With COVID-19, the press has been leaning on IoT data as leading indicators in a time of rapid change. The Wall Street Journal and New York Times have leveraged location data from companies like TomTom, INRIX, and Cuebiq to predict economic slowdown and lockdown effectiveness.[1]https://www.wsj.com/articles/road-and-transit-use-falls-hinting-at-declining-commercial-activity-11584442801 Increasingly we’re seeing use cases like these, of existing data being used for new purposes and to drive new insights.[2]https://www.nytimes.com/interactive/2020/04/02/us/coronavirus-social-distancing.html Even before the crisis, IoT data was revealing surprising insights when used in novel ways. In 2018, fitness app Strava’s exercise “heatmap” shockingly revealed locations, internal maps, and patrol routes of US military bases abroad.[3]https://www.bbc.com/news/technology-42853072#:~:text=Online%20fitness%20tracker%20Strava%20has,the%20heatmap%2C%20a%20spokesman%20said.

The idea of alternative data is also trending in the financial sector. Defined in finance as data from non-traditional data sources such as satellites and sensors, financial alternative data has grown from a niche tool used by select hedge funds to an investment input for large institutional investors.[4]https://www.marketwatch.com/story/the-explosion-of-alternative-data-gives-regular-investors-access-to-tools-previously-employed-only-by-hedge-funds-2019-09-05 The sector is forecasted to grow seven-fold from 2016 to 2020, with spending nearing $2 billion.[5]https://alternativedata.org/stats/ And it’s easy to see why: alternative data linked to IoT sources are able to give investors a real time, scalable view into how businesses and markets are performing.

This phenomenon of repurposing IoT data collected for one purpose for use for another purpose will extend beyond crisis or financial applications and will be focus of this article. For the purpose of our discussion, we’ll define intended data use as ones that deliver the value directly associated with the IoT application. On the other hand, alternative data use as ones linked to insights and application using the data outside of the intent of the initial IoT application.[6]In an earlier piece, we explored how Henrietta Lacks cancer cell culture (“HeLa” cells) had special “immortal” properties, which made them invaluable to science. They were eventually deployed … Continue reading Alternative data use is important because it is incremental value outside of the original application.

Why should we think about this today? Increasingly CTOs are pursuing IoT projects with a fixed application in mind. Whereas early in IoT maturity, companies were eager to pilot the technology, now the focus has rightly shifted to IoT use cases with tangible ROI. In this environment, how should companies think about external data sharing when potential use cases are distant, unknown, or not yet existent? How can companies balance the abstract value of future use cases with the tangible risk of data misuse?

How existing data sharing platforms are approaching data sharing

Existing external data sharing is often limited to specific use cases, often with targeted features developed and specific customer set in mind. Restrictive data licenses can limit the use cases of data and prevent data repurposing. IoT data providers like TomTom, HERE, Michelin, Airbus leverage tools like APIs to not only stream IoT data and display analytics, but also to monitor data usage and enforce data licenses. Since data is easy to copy and share but hard to trace and validate, APIs can help firms monitor suspicious data use.

Influenced in part by their own commitments to the customers who they collect data from, this tight control is also driven by a fear of business risk and pricing to value. Data and even metadata can reveal information about a business’s operations and trade secrets to competitors. Moreover, because different applications have different value, data vendors like TomTom may price the same data package differently based on the stated use case of the data customer.

Other times, data is being shared within consortia and joint ventures. Automotive data aggregation platform Caruso started off as collaborations between industry players led by TecAlliance, a digital aftermarket solution provider and its partnership includes other industry players like Bosch, Fraunhofer, Continental, among others. The benefit of forming these consortia is that often individual players will bring something to the table that no individual company can accomplish, whether it’s data, access to customers, or technology. Bound together by shared information, these development teams can drive innovation.[7]http://www2.law.columbia.edu/sabel/papers/contracting%20for%20innovation.pdf However, these cases are usually limited to partners along a specific value chain, driven by a fruitful, but constrained set of opportunities.

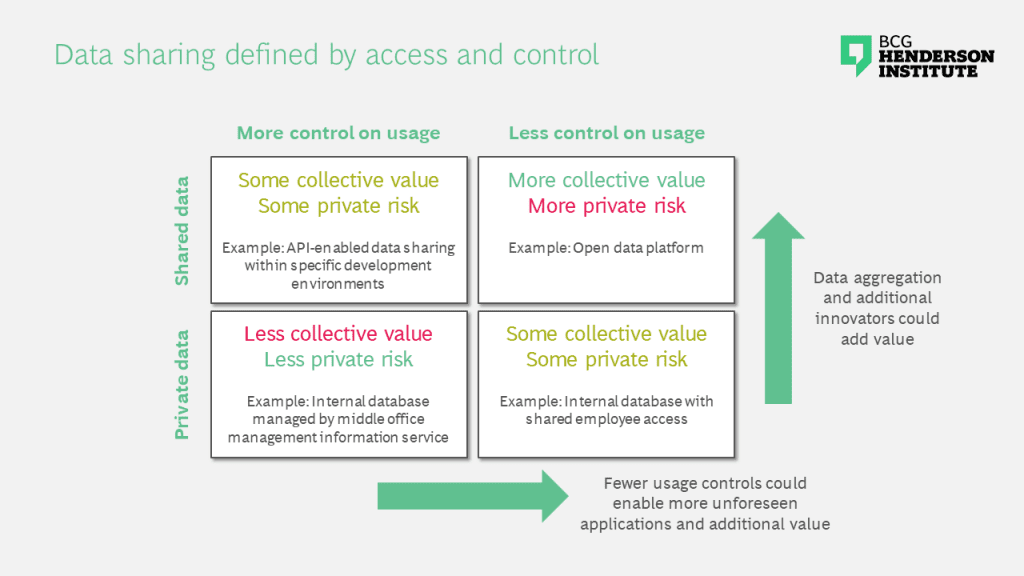

The prevailing avenues of data sharing are overwhelmingly closed (private) and controlled. This behavior can be attributed to the fact that while firms can often capture the value from the closer, intended data applications, it becomes more difficult to capture the value of more distant, novel data applications. Thus, there’s a tension between collective value, private value, and private risk.

What are alternative uses for data?

Unlike the predictable data use cases, many alternative data uses share three distinct features. First, many alternative uses are developed after data collection and are difficult to predict ex ante. Second, alternative data uses are sometimes far from the source of the data, which may pass through a series of intermediaries. Third, alternative data uses will likely increase as more applications shift from technology driven push solutions to use-case driven pull solutions.

Data uses often follow the original data collected and some can be tough to predict ex-ante. Two examples bring this to light:

Maritime Automatic Information System (AIS) was originally developed more than a decade ago to leverage GPS information to avoid ship collisions. In the years since, a variety of new use cases for shipping tracking has come up: fleet control, search and rescue, commodity tracking, asset protection, insurance underwriting, ocean current measurement, and maritime security among others. Israeli startup Windward is one among many companies with a suite of analytics for government and insurance applications.[8]https://wnwd.com US startup Cargometrics leverages this data to glean insights into the commodity markets and includes an investment arm.[9]https://www.freightwaves.com/news/tech-frontrunner-cargometrics-opens-up-on-game-plan In part due to the open nature of AIS data, multiple different use cases have appeared.

Weather sensor information is another example of applications that have far exceeded the original scope. When IBM acquired a portion of the The Weather Company, parts of the investment community were scratching their heads.[10]https://www.marketwatch.com/story/ibm-finally-reveals-why-it-bought-the-weather-company-2016-06-15 It turns out that weather sensors, combined with IBM’s processing capabilities, can yield highly granular forecasts which is valuable on its own and can add value to IBM’s cloud ecosystem.[11]https://newsroom.ibm.com/2019-11-14-IBM-Makes-Higher-Quality-Weather-Forecasts-Available-Worldwide Weather data has a broad range of applications from direct applications in outdoor industries like agriculture, aviation, construction, and logistics to more distant applications in health, finance, insurance, retail, and utilities. Because of the value of weather data, new entrants are also exploring different ways of producing localized weather observations. Geotab, a telematics software company, uses car sensors to deliver localized temperature readings.[12]https://data.geotab.com/weather/temperature Here, alternative uses have led back to alternative sources.

Moreover, not only can these uses be hard to predict, but often the data flows through many intermediaries through a complex web of data and analytics providers before they reach the end applications. Scrubbed, restructured, aggregated, analyzed and distributed (to potential additional aggregators), data can pass through a complicated web of data players. This process enables data to get from the point of origin into applications far from it.

Furthermore, intermediaries add value that guide the data to their ultimate use cases. In their data market pilot, the City Data Exchange, the Municipality of Copenhagen realized the value that data intermediaries play. They discovered different use cases required different data processing, some required fusing with other data to add data context, some use cases need to be taught to end users, some data are fragmented and need to be aggregated with others, some users don’t have the capabilities to process raw data and only require transformed data insights, among others.[13] … Continue reading While sometimes it may be perplexing that one data set might not only pass through one but many intermediaries, this phenomenon might be because each intermediary is transforming the data in different ways.

As the process for creating IoT solutions changes, alternative data uses will spring up in farther removed applications. In the future, we may move from data producers building their own solutions or pushing data packages out to a more use-centric world where data is pulled in. We are already seeing this trend in smart cities where instead of collecting IoT data to collect IoT data, cities are blending the digital with the analog in a more citizen-centric solutioning process. For example, in answering the questions of what would make a senior resident’s life better, cities will form more solutions that span multiple data sources.[14](An upcoming article will examine how smart cities are sharing data.)

For seniors, a variety of IoT solutions are coming up to help individuals stay independent and connected in later years. These are largely set in the home. Wearables and room sensors can identify accidents to alleviate family worry for seniors who live alone. Robotic pets and video devices are designed to bring companionship. Smart devices can improve accessibility and make helpful reminders, i.e., smart prescription bottles.

Electricity or water metering data, originally for utility use monitoring, can be applied to assess activity within a residence and used to alert social workers. Camera data from mapping services are applied to AR exercise equipment to simulate an outdoors bike ride to promote both physical and mental health.[15]https://www.youtube.com/watch?v=M2SzQvTRQZQ

In the future, cross linkages will likely increase. Data from the connected home might be pulled into geriatric care to monitor quality of life. The engagement with robotic pets can be used to monitor alertness and wearables data can be used to monitor chronic conditions, e.g., hypertension, diabetes, etc. Wearable data and weather data can be combined with navigation systems to create personalized walking routes away from home.

Why then do we not see more alternative data monetization today?

In our experience and conversations with companies, we encounter six key reasons:

- Not enough value — there are different ways of acquiring the same insights for the data user with less complexity, or the value of the raw data itself is limited relative to the aggregated data set.

- Technological limitations — there are limited technological capabilities within the company to stream, track, control and monetize the data.

- Structural limitations — firms are limited from monetizing this data based on customer contractual limitations or internal organizational structure.

- Lack of business focus — the monetization opportunity is too early stage or outside the core competency of the firm to get stakeholder engagement.

- In house development — understanding there will be valuable use cases in the future, a firm might be worried about sharing this value with partners and may want to develop use cases internally to capture more of the pie. If they lack current capabilities, they may wait.

- Risks — societal backlash, negative customer reaction, or strategic risk to the firm.

What does the rise of alternative uses for IoT data mean for how I should think about data sharing today?

- Think creatively about the value of your data. While adjacent use cases may be easier to think of, also think of other sectors and needs in the broader economy. Is your data a nice to have or a critical piece of this these needs? Revisit this thinking as use cases enabled by new technologies emerge.

- To capture this value, you may need to share it or find partners to co-explore the value. While you might hold a very valuable data set, you may not have the capabilities or right to win with your data. Today the space is still maturing, but in the future, data aggregators, data brokers, or data markets might be helpful resources to help overcome technological roadblocks and find the right partner to use your data.

- Catalog your data internally first to get the best sense of what is available. Tech players like AirBnB, Uber, LinkedIn keep data catalogs so that their data is internally discoverable.[16]https://engineering.linkedin.com/blog/2019/data-hub Cloud platforms and independent services can also help you sort out your data.

- Keep an eye out for changing data uses. Given the evolving fields of IoT and AI, identifying opportunities to monetize your data should not be a one-time exercise. Engage with external perspectives (e.g., data brokers, data directories, advisors) to get an outside in view on what data can be used for.

- Understand your capabilities and limitations. Sharing data to find new use cases doesn’t just divide the pie, it can enlarge the pie. However, it is important to find the right partners to embark on this innovation journey. Unlike more traditional vendor / customer relationships, modern IoT development ecosystems have a multitude of players and more ambiguous goals, especially those looking to find alternative data uses.

- Balance carefully opening your data to discovery without opening to excessive risk. Holding data too tightly may deprive your company of a revenue stream and society of valuable use cases. Sharing it too broadly may lead to unintended consequences. One solution employed by smart cities is publishing open metadata catalogues to drive innovation.[17](An upcoming article will examine how smart cities are sharing data.) Once a use case is established, potential solution providers can then approach the city for access to the full dataset.