, 49, pp. 181–200. This preserves optionality, reducing the likelihood of getting locked into a suboptimal path for a transient benefit.

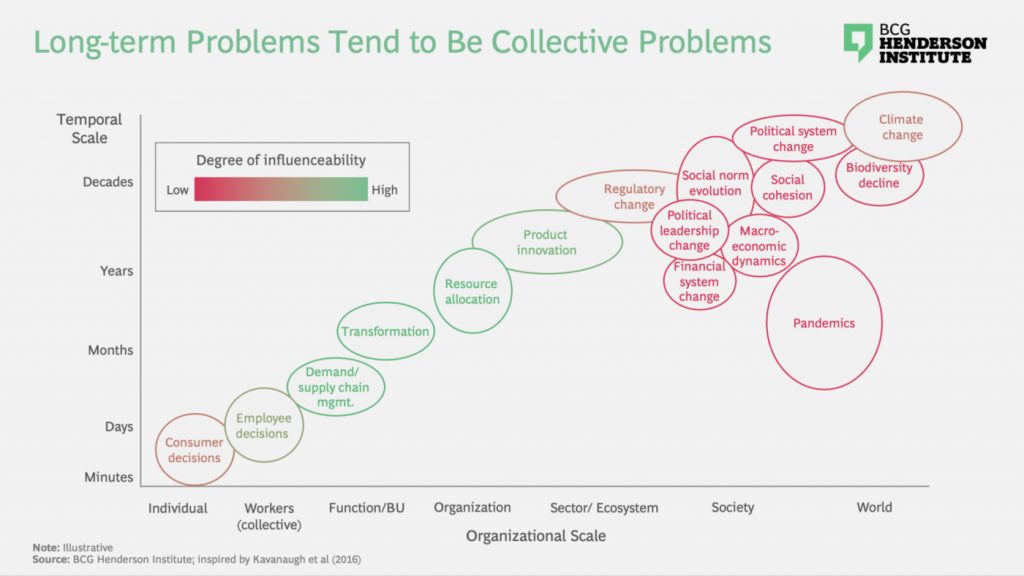

Another important insight from biology is that many phenomena that operate on longer timescales also operate on larger spatial scales: for instance, in the study of ecology, the length of timescale on which a phenomenon operates tends to be correlated with the level of aggregation involved.[6]https://www.researchgate.net/figure/Stommel-diagram-showing-time-and-space-scales-for-typical-biophysical-phenomenon_fig3_305418677

Insights from psychology and anthropology

Multi-timescale problems: When deciding whether and how to prepare for catastrophic risks: individuals must balance the cost of preparation, which generally accrues in the short term, with the benefit of avoiding catastrophe, which will only later become evident. As demonstrated by many institutions’ unpreparedness for the Covid-19 crisis, longer-term threats are often ignored until they impinge on the present.[7]https://www.foreignaffairs.com/articles/2020-10-13/heads-sand

Furthermore, managing such problems is complicated by the “bounded rationality” of human decision-making: finite attention and processing capacity mean that it is often not feasible to optimize over all timescales simultaneously.[8]Simon, H. A. (1957). Models of man; social and rational. Wiley. As a result, individuals often default to dealing with only one goal at a time to simplify the challenge, which can lead to a bias toward immediate concerns.

At a larger scale, society-wide behavior must also be understood on multiple timescales. For example, social instability is driven by feedback loops on several timescales: macro-scale processes such as demographic trends play out over centuries; meso-scale processes such as intrastate conflict play out over decades; and micro-scale processes such as individual acts of violence play out over hours or days. Leaders aiming to maintain stability must consider all timescales. However, these feedback loops interact in non-intuitive ways, and may have very delayed effects, making it difficult to understand the system and identify useful interventions.

Solutions: To overcome challenges of bounded rationality, individuals apply a range of heuristics to make decisions faster and with less complexity. Though such heuristics occasionally lead to sub-optimal outcomes, they generally provide good-enough results in most circumstances and overcome the limitations on human information processing capacity and appetite.

Another remedy is to design “choice architectures” to promote a balanced focus across timescales. One way of achieving this is with automaticity: for example, if an investor is prone to overreact to short-term phenomena at the expense of focusing on longer term issues, they may implement automatic rebalancing rules into their portfolios to avoid the need for frequent manual adjustments. Another mechanism involves incentives: different metrics or rewards can encourage attention toward longer timescales, countering natural myopic tendencies.

At organizational or societal scales, it is also possible to leverage delegation and comparative advantage to ensure challenges on each timescale receive sufficient focus in total. For example, governments generally delegate the short-term task of policing compliance with existing laws to one public body and the longer-term task of making or updating laws for the future to another. Similarly, different investors can complement each other by focusing on different timescales.

Finally, leaders can improve their understanding of the structure and dynamics of the larger system to identify policies or interventions that will lead to positive outcomes. By understanding how responses to interventions or natural experiments unfold, feedback loops and time constants can be understood, creating a foundation for multi-timescale strategy.

Insights from capital markets and economics

Multi-timescale problems: Economic policy decisions often involve trade-offs among different timescales, because what is helpful in the short term is not always sustainable in the long run. Public debt may be used to fund programs that are beneficial in the short run, but in the long run it can make future borrowing more expensive or even cause broader financial system issues (though opinions vary widely on when that point arrives). Entitlement spending programs can improve living standards in the short run, but some may become unsustainable in the long run. And loosening of bank capital requirements may increase credit and short-run economic activity, especially during certain crises, but may also increase systemic risks in the long run.

For investors, the challenge of pricing financial assets itself often requires thinking on multiple timescales, because many assets are valued based on future expectations. An investor deciding what price to pay for equity must consider not only the company’s short-term profit potential but its long-term value, which will necessarily be affected by slow contextual change and risk factors. On the flip side, an investor may choose to participate in an asset bubble if they believe prices will still rise in the short run, even if an eventual deflation is inevitable.

A further complication is that market participants may have very different time horizons — for example, active asset managers often must achieve short-term outperformance or else face withdrawal of funds, whereas pension funds and life insurers adopt a longer-term focus. Even within an institution, time horizons may vary.

Finally, the price signals that financial markets provide to policymakers and other actors must be interpreted on different timescales as well. For example, through the early 20th century the pound sterling was considered the global “reserve currency,” giving the country a greater ability to borrow for short-term spending; but unsustainable borrowing slowly erodes reserve currency status, as eventually occurred when sterling was replaced by the dollar.

Solutions: A common adage in policymaking is that leaders must “first win to govern” — long-term goals can only be pursued if short-term promises are made to win election — effectively taking one timescale as a constraint on which the other can be optimized. The opposite philosophy might be an investing mantra of “never bet the full bankroll” — short-term winnings should be maximized only after satisfying the long-term goal of survival.

Investors facing a contradiction in timescales may be able to resolve the contradiction through persuasion: a sufficiently credible investor expecting a bubble to burst may be able to convince other market participants of that thesis, precipitating an orderly and timely exit.

And because they create valuable information, financial market mechanisms themselves can be seen as a solution to the problem of quantifying long-term risks. For example, to help calibrate the trade-off between the short-term benefits of economic stimulus and the longer-run risk of heightened inflation, policymakers can infer aggregate inflation expectations from the spread between nominal bond yields and inflation-protected yields. Such transparency about consensus beliefs can not only improve individual actors’ ability to manage trade-offs across timescales, it can also facilitate collective action against long-term issues — for example, experiments have shown that cooperation is more likely when there is agreement about the amount of progress that needs to be made.[9]Barrett and Dannenberg, “Climate negotiations under scientific uncertainty” (PNAS, 2012).

Insights from business and innovation:

Multi-timescale problems: A company must manage many trade-offs that operate across timescales. One such notable trade-off is the balance between exploiting its current business and exploring new potential businesses: devoting more resources to marketing the existing product will generally maximize short-term returns, but to survive in the long run a company also needs to create new offerings or business models.[10]Haanaes, K., Reeves, M., and Wurlod, J. (2018). The Two Percent Company. BCG.com.

Another such challenge is the trade-off between short-term financial maximization and system-wide sustainability. Many actions of profit-maximizing businesses can have negative long-term effects on the environmental and social systems in which they are embedded — and if those systems collapse, businesses will also not survive in the long run.

And although aggregate business and economic growth has been driven by continuous technological progress, creating and harnessing new innovations requires efforts taken on multiple timescales. These include basic research with a long time horizon to identify new technologies; entrepreneurship with a moderate time horizon to turn them into products; and scaling in large organizations with shorter time horizons to make them more widely accessible; all of which must be harnessed and balanced to create a thriving innovation ecosystem.

To make trade-offs over time, business leaders have traditionally been trained to model different potential outcomes across timescales, weight them with a discount rate, and select the approach with the highest expected value. But for many emerging challenges, these tools are insufficient.

For one thing, many long-term phenomena often cannot be precisely quantified. For instance, when calibrating the trade-off of reducing short-term efficiency for the long-term benefit of building resilience, calculating the short-term cost is usually trivial, but calculating the long-term benefit requires a projection of the likelihood and expected impact of future shocks — which are not perfectly knowable because the number of plausible scenarios is high, probability distributions could change, and developments may be path-dependent.[11]Reeves, M., Levin, S., et al. (2020.) Resilience vs. Efficiency: Calibrating the Tradeoff. BCG Henderson Institute.

For another, organizations and individuals are often susceptible to hyperbolic discounting — applying a discount rate that varies over time (higher in the short term and lower in the long term), which leads to inconsistent trade-offs. Hyperbolic discounting arises naturally when different exponential discount curves are combined and averaged, making it a natural outcome in organizations or societies composed of individuals with different discount rates.

Finally, optimizing for the expected utility is often insufficient: strict utility maximization can lead to the selection of strategies with an expected value that grows exponentially but a chance of catastrophic failure that approaches certainty in the long run (as in Gambler’s Ruin).[12]Lewontin, R. and Cohen, D. (1969) ‘On population growth in a randomly varying environment’, Proc. Nat. Acad. Sci. USA, 62, pp. 1056–1060. Such an outcome is not favorable for businesses, which need longevity as well as expected value.

Solutions: To address the challenge of making trade-offs among timescales, leaders have developed some simple heuristics to rebalance their efforts. One such example is the “balanced scorecard,” which dictates that all relevant timescales must be addressed to at least some extent.

Some businesses have also improved their ability to calibrate trade-offs across timescales by adopting new, forward-looking metrics.[13]https://www.thorntontomasetti.com/resource/2019-annual-report-vitality For example, measuring a company’s “vitality” (its capacity for sustainable future growth) can shed light on how well the company is positioned to succeed on longer timescales, providing signals about whether or how to rebalance trade-offs.

Companies can also be designed to make short-term failures less catastrophic, increasing resilience on longer timescales. For example, modularization (which many digital platforms employ today) allows for the easy replacement of capabilities: if one provider fails or becomes obsolete, a new provider can easily take their place. Businesses designed for modularity can reduce the likelihood of fatal short-term shocks and also adapt to long-term changes more easily.[14]Reeves, M., Levin, S.., and Fink, T. (2020). Taming Complexity. Harvard Business Review.

Finally, many leaders are articulating a new role for corporations — replacing the single objective of maximizing short-run financial returns with a balanced goal of thriving on multiple timescales by serving multiple stakeholders.

Insights from sustainability:

Multi-timescale problems: The most pressing challenges in sustainability fundamentally involve trade-offs across multiple timescales: the benefits of mitigation play out over very long timescales, while the costs of such actions are incurred in the present day. This applies to a wide range of sustainability issues, such as climate change, species depletion, chemical pollution, and disaster preparedness.

For governments, NGOs, and public bodies, the challenge is balancing the trade-off over time — calibrating the short-term costs and long-term benefits as well as aligning beliefs about them to promote effective action. For other actors like businesses and investors, the problem is less direct but still present — sustainable natural and social systems are necessary to preserve business and financial systems in the long term.

However, different actors face different incentives: politicians may be most concerned about what happens before the next election, whereas the public at large may have a much longer-term horizon. The potential costs are often borne by different stakeholders than the potential benefits, further complicating the challenge. Social willingness to make trade-offs across timescales may vary over time as well. For example, when the financial crisis made short-term risks more pressing in 2008–09, willingness to act on longer-term issues such as climate change declined.

A final challenge is that few effective mechanisms exist to govern collective action at the scale needed to take on sustainability threats. In particular, governance generally stops at country borders, whereas such problems are global in nature.

Solutions: Common goals, when articulated and agreed collectively, can act as a focusing mechanism to direct collective action — as seen in how John F. Kennedy’s goal of putting a man on the moon within a decade became reality. As a more recent example, the Sustainable Development Goals set by the UN General Assembly established 17 sustainability objectives with specific targets for each, helping focus global efforts toward acting on those issues.

New data and analytical tools can help make progress toward those long-term goals more visible, increasing the ability to quantify trade-offs against short-term concerns. The rapid increase in ESG (environmental, social, and governance) data in business is one example of this phenomenon, and recent advances in big data and analytics promise to further increase transparency about sustainability risks and potential interventions.[15]Bril, Kell, and Rasche, Sustainable Investing: A Path to a New Horizon (2020).

Finally, to overcome international governance challenges that inhibit top-down efforts, bottom-up solutions can advance progress. In some circumstances, polycentric approaches with multiple, overlapping coalitions of actors can tackle global challenges more effectively than top-down efforts.[16]Ostrom, E., Dietz, T., Dolsak, N., Stern P. C., Stonich, S., & Weber, E. U. (Eds.) (2002). The Drama of the Commons. Washington, D. C.: National Academies Press. For example smaller groups of collaborators can change the incentives of participants by rewarding cooperators or penalizing non-participants, transforming a “prisoners’ dilemma” (in which the only stable equilibrium is a lack of cooperation) into a “coordination game” (in which at least some degree of cooperation is possible).[17]Chapin et al., “Earth Stewardship: Shaping a sustainable future through interacting policy and norm shifts” (forthcoming).

Common insights on multi-timescale strategy

When looking across these individual perspectives, several insights about the challenges and strategies involved in managing across multiple timescales begin to emerge. Though more work is required to operationalize solutions and specific prescriptions will vary by context, we can identify some initial principles that leaders can use as a basis for developing effective multi-timescale strategies.

Embrace contradiction. Leaders often seek a single correct answer that can be pursued consistently. But the nature of multi-timescale challenges is that the answers are often in fact contradictory — what is best in the short run may not be best in the long run. Leaders therefore need more sophisticated strategies that acknowledge contradiction. This might involve a strategy of switching between solutions at different points in time or in different parts of the business. And it might involve optimizing one timescale subject to a constraint set by another, such as maximizing the short term only subject to surviving in the long term.

Leverage simple rules for “good enough” outcomes. When dealing with highly complex problems such as making trade-offs across intertwined timescales, it is tempting to try to analyze them in as much detail as possible and come up with an optimal solution. However, simple heuristics can often achieve satisfactory outcomes across a range of scenarios — and they may be more robust to uncertain and changing conditions than a precise optimization, even where it is feasible.[18]Simon, H. (1956). Rational Choice and the Structure of the Environment. Psychological Review. 63 (2): 129–138. Leaders can identify and adopt heuristics that enable such “satisficing” strategies. An example of such a heuristic in business might be to avoid existential risk on any timescale — which does not necessarily produce the ideal trade-off between timescales but avoids making trade-offs that could result in the worst outcomes.

Design decision architectures that promote a balanced focus. Individuals and organizations have inherent tendencies to focus on the most immediate issues. However, leaders can counter-balance this trend by designing decision-making architectures that promote a more balanced focus across timescales. Mechanisms for doing so include default-setting (have automatic decision rules that consider long-term needs as a default); division of responsibilities (ensuring some decision-makers are focused on longer timescales); and engineering incentives (metrics or rewards that encourage attention on longer timescales).

Map and understand the larger system in which you operate. Businesses operate within larger economic, social, and environmental systems, which have feedback loops in both directions — businesses’ actions affect the larger systems, and vice versa. Though predicting the exact behavior of such systems is rarely feasible, leaders can improve their understanding by explicitly mapping out the most impactful forces (accelerators or inhibitors of the system’s workings) and understanding feedback loops and time constants, to identify more useful interventions. Because complex systems are often non-intuitive, conducting experiments at various levels of the system can help.

Use adaptive mechanisms. Trade-offs between timescales should not be considered a one-shot decision: as phenomena evolve over time, more will be learned about the viability of initial trade-offs, and the underlying situation may change. Therefore, leaders should implement structures or mechanisms that allow such decisions to be modulated over time. This allows the organization to tune the balance over time to avoid catastrophic outcomes on any one timescale.

Make decisions with progressive commitment. To avoid the trap of premature “lock-in” — short-term decisions that constrain what can be done on longer timescales, potentially leading to loss of viability in the long run — leaders should aim to maintain reversibility in their decisions to the degree possible. A strategy for doing is to use progressive commitment — using change mechanisms that can be reversed at first (even if that comes at some cost) and graduating to more irreversible mechanisms only later when they are more certain to be needed in the long run.

One major insight emerging from our discussion is that long-term problems are generally collective problems. Many of the challenges on longer timescales that businesses face, such as maintaining sustainability of the environmental or economic context, cannot be sufficiently addressed only at the level of individual organizations. Instead, cooperation and collaboration are required.

This connects to a second set of solution principles involving collective action.

Don’t treat a “prisoners’ dilemma” as inevitable. Collective action problems can take the challenging form of a prisoners’ dilemma game. In such settings, the only stable equilibrium is one in which no actor cooperates — because doing so would always be detrimental to their private interests — even though full cooperation would be a better outcome for everybody. However, this state of affairs is not inevitable: in many situations, the payoffs can be changed (through side payments or other mechanisms) to transform the game into a “coordination” game, which has multiple stable equilibria, at least some of which involve cooperation. This does not have to be done by an external authority — decentralized action can also shift incentives, such as through the formation of coalitions that promote and reward action toward the common good.

Create better metrics of progress toward long-term goals. Reducing uncertainty about what and how much action is needed can shift incentives toward collective action. Businesses have developed a sophisticated set of metrics for quantifying past performance, which may be a useful proxy for the short-term outlook — but less progress has been made on metrics that effectively quantify progress on long-term societal challenges. Leaders need to build on recent advances in analytics and ESG measurement to adopt new metrics that provide better transparency on such issues.

Leverage financial markets to illuminate and amplify existing beliefs. By providing a platform for a wide range of participants to make assessments about on future outcomes, financial markets can play a powerful role in bringing to light common beliefs about long-term issues. These price signals can guide collective resource allocation towards solving collective challenges. Though potentially powerful, markets only exist for a handful of primarily financial risks today, but the same mechanism could be applied to a wider range of phenomena, including climate change.

Articulate compelling goals and narratives. Articulating a vision of the future can help make it a reality. Compelling goals or narratives can act as a focusing mechanism by coordinating beliefs around what other actors should strive to achieve, and they can make long-term issues more salient. Leaders can harness this power to build momentum for effective long-term action within their own organizations, such as by articulating a positive purpose that their business serves. They can also support the development of broader goals and narratives that focus collective action against broader social problems.

Pursue bottom-up approaches. Top-down authority is not the only way to bring about effective change on large-scale problems — bottom-up collaboration is also capable of making sufficient progress and has advantages in terms of innovation and stability (especially in a polycentric framework). While leaders should encourage and promote effective regulation, they can also promote bottom-up action, such as collaborating within or across industries, to create momentum on common challenges.

As the tension between economic growth and planetary and societal sustainability becomes more acute, the challenge of managing on multiple timescales will become more important. In order to meet that challenge, leaders in business and society will have to build and adopt a new toolkit. Though there is more work to be done on defining what that entails, we hope the insights outlined here can form a starting point.