The traditional principles of business strategy are derived from military warfare, the art of winning battles and conquering enemy territory. This is also reflected in the language of business where companies attack competitors and exploit their weaknesses to capture market share or defend a position by fighting back rivals.

These principles served many firms well. Corporations that mastered them developed a sustained competitive advantage, dominated their industries, and were rewarded with outsized financial returns. These firms understood that success in business was all about beating competition or — as former General Electric CEO Jack Welch neatly summarized in the title of the book on his management philosophy — “winning”.

In the past two decades, however, these incumbents saw a new breed of competitors gradually occupying top spots in the largest and most successful company rankings. Rather than just being hypercompetitive, these new players developed a new way to compete by adding collaboration as a source of competitive advantage. This allows them to reduce asset ownership and instead use the resources of others, and also to address new customer value propositions that individual competitors cannot match.

These admired companies, such as Airbnb, DoorDash, Spotify, Alibaba, or Grab, seem to reinvent the rules of strategy by deploying a new model: the business ecosystem, which we define as a dynamic group of largely independent economic players that create products or services that together constitute a coherent solution. Incumbents realize that something has changed. Nokia CEO Stephen Elop rightly asserted already in 2011: “Our competitors aren’t taking our market share with devices; they are taking our market share with an entire ecosystem!”[1]https://www.theguardian.com/technology/blog/2011/feb/09/nokia-burning-platform-memo-elop

Traditional companies have started to understand the threat, embrace the opportunity and launch their own business ecosystems. For example, agriculture machinery manufacturer John Deere, founded in 1837, is leading the race to building the most comprehensive smart-farming ecosystem. Retailer giant Walmart has become a serious competitor of Amazon with its Walmart Marketplace. Maersk, the 118-year-old market leader in container shipping, is disrupting its own industry with digital platform solutions. And they are not rare examples — we found that more than half of the largest companies in 2021 have already seriously engaged in ecosystem business models.

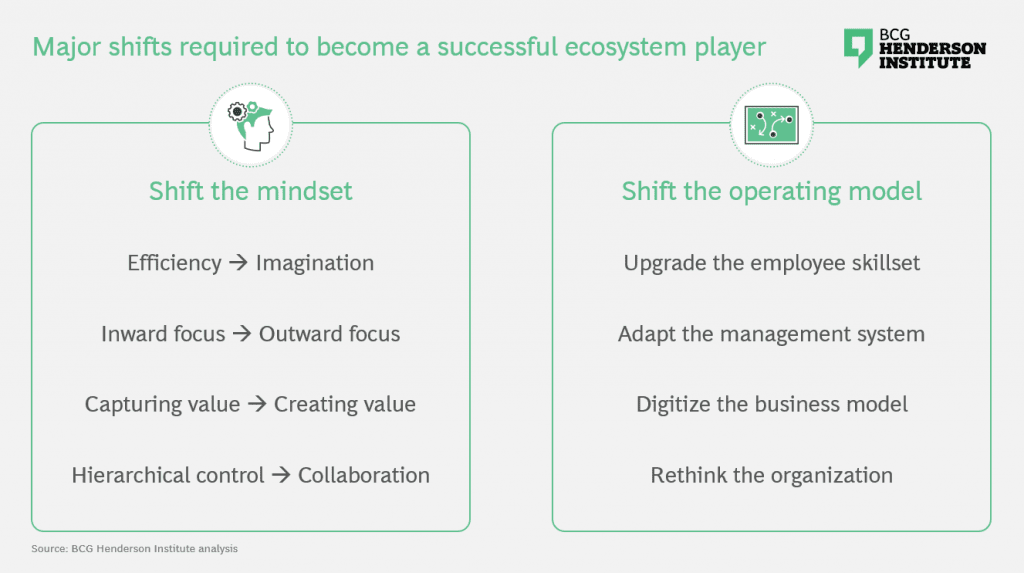

However, many incumbents increasingly realize that it is hard to become an ecosystem player. According to our research, only 15% of business ecosystem thrive in the long run,[2]M. Reeves, H. Lotan, J. Legrand, and M.G. Jacobides, How Business Ecosystems Rise (and Often Fall) MIT Sloan Management Review 60(4), 2019 and we estimate this success rate not to be higher for incumbents. Actually, there is still a surprisingly small number of successful examples of substantial incumbent ecosystem plays, when compared to large technology or startup players. While incumbents can build on valuable resources, they may also be retarded by their legacy. Based on our research and work with these firms (see About the research), we found that they need to rethink their management principles, question deeply held beliefs and build new capabilities. We identified eight major shifts (four shifts in mindset and four shifts in their operating models) that traditional companies must accomplish if they want to become successful ecosystem players (Exhibit 1).

About The Research

Our findings are based on four years of dedicated research on business ecosystems and on working with more than 50 incumbent firms on their ecosystem strategies. For this article, we have analyzed over 100 successful and failed incumbent ecosystem ventures and compared them with startup and big tech ecosystem plays in the same sector. Results were substantiated with 20 targeted interviews with a diverse set of executives from startups, big tech, and global corporations.

Shift The Mindset

The new opportunities and challenges of ecosystem business models require a change in the mindset of how to approach strategy and competition. Incumbents must move from perceiving business as warfare to recognizing the prospects of joint value creation. This involves four major mindset shifts.

Mindset shift 1: From efficiency to imagination

To identify opportunities for ecosystem business models, companies must concentrate less on optimizing current operations, exploiting existing capabilities and expanding present positions. They need to focus more on uncovering unmet customer needs and imagining new solutions, beyond the scope of their current activities. One of the strengths of a business ecosystem is that it can address challenges and enable value propositions that no individual company could achieve alone. Finding such opportunities requires counterfactual thinking and imagination, “the ability to create a mental model of something that doesn’t exist yet.”[3]M. Reeves and J. Fuller, The Imagination Machine, Harvard Business Review Press, 2021

Haier, for example, now the largest appliance manufacturer in the world, was in a crisis in the 1980s. The factory was run down and in debt. Instead of following solely a traditional restructuring approach, the new chairman, Zhang Ruimin, thought that the company and its managers needed to change how they think about their core product refrigerators. He pulled seventy-six fridges off the production line — any that had even minor faults — and asked employees to smash them up. It was a symbolic act to shift thinking from factual to counterfactual which later paved the way for Haier’s rebirth as an ecosystem company.[4]K.G. Palepu, T. Khanna, and I. Vargas, Haier: Taking a Chinese Company Global, Case 9–706–401 (Boston: Harvard Business School, 2006)

Mindset shift 2: From inward focus to outward focus

Most traditional companies have a strong inward focus when developing strategies. They typically start from their own positions of strength, consider how best to deploy existing resources and capabilities, invest into building new assets, and measure success as additional revenues and profits that accrue to the firm.

As the locus of value creation and innovation moves from the company to the ecosystem, firms must look beyond their own boundaries to explore business opportunities and secure the required resources and capabilities. They must be more susceptive to ideas and impulses from the outside world, also beyond their own industry. They must reconsider which activities should be core to the firm and which can be left to partners, questioning the scope and identity of the company. They must open up and be ready to share resources, data, strategies and plans with external partners. And when they think about partnerships, they must move beyond bilateral contracts towards building multilateral relationships and nurturing communities.

For example, when John Deere, the global leader in agricultural equipment, ventured into precision farming, the company initially focused on internal innovation, developing, for instance, its GreenStar yield mapping system and its JDLink telematics solution. However, John Deere quickly realized that, in order to develop an effective precision-farming solution, it needed to collaborate with a whole range of external partners that offered, among others, advanced sensors, software, and location, weather and agronomic data. It built MyJohnDeere.com, a cloud-based platform to access, manage and share data with outside partners. Initially focusing on third-party applications in areas where John Deere did not compete, it eventually also opened the platform to farming equipment from direct competitors. In this way, John Deere moved from being an equipment manufacturer to becoming the orchestrator of a smart-farming ecosystem.[5]R. Lal, M.E. Porter, and A. Houghtalin, Precision Agriculture at Deere & Company, Harvard Business School 2017, 9–717–478 The company has more than doubled its share price in the last two years and is now traded at P/E multiples similar to tech stocks.

Mindset shift 3: From capturing value to creating value

The traditional goal of strategy is to capture value by claiming profit pools, increasing market share, and outperforming competitors. By contrast, the most effective way to benefit from a business ecosystem is to grow the pie together rather than fighting for a larger piece. An ecosystem where all participants focus on their own advantage will find it hard to establish the level of cooperation that is required to create sufficient value to distribute in the first place.

Instead of asking “How can we make money?”, successful ecosystem builders start with the question “How can we create value together?”. They understand that if they collaborate effectively, every partner will be better off. This may involve co-investing into the ecosystem beyond the boundaries of the firm, supporting partners to improve the overall customer value proposition, and removing bottlenecks at the system level even if they are not related to the own activities.

For example, Alibaba invested heavily to support the many small sellers on its B2B marketplace with tools and data to run their online stores, partner with manufacturers, coordinate with logistics partners, and arrange payments online. Similarly, Airbnb focused early on providing professional support for hosts on its platform, such as photography and cleaning services, linen delivery, and tools to simplify property listing and guest check-in. Sometimes, orchestrators need to squarely subsidize partners to remove a bottleneck in the ecosystem. For instance, digital cinema was only established on a broader scale once the film studios implemented a financing scheme in which they shouldered the initial outlay for the projectors and shared the benefits with the cinemas by paying a virtual print fee per digital film screened.[6]R. Adner, The Wide Lens, Penguin Group, 2012

The orchestrator of an ecosystem needs to accept the role of residual claim holder. While it has a big influence on the distribution of the value created, it must also make sure that all players earn enough to keep them on board. In return, the orchestrator can retain the residual profit, which may eventually be very high but can be negative for an extended period. In this way, it took even the most successful ecosystem builders many years to turn their strong market position into profits. On the other hand, some orchestrators that focused too early on value capture failed because they never made their ecosystem flourish. For example, eBay failed in China because it charged sellers to list products and services, whereas Taobao offered a cost-free service. Similarly, Rdio flopped in music streaming because users had to pay a subscription fee while competing platforms offered free ad-based services at the entry level.

Mindset shift 4: From hierarchical control to collaboration

Most traditional relationships within and between companies are based on some kind of hierarchical control. In the relation between employer and employee, parent company and subsidiary, purchaser and supplier, or acquirer and target there are clear directions and strong dependencies, and it is clear who calls the shots. By contrast, business ecosystems are based on voluntary collaboration between largely independent partners.

Incumbents that want to become ecosystem players must accept that they will not be in full control. As Haier chairman Zhang Ruimin put it, a business ecosystem is more akin to a rainforest than to a walled garden. Ecosystem builders cannot dictate the rules, they need to convince partners to join and collaborate. They cannot rely on detailed contracts because dealings in ecosystems are complex and permanently evolving. Instead, they must exert influence by establishing effective and robust relationships and fostering alignment.

In order to get there, incumbents must invest into building trust in their ecosystems. In a recent study, we found that trust issues were involved in the failure of more than half of the 110 unsuccessful ecosystems that we analyzed.[7]M. Aguiar, U. Pidun, S. Lacanna, N. Knust, and F. Candelon, Building Trust in Business Ecosystems, Boston Consulting Group, Feb. 2021, www.bcg.com Building trust requires consistently demonstrating competence (the ability to deliver on promise), fairness (in treating all stakeholders of the ecosystem), and transparency (providing true, reliable, and unambiguous information that enables stakeholders to monitor behavior and results).

Ceding control may be the most challenging mindset shift for incumbents — and one of the advantages of startup firms that are less used to hierarchies and positions of power. A great example of an incumbent firm that managed this mindset shift well is Microsoft. For many years, Microsoft had a reputation of playing hardball, commoditizing the other players in the computer ecosystem and squeezing its software partners, for example, by bundling their products into its core platforms. Under the leadership of Satya Nadella, Microsoft operates with a different mindset. As Mr. Nadella told us at a global BCG partner meeting, the company now pursues a much more collaborative approach, opens its interfaces for integration with other platforms, and no longer tries to dominate its ecosystems, leaving room for others to lead. In this way, Microsoft has become a preferred partner in many cloud applications and IoT ecosystems.[8]For an account of Microsoft’s transformation, readers are referred to, for example, V. Wadhwa, I. Amla, and A. Salkever, How Microsoft made the stunning transformation from Evil Empire to Cool … Continue reading

How can incumbents learn from these examples and achieve the four mindset shifts that are required to succeed in an ecosystem world? For starters, it is important to acknowledge that the mindset of an organization and the behavior of its employees are a rational response to the context they are operating in, the constraints they are facing, and the resources at their disposal. So, if you want to change the mindset, you need to change context, constraints and resources.[9]Y. Morieux and P. Tollman, Six Simple Rules, Harvard Business Review Press, 2014 The good news is that most people enjoy imagination, outward focus, value creation and collaboration. If they operate in a context that encourages and supports such behaviors, they are likely to embrace them.

At this point, leadership comes into play. Most examples of successful incumbent transformations to ecosystem players have been led by strong and visionary CEOs. Think of Sam Allen at John Deere, Zhang Ruimin at Haier, Satya Nadella at Microsoft, Ma Mingzhe at Ping An, and Piyush Gupta at DBS. We observed that many leaders of successful ecosystem companies seem to contradict the popular image of an omnipotent leader. They tend to be more curious than determined; more humble than assertive; and better listeners than presenters. They exhibit more empathy than persuasive power; have a stronger customer than competitor focus; and put more emphasis on long-term value creation than quarterly EPS. They are willing to admit mistakes and make compromises. In this way, such leaders can credibly represent the ecosystem mentality and spearhead the required mindset shifts in their companies.

Shift The Operating Model

In addition to shifting their mindset, incumbent firms that want to successfully build business ecosystems also have to rethink their operating models. Existing operating models are typically optimized for efficiently running hierarchical supply chains with clearly defined roles and interfaces. Based on our analysis of successful and failed incumbent ecosystem ventures, and a comparison with their big tech and startup peers, we identified four major operating model shifts that are required.

Operating model shift 1: Skillset

Incumbent firms that want to engage in business ecosystems often realize that they are lacking some essential skills in their workforce. The most obvious skill gap relates to digital competences, for example, related to the design and construction of digital infrastructure, cloud computing, blockchain, human-machine interface, virtual/augmented reality, data analytics, machine learning and data and cyber security. However, it is not sufficient to hire digital experts to develop the tools, processes and algorithms. The digital skills of the broader workforce for using the digital tools for communication, collaboration and productivity improvement also need to be developed.[10]P. Forth, T. Reichert, R. de Laubier, and S. Chakraborty, Flipping the Odds of Digital Transformation Success, Boston Consulting Group, October 2020, www.bcg.com.

Beyond technical skills, incumbents also need to build competences in ecosystem management. The number of job postings of incumbent firms for “ecosystem professionals” with new positions such as platform strategist, ecosystem manager, and platform regulation & compliance officer has substantially grown in recent years.[11]P.C. Evans, G. Parker, M. Van Alstyne, and D. Finkhousen, Preparing the Next Generation of Platform Leaders, Platform Strategy Institute, Jan. 2021, www.platformstrategyinstitute.com Such professionals need to be able to collect and analyze business intelligence through an ecosystem lens, build fact-based use cases for ecosystem business models, create, incubate and launch new ventures, lead cross-functional teams, and collaborate with external partners. They require a deep understanding of platforms and ecosystem business models, a combination of technical and business skills, end-to-end product management experience, and strong collaborative and communication skills.

A final, easily overlooked skill gap relates to domain expertise beyond an incumbent’s core business. Most business ecosystems span industry boundaries, so participants need to broaden their understanding of the underlying markets. For example, when IBM ventured into Life Sciences it hired computational chemists, genetic scientists, and pharmaceutical business experts on a grand scale. Similarly, several financial institutions use ecosystem models to expand into new fields, such as real estate, mobility, health care, or smart cities. To understand customer needs, partner expectations, competition, and regulation in these domains, firms must build substantial new capabilities, otherwise they risk costly failures.

How can incumbent firms close these skill gaps? Many traditional firms find it hard to compete with big tech and startup firms for digital talent, so they need to rework their employee value propositions and improve their recruitment capabilities to tap the right talent pools and establish a robust talent pipeline over time. They should also invest into internal and external training programs to develop the required skills among the existing workforce. Given the tight job market for digital and ecosystem talent, ambitious incumbents may go one step further and follow the approach of technology firms: A recent study found that 73% of the 748 acquisitions by large US ecosystem players since 2000 were — at least partially — aiming at acquiring talent.[12]G. Parker, G. Petropoulos, and M. Van Alstyne, Platform Mergers and Antitrust, SSRN, 2021 A final option for incumbents is to collaborate with other firms that provide the needed complementary capabilities. For example, Maersk partnered with IBM to set up TradeLens, a neutral industry platform for the global shipping industry.[13]https://www.maersk.com/apa-tradelens Similarly, Shell worked with IBM to establish Oren, a B2B marketplace for the mining sector.[14]https://miningglobal.com/technology/shell-and-ibm-introduce-oren-marketplace

Operating model shift 2: Management system

Successfully competing in an ecosystem world also requires changes to the management system of incumbent firms. This encompasses the adaptation of existing functions and processes as well as the establishment of new processes and tools.

For example, in strategy and corporate development, structured approaches for ecosystem design, partner search, and venture building and scaling need to be developed. Traditional business cases — based on long-term projections of cash flows and calculation of internal rates of return and payback time — rarely work in an ecosystem context because uncertainty is high not only on the demand side, but also regarding the behavior of partners in the ecosystem. Instead, investment decisions should be based on a clear value proposition that addresses a substantial market friction, and on a deep and explicit analysis of the fundamental economics, including customers’ willingness to pay, partner economics, required investments, strength of network effects, competitor reactions, and barriers to entry. Detailed multi-year financial plans are not very meaningful and should be replaced by frequently adapted plans and milestones, with clear stopping rules for ecosystem activities and ventures with limited prospects of success.

The dynamic development of many ecosystems also calls for decision-making routines that are much faster and more pragmatic than most incumbents are used to. Ecosystem-related decisions must be taken under greater uncertainty and before all the information is available. For example, Jeff Bezos used a 70–90 rule at Amazon and stated that “most decisions should probably be made with somewhere around 70% of the information you wish you had. If you wait for 90%, in most cases, you’re probably being slow.”[15]R. Chaman and J. Yang, The Amazon Management System, Ideapress Publishing, 2019 It is more important to quickly recognize and correct bad decisions, and to establish effective feedback and learning loops. Incumbents can also learn from successful tech players how to apply scientific methods to decision making and to base decisions on hard data and quantitative evidence rather than hierarchies, power and fancy PowerPoint presentations. Companies such as Uber, Airbnb and Amazon have a strong discipline in translating assumptions into testable hypotheses and decisions into options that can be rigorously assessed, for example, in A/B tests with customers.

Performance management routines may also need adaptation. Conventional financial metrics, such as revenue, cash burn rate, and profitability, are not very useful for assessing the prospects of an ecosystem because they are backward looking and don’t reflect the economics of ecosystems with their network, learning and scale effects. Metrics for evaluating the health of an ecosystem should reflect the success factors unique to each of the distinct phases of ecosystem development. Emphasis should be on measuring ecosystem engagement and interactions, satisfaction of customers and partners, and value and unit costs of transactions. Performance metrics should be complemented by early warning indicators that can help identify emerging issues and decide if and when it is time to cut losses or reorient the ecosystem.[16]U. Pidun, M. Reeves and E. Wesselink, How Healthy Is Your Business Ecosystem? MIT Sloan Management Review 62(3), 2021

Becoming an ecosystem player may also entail the institution of new functions. For example, a recent empirical study found that ecosystem contributors that established a dedicated partner management unit were more effective in collaborating with partners than their peers that used other functions (such as marketing) for this role.[17]R. Kapoor, Collaborating with Complementors: What Do Firms Do? in Collaboration and Competition in Business Ecosystems, published online: 11 Sep 2014 Effective partner management involves acquiring new partners, developing joint value propositions and co-marketing and co-selling initiatives, supporting partners, and negotiating data and value sharing agreements. Many of our interview partners stressed that such a function requires a very different mindset than customer management because it needs to balance the collaborative and competitive aspects of working together in an ecosystem.

Operating model shift 3: Digital model

Most successful ecosystems today are built on digital platforms and rely on the efficient exchange and analysis of large amounts of data. This is also one of the reasons for the success of big tech players and technology-driven startups in this field. Incumbents that want to become ecosystem players need to catch up and rethink their digital operating models.

Virtually all successful incumbents that we investigated started their ecosystem journey with a profound digital transformation. On average, their digital transformation preceded their first substantial ecosystem activities by four years. Incumbents need to strengthen their digital capabilities and lay the foundations for data- and software-based business models. Many first established a common data and analytics infrastructure as a backbone that enables the effective collection, analysis and utilization of data and that ecosystem ventures can connect to. In this way, synergies among ventures and with the core business can be harnessed, and data flywheels can get started.

For example, the global shipping giant Maersk, started the journey towards its vision to become a global end-to-end integrator of container logistics in 2017 with the digital transformation of its transport and logistics activities. The initial focus was on its own operations, for instance, digitizing formerly paper-based transactions, establishing remote container management, and optimizing the entire value chain using IoT. The internal digital transformation became the basis for subsequent broader ecosystem plays, such as the blockchain technology based TradeLens platform that connects all parties in the shipping supply chain, including traders, freight forwarders, inland transportation, ports and terminals, ocean carriers, customs and other government authorities.[18]IBS Center for Management Research, Maersk Sails on Digital Ecosystem, 2019, 319–0283–1

Another key element of the digital operating model in ecosystem companies is the harmonization of internal and external interfaces. Effective interfaces enable the modularization and seamless coordination of activities. If such interfaces are open to external partners, they facilitate collaboration beyond the boundaries of the firm and foster the development of ecosystems. Jeff Bezos was one of the first to understand this. In his legendary 2002 memo he stated “All teams will henceforth expose their data and functionality through service interfaces. […] All service interfaces, without exception, must be designed from the ground up to be externalizable. That is to say, the team must plan and design to be able to expose the interface to developers in the outside world. No exceptions.” And Bezos meant it, ending the memo “Anyone who doesn’t do this will be fired. Thank you; have a nice day!”[19]K. Miller, APIs Are Social Norms For Computers — And They’re Ripe For Disruption, Forbes, June 22, 2020 … Continue reading

The tool of choice for managing digital interfaces are APIs (application programming interfaces). Empirical evidence shows that adoption of APIs has a positive impact on company performance, which is not so much driven by increased internal productivity but mainly by enabling external complementors. Adopters of externally facing APIs were found to have grown their market capitalization by an additional 38% over 16 years relative to non-adopters.[20]S.G. Benzell, J. Hersh, and M. Van Alstyne, How APIs Create Growth by Inverting the Firm, SSRN, 2021 Incumbent ecosystem players have understood this and started to develop their own API strategies and to open their APIs to external partners. For example, Airbus created a new platform, OneAtlas, to provide simple and quick access to satellite imagery through APIs that allow customers to integrate the data seamlessly in their own workflows.

Operating model shift 4: Organization

A final challenge to an incumbent’s operating model relates to the scope and speed of the organizational transformation. How should the ecosystem activities be integrated into the existing organization, and to what extent will they impact the traditional core business? We observe three models in practice that can be applied depending on the firm’s ecosystem ambition, the size of the opportunities and their linkages to the core.

Many incumbents that start to launch ecosystem plays decide to keep them — at least initially — as a separate venture portfolio. They pursue multiple ecosystem opportunities at the same time, bundle them in a business development or venture unit, and manage them as a portfolio, always ready to stop them if they don’t perform. This approach works well for companies that consider ecosystems as an interesting opportunity to expand their current business activities, but not as a threat to their core business. In this way, they can experiment with ecosystem business models, create options and learn.

For example, some car manufacturers approached mobility services in this way, such as BMW and Mercedes that bundled their activities in a broad range of digital mobility solutions in a joint venture called YourNow. Many insurance companies manage their ecosystem activities in a separate investment vehicle. For instance, Allianz X is a subsidiary of the German insurance giant Allianz Group that invests in digital frontrunners and ecosystem players relevant to insurance and asset management, having grown a portfolio of more than 25 companies, among them nine unicorns, in just a few years.

By separating their ecosystem activities from the traditional business, these incumbents don’t lose focus, protect the ventures from corporate bureaucracy, nurture an ecosystem mindset, and limit the risk for the overall company. On the other hand, the separate ventures may not have sufficient access to the company’s resources and capabilities, and there is only limited fertilization of the core business. To overcome these limitations, some companies, such as the German engineering and technology firm Bosch, allocate their ecosystem venture activities for scaling to individual business units that are closer to the market, rather than managing them at the corporate level.

A second organizational model can be observed if the incumbent decides to focus on only few large ecosystem plays rather than pursuing a broader portfolio approach. This may be a good strategy if individual ecosystem opportunities are big, require significant investments of capital and management capacity, and the company has a high probability to win. Even in this case, many incumbents keep their ecosystem businesses separate from the core and run them as parallel business models, in particular, if the core business continues to be viable and linkages between core and ecosystem plays are limited or easy to manage. For example, when Best Buy, the multinational consumer electronics retailer, built its care delivery platform Best Buy Health, it decided to manage it as a separate business unit in its otherwise functional organization.

If done well, this model combines the autonomy of a startup with the access to the resources of a mature business. The Chinese insurance company Ping An implemented it by centralizing all IT-related back-office operations in its subsidiary Ping An Technology to provide the IT infrastructure and govern all data flows within the group. Ping An Technology was instrumental for creating and supporting four large ecosystem businesses in financial services, healthcare, automobile services, and smart cities.[21]IMD, The Role of Ping An Technology in Enabling Ping An Group’s Digital Ecosystem, 2019, IMD-7–2145

However, the model poses challenges if conflicts between the new and established business models rise. GE Digital, for example, was charged with building the software business for General Electric and establishing the company as the orchestrator of a large industrial IoT ecosystem. GE Digital was managed as an autonomous business unit, while still retaining access to key assets in the core business. However, the new unit was dependent on the established business units. For instance, no revenues were directly attributed to GE Digital, just the sum of software sales of the other business units. After some initial success, pressures to generate short-term profits mounted, at the expense of long-term investments to build the business, contributing to GE Digital never being able to meet the high expectations.[22]A. Binns, C. O’Reilly, and M. Tushman, Corporate Explorer, John Wiley & Sons, 2022

In the third organizational model, the traditional core business is integrated into the ecosystem business, leading to a full ecosystem transformation. For example, when Amazon launched its marketplace in November 2000 it combined it with its original reseller e-commerce business model. This approach works well if the emerging ecosystem play is strategic for the future of the firm because it presents an enormous opportunity and is expected to become the dominant business model, and if there are important core assets to leverage, such as payment and fulfillment services in the case of Amazon.

Ecosystem transformation requires the incumbent firm to adapt major processes to the ecosystem business model and to fundamentally rethink its culture and way of working. DBS Bank from Singapore, for example, transformed itself from a bank to a platform company and technology integrator. Its CEO Piyush Gupta was convinced that cross-industry ecosystems would be the business model of the future and that organizational structures needed to evolve, as data and inter-departmental collaborations would be pivotal to succeed. The company embarked on a major digital transformation of its core banking processes, insourced most technology services, established a data first culture, formed platform teams of business and technology functions, and launched the world’s largest banking API platform. DBS Bank won Global Finance’s Best Bank in the World award for three years in a row.[23]SMU, DBS: Digital Transformation to Best Bank in The World, 2020, SMU-20–0015

We are still in the early days of the ecosystem revolution. Many incumbent firms have been caught off guard by technology players and startup firms venturing into their markets based on ecosystem business models. But traditional firms are catching up fast. It may well be that they will dominate the next wave of ecosystem plays, in particular as ecosystems become more prevalent in B2B markets.

Incumbent firms that want to become ecosystem players should learn from big tech and startup firms, but they should not blindly copy their models. They need to adapt the mindset and operating model of the company to achieve the eight major shifts described in this article. However, they should also harness their existing resources and capabilities that technology competitors may not have, such as a deep understanding of an established customer base, strong infrastructure and sales force, intellectual property, and effective support functions.

The required degree of transformation should be guided by a clear ecosystem strategy that is shaped by the size of the opportunity and threat to core business.[24]U. Pidun, M. Reeves, and B. Zoletnik, What is Your Business Ecosystem Strategy? Boston Consulting Group, March 2022, www.bcg.com. Incumbents should avoid overstretching the organization; it takes substantial time and investment to build the skillset, management system, digital foundation, organizational model, and culture to succeed in an ecosystem world. They must be prepared to run an ambidextrous organization, building new business models while not neglecting the core business to fund the journey.