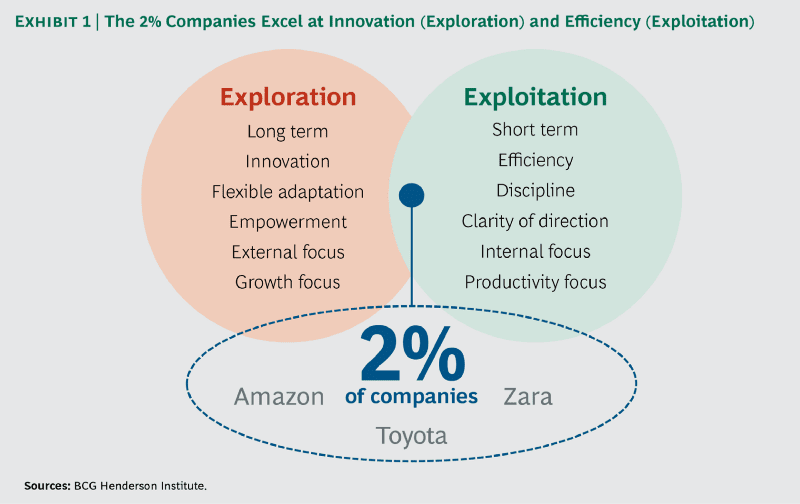

Very few companies can excel at innovation and efficiency at the same time. Of the 2,500 public companies we analyzed, just 2% consistently outperform their peers on both growth and profitability during good and bad times. These “2% companies,” as we call them, are able to renew themselves in large part by driving innovation and efficiency simultaneously. All ambitious companies should, in our opinion, strive to become 2% companies, which are positioned to succeed over time and thrive during both turbulent and nonturbulent periods.

Being excellent at both exploration (new ideas and innovation) and exploitation (operational proficiency and efficiency) simultaneously is difficult because these activities are contradictory; they pull companies in different directions. They require different skills, different performance management, and an ability to drive success with different time perspectives. They are also potential traps — each in its own way. For example, pursuing too much innovation tempts companies to seek further change before they see the benefits of the initial change. Conversely, operational success today makes it more difficult to change and explore.

The 2% companies take varied approaches to exploration and exploitation and thus manifest themselves in different ways. (See Exhibit 1.) Three examples:

- The fashion retailer Zara has developed “fast fashion” DNA that combines adaptive innovation and speed-to-store. Zara consistently taps into unpredictable changes in taste through excellence in design agility and fosters continuous improvements in efficiency through a very tight supply chain.

- Amazon is also a 2% company, but it manifests this status differently. Amazon has been visionary since its founding, rolling out a global marketplace for its expanding customer base. From the top, CEO Jeff Bezos constantly pushes for a culture of innovative thinking through his “day one” mantra, stressing how the company should never stop being a startup. In parallel, the global retailer is able to drive efficiency by building an ever-tighter customer insight, logistics, and delivery operation.

- Toyota is another 2% company, here manifested through a long-term quest to develop new products (such as hybrid engines) and new ways of using materials and by continuously improving its lean manufacturing system. By playing the long game, Toyota has shown that gradual improvements in quality and manufacturing can be combined with breakthrough innovation and industry shaping.

All three companies excel at both innovation and efficiency: the hallmark of the 2% company.

Traits of 2% Companies

The 2% companies share four traits:

- First and foremost, these companies are excellent at both exploration and exploitation. They continually rethink and revise their strategies and operating models while improving their current products and operations.

- Second, they retain an “outside in” focus even when successful. By bringing outside perspectives in, they avoid succumbing to the risks posed by success and growth, which, although they are positive and desired outcomes, tend to increase organizational complicatedness and push companies toward an internal focus. In a rapidly changing environment, any company with too much of an inward gaze will fail to detect fundamental external market changes.

- Third, the 2% companies embrace necessary disruptions (even if painful). This also implies deprioritizing profitable businesses to bet on future growth areas and build early-mover advantages.

- Finally, they have a clear model for renewal. Renewal models help to manage the inevitable tradeoffs between short- and long-term objectives. They also fit specific business environments and organizational capabilities. For instance, in industries where disruption is imminent but directionally unclear and when go-to-market capabilities are strong, companies can capitalize on innovation from outside by scanning the market for relevant innovations, bringing them in-house, and commercializing them. This allows them to build an early-mover advantage while avoiding the risk of going full steam in the wrong direction.

Excellence In Exploration and Exploitation

On the one hand, exploitation activities focus on short-term improvements and refinement of existing knowledge. Capitalizing on current opportunities has the advantage of providing payoffs that are imminent and that offer greater certainty.

On the other hand, exploration activities (new ideas and innovation) are linked to the longer term and represent the search for new opportunities. Exploration is necessary to build the knowledge to cope with disruption risks and to seize new opportunities, which is fundamental for long-term success.

Most companies aren’t good at both, because these two areas require very different skills. The short-term focus on cost, efficiency, and process improvement is fundamentally at odds with the long-term need for innovation, experimentation, and risk taking. Despite this inherent tension, both viewpoints are critical for sustainable business success.

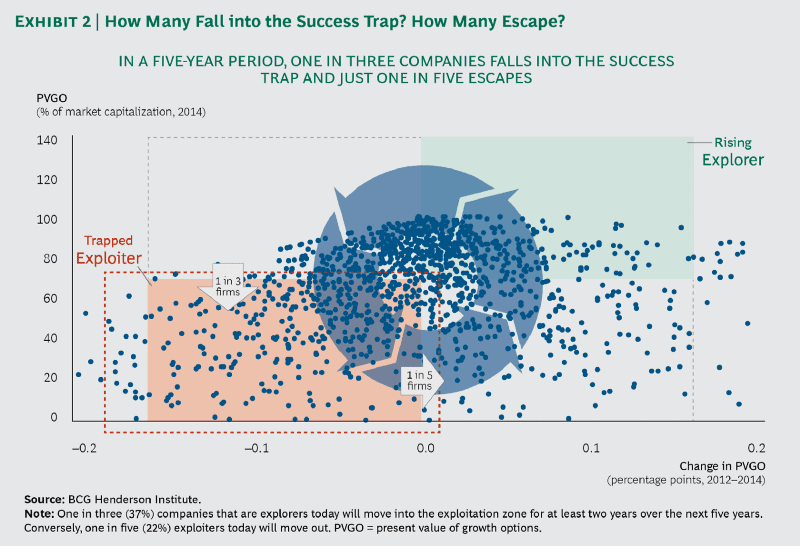

The 2% companies manage to be excellent at both, which in practice means that they avoid two traps: the perpetual-search trap and the success trap. (See “An Atlas of Strategy Traps,” BCG interactive.)

Companies mired in the perpetual-search trap do not have the patience to wait for the payback on exploration because realizing value from exploration is both time-consuming and uncertain. The diffusion of new ideas is often an S-shaped curve, which means that innovations can take time to reach critical mass and yield any substantial profits. If companies make projections based on the very short term, prospects will always look unfavorable. In fact, applying a short-term perspective to exploration makes almost all new ideas look bad.

The success trap, conversely, is associated with too much exploitation. That is the case when a company is satisfied by the returns on exploiting present knowledge and technologies. Its current success will tempt the company to continue exploiting, at the expense of exploration — although exploration is necessary in the long term. We found that fully one-third of companies fall into the success trap during a five-year period and that only one in five manages to escape. These companies are pictured in the lower-left quadrant of Exhibit 2.

Maintaining an “Outside In” Focus Even When Successful

Disruption usually comes from the outside, and being too inward-looking puts companies at risk of missing key customer or market trends. The 2% companies don’t just excel at both exploration and exploitation activities, they also manage to keep an external (outside-in) focus even when they are successful. This is not as easy as it seems; successful companies very often become introverted. History is paved with examples of companies that reached the top of their industry but failed to remain there. Recall Motorola, Blockbuster, Dell, Nokia, and Kodak.

Some current industry leaders, flush with current success, might be overlooking emerging threats. Traditional banks, for example, may be underestimating fintechs. The fintech industry has exploded over the last decade and is now worth an estimated £7 billion in the UK alone. A recent report by the Bank of England found that traditional banks believe they can cope with fintech competition without making big changes to their business models or taking on more risk — but also that fintechs may cause “greater and faster disruption” to banks’ business models than the banks themselves project.[1]Bank of England, Stress Testing the UK Banking System: 2017 Results, November 2017. The report is based on a stress test of seven major banks in the UK: HSBC, Barclays, Lloyds Bank, the Royal Bank of … Continue reading

One reason for an inward shift could be complexity. Successful companies have a tendency to gradually become inward facing because organizational complexity has increased. When successful companies grow, so do the breadth and depth of business requirements. As a response, companies tend to create dedicated structures, processes, systems, and metrics that increase the complicatedness of the organization. Significant resources and attention must then be devoted to internal management. (See “How Complicated Is Your Company?,” BCG article, January 2018.)

Success can also make companies look inward because, by generating too much free cash flow for allocation, success can exacerbate an agency problem: managers might push to keep as many resources as possible under their control and thus invest all extra cash in projects in-house, while, in contrast, board members might want to maximize the payoff for shareholders and thus avoid investing in projects that gradually become, according to the law of diminishing returns, less attractive.

Maintaining an outside-in drive starts by continuously scanning the market, both demand and supply. On the demand side, successful companies must see themselves through the eyes of the customer and constantly look out for early signs of potential megatrends. On the supply side, companies must be willing and able to engage in partnerships and collaborations.

For example, in 2011, Umicore, a Belgian metals and mining company, wanted to expand its recycling activities in order to recover rare earth elements from rechargeable batteries. The company possessed a state-of-the-art battery-recycling process — the Ultra High Temperature (UHT) process — but lacked the capabilities to refine rare earths. It thus partnered with Rhodia, a French chemical company. Together, the two companies developed the first industrial process that closed the loop on the rare earths contained in batteries.

Breakthrough innovation is rarely performed by one single actor end-to-end, and participation in relevant partnerships, platforms, or ecosystems can be key.

Embracing Disruption

When disruptive shocks hit, they must be fully embraced. Doing so first requires companies to recognize risks. Strategic decision making in the context of risk can be subject to multiple cognitive biases. One example is loss aversion, in which the thought of losing something one has is more abhorrent than not taking advantage of a new opportunity for gain. Therefore, there is a tendency to overvalue current business models compared with new, disruptive models and their opportunities. To sidestep that problem, companies must be brutally honest and recognize that market conditions won’t remain the same forever. They never do. Profitable businesses inevitably attract potential entrants with innovative business models.

In practice, fully embracing disruption means that at times companies must respond by being disruptive themselves rather than making small incremental fixes to their current model.

Tobacco companies understood this when they invested — massively — in electronic cigarettes. Electronic cigarettes have been around for nearly 30 years but gained strong momentum only recently, pushed by small emerging players such as V2, Juul, and Mig Vapor.

Large tobacco companies decided to embrace disruption by bringing to market their own solutions. Philip Morris International (PMI), for example, invested about $3 billion to develop its iQOS. The company has done so despite the high cannibalization risk to its current business.[2]The disruptive risk posed by electronic cigarettes is material: they are most popular among young smokers, and specialists believe that young people who miss the early tobacco habit may never become … Continue reading In fact, PMI’s CEO, André Calantzopoulos, even declared, in late 2017, that this new technology will eventually fully replace traditional cigarettes. (Admittedly, this statement might have been motivated in part by public-image concerns.)

Another example involves the introduction of mobile technologies. When telecom companies faced the entrance of mobile technologies, they could have responded either by incrementally refining their old landline business or by using those innovative mobile technologies themselves to become part of the disruptive force. In the longer term, only the latter approach allowed companies to realize the full benefits of disruption.

Overall, when disruption hits, major commitments have to be made, even if doing so is painful. These commitments can also mean deprioritizing profitable activities to focus resources — management attention, talent, or financial resources — on disruptive trends. Neste, a Finnish oil-refining company, invested heavily in renewable-diesel production, foreseeing regulatory changes in the EU that would create a market for diesel made from renewable sources.[3]The EU required 5.75% of transport fuels to be biofuels by 2010 and the share of energy from renewable sources in all forms of transportation to be at least 10% of the final consumption of energy by … Continue reading The firm developed technology that allows it to produce diesel from vegetable oils and waste animal fats. With this technology, it is possible to slash CO2 emissions by 40% to 60% compared with its fossil-fuel-based counterpart. This strategy paid off. In 2015, Neste was the largest producer of renewable fuels from waste and residues worldwide. In 2016, thanks to high margins, renewable products reached close to 50% of the company’s total operating margin, for approximately 20% of total revenue.

Having The Right Model For Renewal

The 2% companies have an explicit model for managing the inevitable tradeoffs between near- and long-term priorities. The right model for the subsequent renewal also optimally leverages the capabilities of the company and fits the organizational culture. Needless to say, these models are company specific and there is no “one size fits all.” In our work with various industries and in ongoing discussions with executives, we’ve identified a set of models. A few examples:

- The Freeze Timeframe Model. In this model, companies define a specific time horizon and operate within this window to optimize their existing product portfolio and pursue exploration activities accordingly. This can be a good strategy if, for example, management has limited long-term priorities, can predict the near future fairly confidently, has the resources to invest in the desired product enhancements, and believes that building these enhancements upfront will deliver a competitive advantage. Private equity firms are good examples of businesses that invest to create value in a defined time window, usually approximately three to five years. When taking on a company, they will do the exploration that creates visible value in the medium term.

- The No-Regrets Model. This strategy means making sure that your company encounters no surprises in its market domain. Companies need to identify the domain they are playing in and then, within it, engage a wide variety of technological options. By adopting this strategy, companies guarantee an early-mover advantage whatever winning option the market ultimately picks. Companies need to be able to recognize winners early by picking up weak signals. A case in point: Essilor, the world leader in eyeglass lenses, has proved that it can stay successful by continuously scanning and engaging with all novelties in its domain that can change the industry. With this strategy, the company has successfully caught multiple innovation waves, such as online retailing, plastic lenses, sunglasses, and low-cost manufacturing in Asia.

- The Commercializer Model. Companies do not always have a monopoly on good ideas. The commercializer model implies scanning outside for relevant products developed externally, bringing them in-house, and then commercializing them. This strategy requires strong go-to-market capabilities and the resources necessary to acquire the targets identified. It also rests on the ability to scan the market for relevant opportunities and recognize them early, before their market value shoots up. To some extent, this strategy complements a strong in-house innovation engine. Most big pharma companies rely on this model to supplement their own drug pipelines, for instance. By in-licensing products that are already fairly well developed, getting FDA approval, and taking them to market quickly, pharma companies can ensure a steady stream of new products with faster time to market and lower R&D risks.

- The Win-Stay/Lose-Shift Model. Another model is to gather, screen, and test many ideas quickly, with minimal financial investment in each. This diversified strategy can be far less risky than one big bet-the-farm commitment. But it requires the company to identify early the ideas that are less promising and to “fail fast” before too many resources are spent. It therefore necessitates clear criteria and metrics and disciplined objectivity. Once a winner is identified, the company also needs the capabilities to quickly scale up. Zara, the fashion company, typically masters this model. Another good example is Amgen: The biotech company used to fund as many drugs as possible and hope for the best. Now, although Amgen’s R&D strategy still focuses only on breakthrough drugs, the company evaluates drugs quickly, weeding out candidates that don’t make the grade. This fail-fast approach saved the company $1 billion in research spending on just a single drug.

- The Innovation Platform Model. Some companies are able to create an attractive technology platform on which other companies can build their businesses. Amazon and Alibaba have made this strategy work, providing partners with tools, data, and other services to help online businesses succeed. Key success factors here include a truly differentiated platform, cutting-edge technology, the satisfaction of merchants and business partners, and the continuous incorporation of new ideas and improvements — there has to be a clear reason why an outside business would use your platform rather than taking products to market themselves or through others.

Recommendations for Top Management

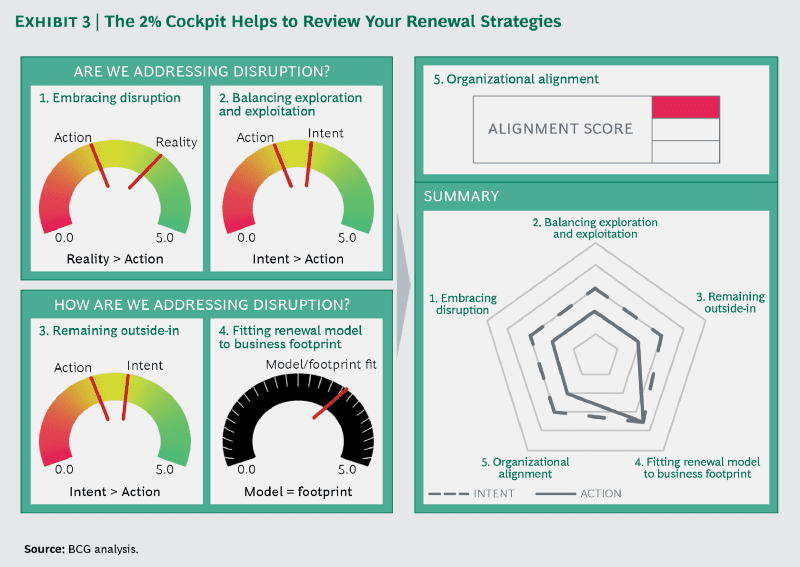

We offer five recommendations for becoming a 2% company:

1. Invite challenge and coaching from the outside. Welcome differing opinions. Be willing to be challenged by, and to learn from, others. No one can be right all the time, and welcoming outsiders so that you can benefit from their unbiased, outside-in perspectives will help you stay close to customers and nascent market trends. Having a clear picture of those trends will also prevent your company from setting out in a wrong direction and provides the confidence necessary to make difficult decisions.

2. Think in multiple time frames. Ask yourself what you’re doing to best position yourself for next year, five years from now, and ten years from now. This mindset will enable both exploration and exploitation activities and strike the right balance of the two. Thinking in multiple time frames is also a critical first step toward defining the right renewal model for your company, as it ensures that your chosen strategy will deliver results at all relevant time frames.

3. Get ahead of any crisis. Recognize risk and be brutally honest. Once risks and opportunities have been clearly identified, make sure you address disruption in the way that best positions your company and takes full advantage of the disruptive forces. Have the courage to act promptly and preemptively: establish an early-mover advantage that can be instrumental for sustainable success.

4. Be skeptical of current success. One should never rest on one’s laurels. Successful companies must stay sober and modest so as to avoid creating a company culture that rests on complacency and self-satisfaction. Rather, keep a mindset of continuous quest for improvement and search for novel ideas. This will trickle down through the entire organization and ensure that key stakeholders always push the frontier of possibilities.

5. Review your renewal strategies explicitly. Pursuing excellence on all four of the previously described traits can be exhausting for an organization. As a result, explicitly reviewing your company’s performance is necessary to ensure that all dimensions are tackled and that there are no gaps between intention and action. To this end, we have built a simple, pragmatic assessment tool that helps executives to rapidly weigh their strategies against the four traits. We call it the “2% cockpit” because it helps to show executives how to pilot their organizations the way that 2% companies do. Exhibit 3 is a sample cockpit view.

The 2% companies set a high bar. But by emulating these performance leaders and heeding the recommendations set forth above, other companies can achieve and sustain a higher level of success than they currently enjoy. Ten years from now, we may find ourselves talking about new manifestations of exploration and exploitation and an expanded roster of companies that excel at both innovation and efficiency: the 3% — or more.