As the UK has begun administering the Pfizer-BioNtech vaccine this week, many leaders might experience their own “Sputnik Moment” for Artificial Intelligence. Through AI-enabled drug discovery, few pharma companies have been able to develop very innovative vaccines, faster than their competitors. One can easily imagine they will be able to replicate this advantage for several other diseases and secure a strong leadership on the future of healthcare. More broadly, in many other industries, incumbents who navigate the AI-innovation races smartly will get great reward from it.

At the same time, after spending between $20m and $40m per month over the last 5 years on its self-driving unit, Uber announced last week its sale to Aurora. Back in 2015, Uber’s co-founder Travis Kalanick believed leading the AV race was a matter of life and death for the company. He explained that the first ride-hailing company who will master the technology will be able to significantly cut the rides’ cost and squeeze its competitors out of business. In a remarkable turn of events, the company now wants to focus on today’s core business and profitability. This is not an isolated example in the mobility industry, as several carmakers allegedly deprioritized the race for autonomous vehicles.

As the Pfizer and Uber examples illustrate well, many CEOs are asking themselves a complex and critical question: “how far should my company fight for industry-leadership on AI innovation?”

First, business leaders should focus only on the few most critical AI innovation races to achieve the company’s objectives. Objectives that will bring substantially different offers to the market, combining AI with other key capabilities as in the Pfizer and Uber examples.

For each of these critical races, business leaders must assess two important questions:

- Given their current AI maturity and the required funds and capabilities (mainly on data, tech, infrastructure and talents), can they be among the AI winners?

- For companies lagging in AI innovation, will they be at a clear disadvantage vs. winners? (Notably in the case of a winner-takes-all situation or captive market — and if there is a risk of commoditization or disintermediation)

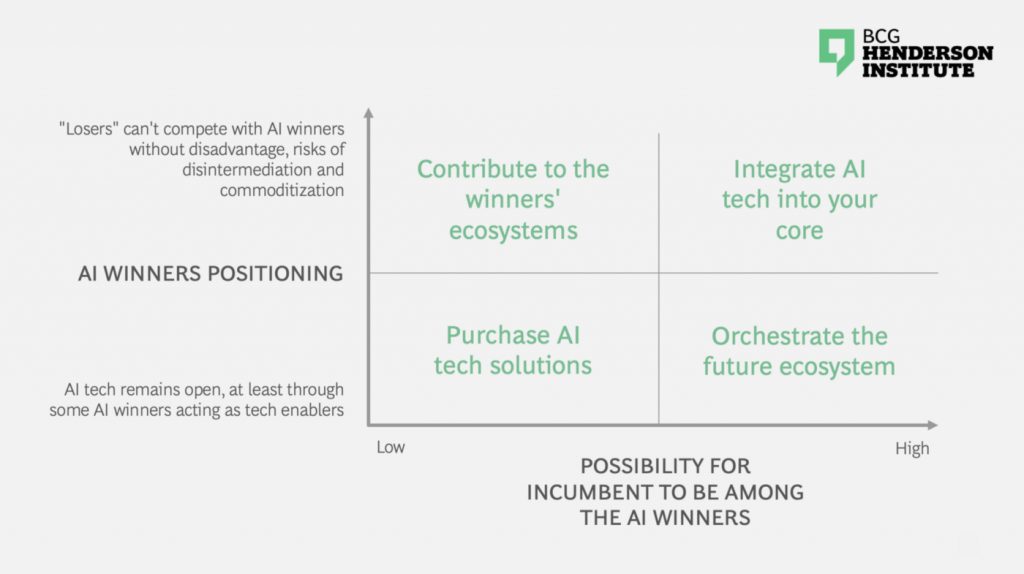

Leaders will then be able to choose one of four strategic orientations based on the following matrix:

1. Integrate AI tech at your core

- If you are in a good position to win the race with a highly favorable endgame for winners, you should absolutely pursue your investments and secure a winning position! You’ll have to integrate the differentiating tech into the core of your capabilities — either organically, through a partnership or through M&A.

- By buying ModiFace, an AI-powered app offering virtual try-on for makeup, L’Oréal reinforced its online brand experience. Then, bringing it to platforms like Amazon put the cosmetic brand in a position to disintermediate its competitors.

2. Orchestrate the future ecosystem

- If winning the AI race doesn’t grant you with a clear advantage over others, you should opt for a more collaborative — and less expensive — approach: identify the companies who can contribute to your offer, potentially with adjacent AI innovations, and form a robust ecosystem with them. Secure the ecosystem’s leadership through your own innovation capabilities, your relationships with end-customers and some control over other players.

- For example, Uber’s most important AI-enabled race is MaaS (mobility as a service). Autonomous vehicles will be a key component of MaaS but not one that could alone put incumbents at risks (well-advanced tech, many companies in competition). Therefore, Uber’s orientation is to focus on orchestrating the MaaS race through its app (which today doesn’t require AVs) and outsource costly development of the AV technology to a 3rd party company, while keeping a stake in it to secure a preferred partnership in the future.

3. Contribute to the winner’s ecosystem

- If you can’t win the race and won’t be able to compete with winners without a clear disadvantage, your best option lies not in a direct confrontation with the winner(s). Rather you should try to complement their offers and find an adjacent position based on your core strengths as an incumbent: access to customers, production facilities, brand image, etc.

- Last year, Puma, the sportswear company, teamed-up with Amazon to create a new fashion brand “Care of by Puma”. The collection, developed using Amazon customers reviews and search data, will be available exclusively to purchase on Amazon.

4. Purchase AI tech solutions

- Companies in this part of the matrix (they can’t win but are not at a disadvantage to compete) should purchase ready-to-use AI solutions. This doesn’t mean they should stop scaling AI, but focus on winning with AI, not winning in AI

- For instance, a luxury goods brand buying AI-enabled CRM off-the-shelf from a tech specialist is indeed not threatened by the CRM company and have little interest in investing in the CRM race (nor has a chance to win it).

By following this logic, we believe companies facing competition on AI innovation will be better equipped to make the tough choices ahead of them.

But the clock is ticking and all companies should start working as soon as possible. AI leaders are indeed exponentially increasing the gap with laggards and the opportunities to lead the race or even just to secure a good position in winners’ ecosystems are rapidly shrinking. You must act now!