治末病“Cure the disease which has not yet happened”- Chinese saying

Due to the accelerating evolution of technology and rising risk of disruption, companies frequently need to transform in order to realign themselves to their environment. While early intervention may seem desirable, leaders may also be understandably biased against changing a successful recipe. What does the evidence say about the value of preemptive transformation?

Among companies in need of change, our analysis shows that preemptive transformations drive 3% higher annual Total Shareholder Return (TSR) than ones launched in reaction to declining performance, and the ROI of investments in preemptive transformation programs is 50% higher. Moreover, preemption appears to be the strongest measurable factor in predicting success.

In business transformations, there are seemingly good reasons to believe that time is an essential factor. Companies that change early may get a first-mover advantage, acting ahead of their competitors and potential disruptors. Besides, business organizations are complex systems, which often decline much faster than they grow, an asymmetry which has been called the Seneca Effect. Considering that transformations take time, moving preemptively may be the best way to prevent obsolescence and collapse.

Nevertheless, leaders may be reluctant to change their companies when they are in a comfortable position. And organizations may feel little urgency to change when current performance indicators are still healthy. Transformations are costly, monopolize management attention, and create a risk of distraction. In addition, change can destabilize organizations, leading many to follow the adage, “If it ain’t broke, don’t fix it.”

So should business leaders engage in transformation preemptively, or wait for a degradation of performance to trigger change? To answer this, we extended our evidence-based approach to transformation. We analyzed transformations involving restructuring costs [1]Our approach captures transformations involving relatively bold changes that trigger restructuring costs. It may not capture other forms of change such as continuous incremental adjustment, which … Continue reading launched between 2010 and 2014 by large listed US companies, [2]Large companies are companies that reached a market capitalization of $5bn. at least at one point during the considered timeframe, excluding Real Estate (N = 919). We observed 608 transformations … Continue reading and we found that preemptive change does indeed generate significantly higher long-term value than reactive change, doing so faster and more reliably.

The value of preemptive transformation

Because each company’s circumstances are unique, we studied relative financial performance to define preemption, rather than making qualitative timing judgments. If a company embarks on a transformation [3] We use the appearance of restructuring costs in the quarterly accounts of a company as the signal that a transformation effort has started. while its relative TSR is positive (i.e. overperforming its industry over the past year), the transformation can be described as preemptive. Management’s decision to transform can have many potential triggers — for instance, competitive moves, disruptions in analogous sectors, or technological developments — but these phenomena have not yet caused negative financial performance. On the other hand, a transformation is categorized as reactive if it is launched while the firm is underperforming its industry.

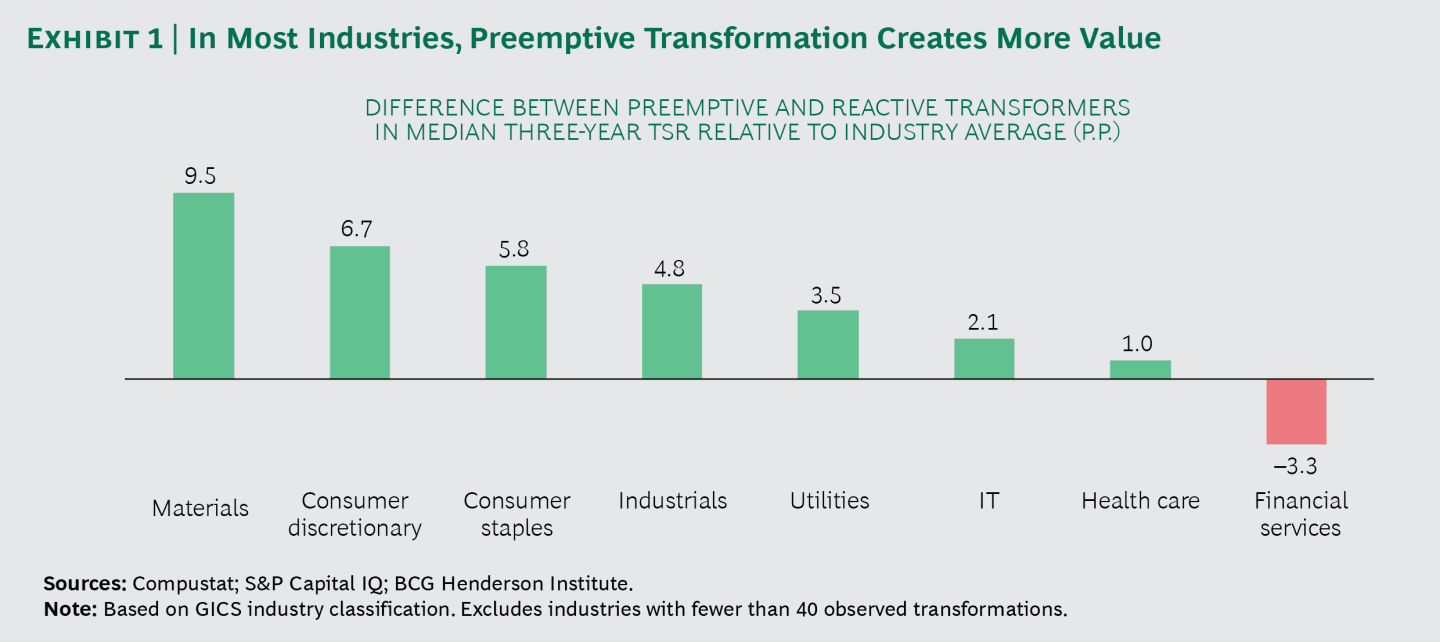

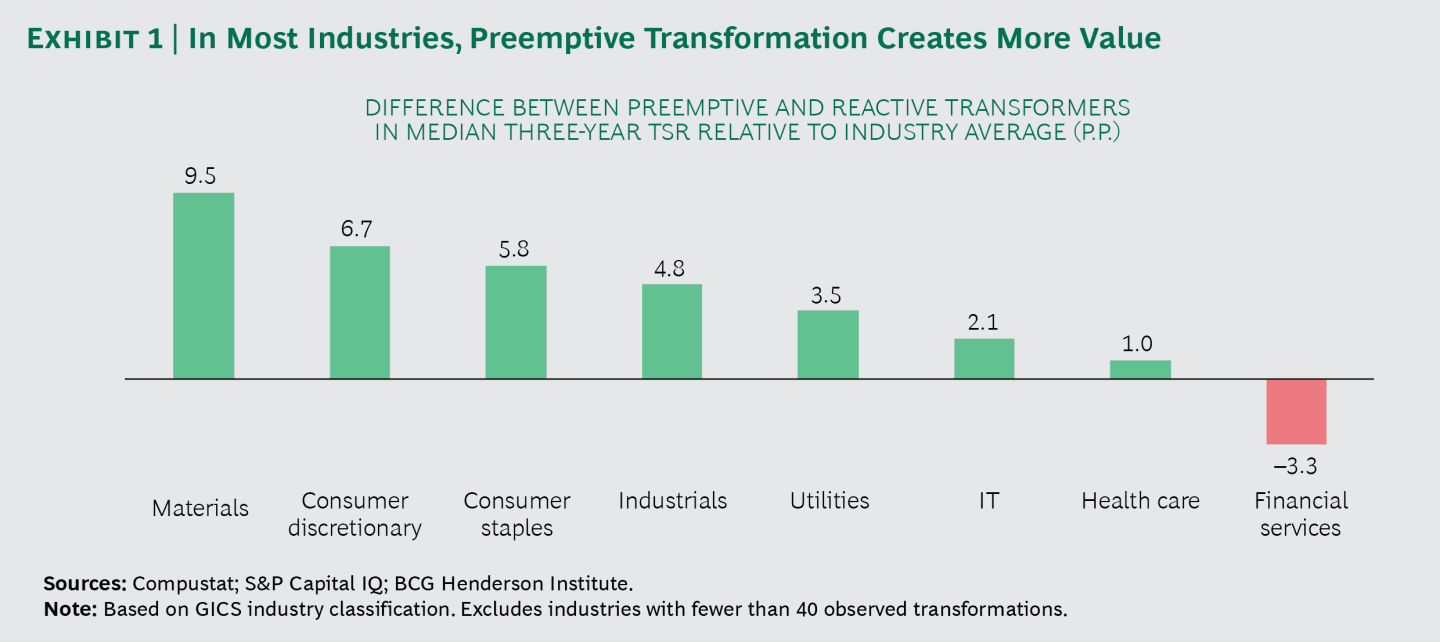

Our analysis shows that, out of all companies that eventually transform, preemptive transformers have 3 p.p. higher annualized TSR than reactive ones over the following three years. This is true not only in aggregate but in most individual industries, except financial services [See Exhibit 1]. (In the period of our analysis, the financial sector was still recovering from the crisis and consequential regulatory changes, which may have caused anomalies.)

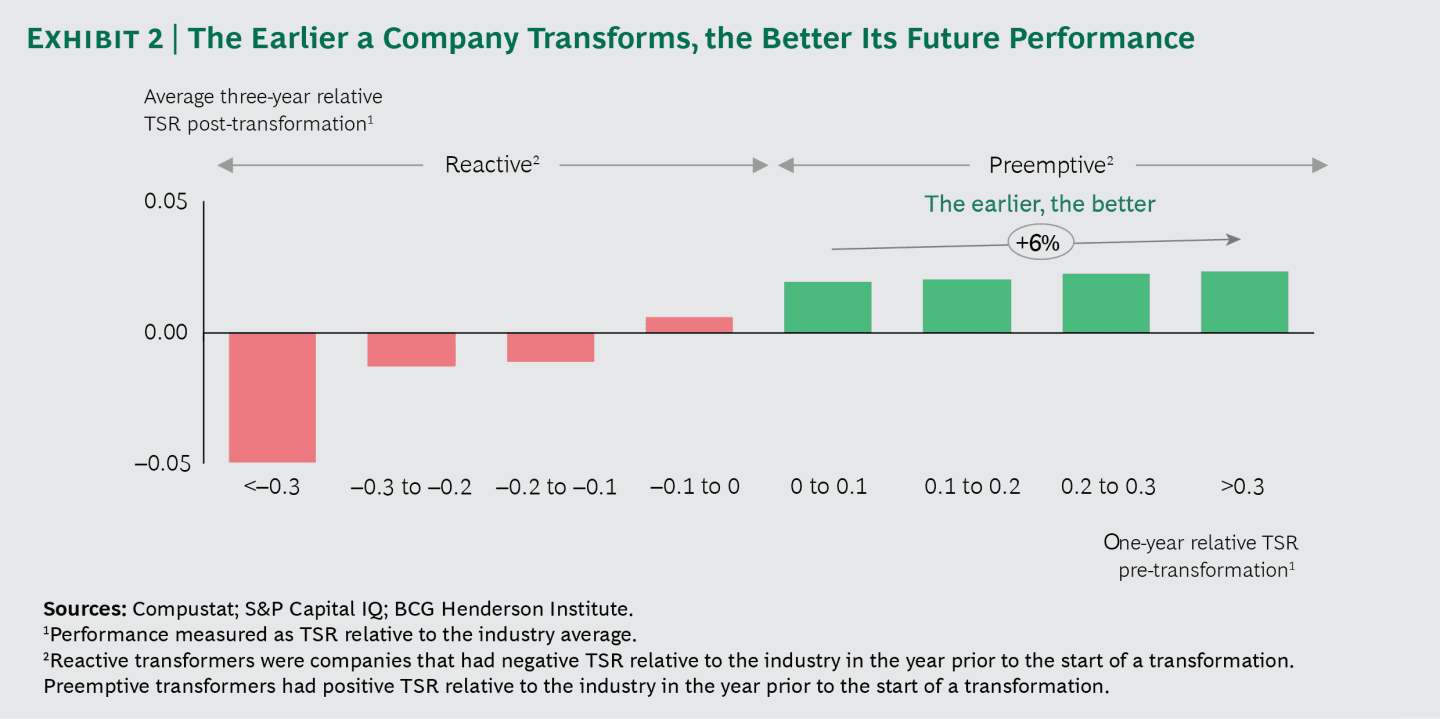

This preemption premium is continuous: the higher the relative performance of a company when it initiates change, the higher its long-term relative performance. In other words, the earlier a transformation is initiated, the better.

Is this outperformance simply explained by the tendency for high-performing firms to continue outperforming? In fact, for companies that do not transform, there is no such link between past TSR and future outperformance on a 3-year horizon.[4]Based on a multilinear regression controlling for industry. Among transforming companies, future TSR and past TSR are significantly positively correlated at a 95% confidence interval. A small “momentum effect”, where previously outperforming companies continue to outperform, is observable on shorter timeframes (up to 1 year), but it disappears in longer horizons [See Exhibit 2]. Consistent with financial literature,[5]Damodaran, Aswath. Investment valuation: Tools and techniques for determining the value of any asset. Vol. 666. John Wiley & Sons, 2012. we find that on longer time horizons, TSR has no “memory.”

Transforming companies, on the other hand, do show memory — their long-term momentum can be preserved by preemptive moves. “If we want things to stay as they are, things will have to change”, as Giuseppe Tomasi di Lampedusa famously wrote in The Leopard.

In spite of this pattern, companies are still reluctant to transform preemptively: in any given year only 15% of overperforming companies embark on transformation, while 20% of underperforming and 25% of severely underperforming companies do the same.[6]Severely underperforming companies are defined as companies with -40% TSR vs. industry or less.

There are exceptions. When Jack Ma founded Alibaba in 1999, internet penetration in China was less than 1%. Growth in that area was expected, but no one could predict its precise course. So, early on, Alibaba took an experimental approach — in which leaders constantly reevaluated their vision and, when necessary, restructured the company accordingly.

In 2011, its online marketplace Taobao had captured more than 80% of the digital Chinese consumer market. Even though Taobao was highly successful, Alibaba decided to split it into three independent businesses in order to participate in three possible futures for e-commerce: one for consumer-to-consumer transactions (Taobao), one for business-to-consumer transactions (Tmall) and one for product search (Etao). The restructuring resulted in two successful mass-market businesses and one strong niche market. Alibaba frequently reshuffles its more than 20 business units, so Taobao is just one example of many preemptive restructurings implemented as Alibaba grew from an 18-employee start-up into a Fortune Global 500 company in less than 20 years.

Secondary benefits of preemption

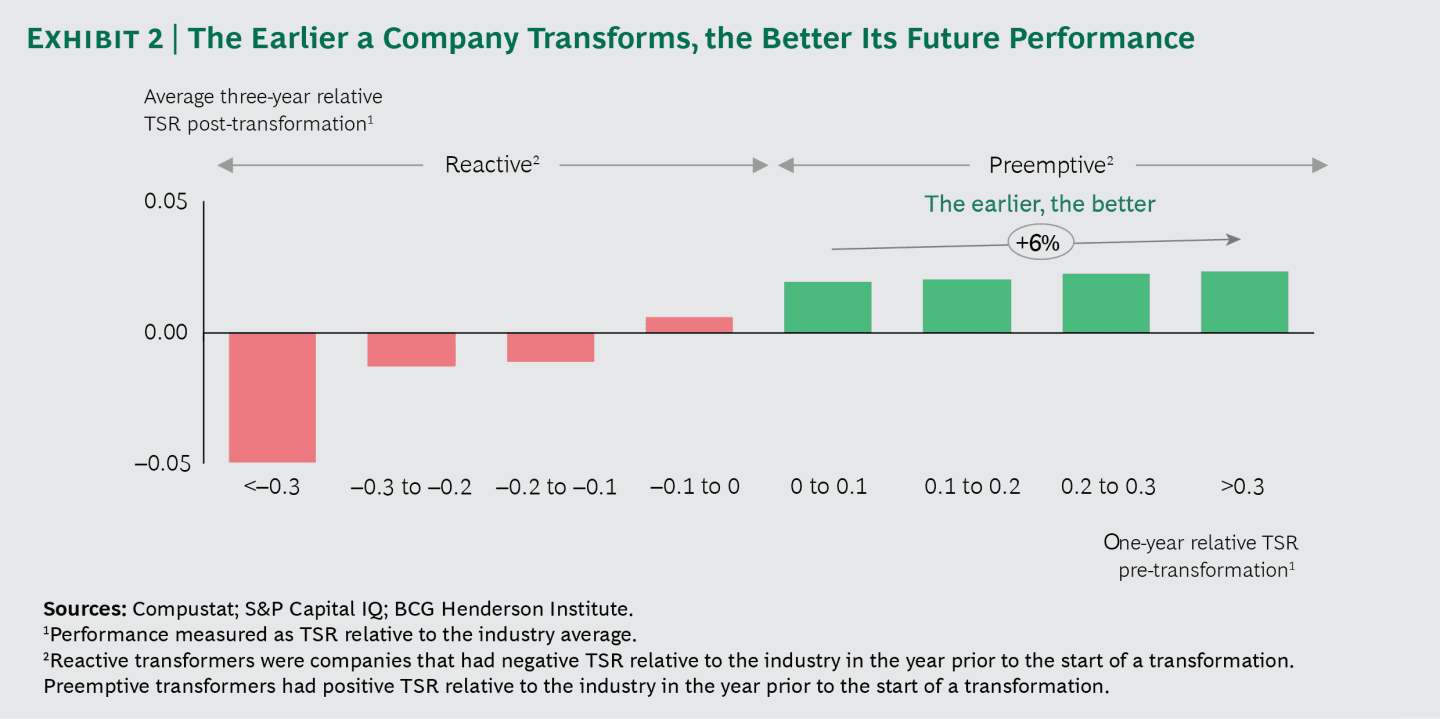

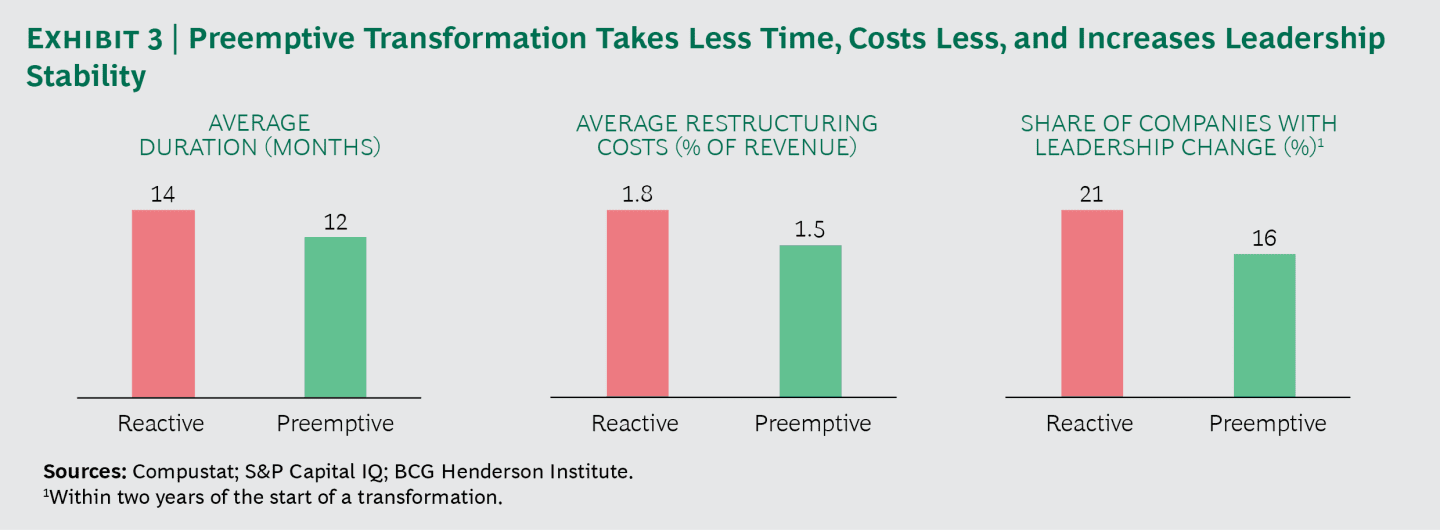

In addition to having better aggregate financial performance, preemptive transformations have three secondary benefits [See Exhibit 3]. First, they takes less time: preemptive transformations result in consecutive restructuring costs for only 12 months on average, compared to 14 months for reactive ones.

Secondly (and perhaps partly as a result of the shorter duration), it is less costly. The costs of restructuring in preemptive transformations total 1.5% of yearly revenues on average, compared to 1.8% for reactive transformations.[7]Total costs of transformation are measured by adding restructuring costs from the beginning to the end of the transformation effort (the end is defined as 2 consecutive quarters without restructuring … Continue reading Considering that these costs are only a proxy for the total transformation costs, the real effect may be even larger.[8]In addition to restructuring costs as defined by accountancy norms, transformations typically involve investment in new capabilities, M&A, repurposing of assets, etc.

By combining the lower average cost with the superior returns, we estimate the ROI of preemptive transformation to be ~50% higher than that of reactive transformations. [9]The relative simplified ROI is calculated by comparing median estimated ROI of reactive and preemptive transf. defined as: ROI = ((change in dividend-adjusted market cap)-restruc. costs)/(restruc. … Continue reading

Finally, preemptive change is associated with increased leadership stability. The chance of a CEO change in the 2 years following the start of the transformation are significantly lower in the case of preemption (16% vs 21%).

Preemption as the primary success factor in transformation

How can leaders successfully implement preemptive transformation? In our previous study on evidence-based transformation, which focused on reactive moves designed to restore financial performance after a decline, we identified several success factors that boost the odds of success:

- Higher capital expenditure[10]High is defined as above industry average.

- Higher R&D spending

- Long-term strategic orientation[11]Measured with BCG proprietary Natural Language Processing (NLP) algorithms using Latent Semantic Analysis (LSA) to measure the long-term orientation of corporate communication in annual reports.

- Leadership change

- Higher restructuring costs and a formal transformation initiative

Our analysis confirms that these success factors also apply to preemptive transformations.[12]Based on a multivariate linear regression for preemptively transforming companies; success factors are positively correlated with future 3-year TSR. But a more fundamental question is whether and how timing affects that recipe for success.

In preemptive transformations, R&D expenditure and capex are the next-most decisive factors, reflecting a need to properly understand and invest in the future. In reactive transformations, leadership change is the second-most important success factor — perhaps because companies that have already allowed performance to decline need to refresh their leadership and culture in order to accelerate change.

One illustration of how preemptive transformation with heavy investment in the future allows a company to sustain performance is Microsoft.[13]Since 2012, Microsoft has increased its R&D spending by 7% per year, reaching $14Bn and 15% of revenues in calendar year 2017. After a few years of stagnating performance in 2009–2012, the software company managed to create strong momentum in 2012–14 (36% annualized TSR). Rather than resting on its recent successes, Microsoft changed its CEO and restructured again preemptively in 2014, which enabled it to preserve its momentum and continue to strongly outperform. The transformation aimed to orient the company to the new dominance of mobile and cloud, even though these trends had not yet damaged the bottom line. In March 2018, Microsoft announced yet another restructuring amid strong performance. For the first time, Microsoft will not have a division devoted to personal computer operating systems, again trying to adapt its organization preemptively to the ongoing technology changes and an evolving competitive environment.

Six steps to successful preemptive change

Faced with a need to adapt to changes in their business, technology or competitive environment, companies should transform early, before financial performance has started to decline. How can leaders turn around the successful company in practice?

1. Constantly explore

To be able to transform preemptively, leaders need to anticipate change by continuously exploring new options. The observation of biological systems teaches us that it is optimal for companies to begin searching well before they exhaust their current sources of profit, and that firms should use a mix of “big steps” to move to uncharted terrain and “small steps” to uncover adjacent options at low cost. This requires balancing short-term tactical moves with laying out a long term aspiration, and investing enough in the future, especially in digital technology and R&D.

2. Create a sense of urgency

When a company is doing well, danger lies in self-satisfaction. Leaders shouldn’t wait for an actual crisis to mobilize. Creating a sense of urgency is the best way for leaders to preempt the risk of complacency. Using scenarios, studying maverick challengers, surveying dissatisfied customers or non-customers and other exercise can help management envision new risks and opportunities, and test the resilience and adaptability of the current business model in a changing environment.

3. Watch out for early warning signals

Most financial metrics, such as earnings, profits or cash flow, are backward-looking. Detecting the need for change requires a variety of early warning signals for phenomena that have not yet impacted the bottom line. Forward-looking metrics such as vitality can help assess the future-readiness of a company.

4. Create transformation capabilities

Moving quickly against risks and opportunities is essential. This requires building permanent transformation capabilities and strengthening the adaptability of the organization. In particular, leadership teams should balance the right mix of fresh ideas and experience to foster innovation and ensure that new ideas are constantly explored and entertained.

5. Control the narrative

Preemptive change may generate frictions with stakeholders who believe that prudence and continuity are the best policies. Leaders should take control of the investor narrative and actively manage investor expectations in order to make preemptive transformation feasible. Defining and conveying the purpose of the company, and relating change efforts to that purpose, can also help energize and recruit employees and middle management for change efforts, which may otherwise be perceived as threatening. Indeed, a common reliance on reactive approaches has caused transformation to become associated with painful, defensive and remedial change efforts, whereas preemptive transformation is more likely to be focused on innovation and growth from the outset.

6. Choose the right approaches to change

Companies tend to drive change with a monolithic, linear project management mindset. But there is no such singular thing as change management. In reality, a complex business transformation comprises multiple types of change. Each form requires a different mindset and different change management mechanisms. While the transformation may be run as a comprehensive program under a consolidated agenda, leaders should de-average and sequence the different forms of change within. In particular, preemptive change is more likely to rely on adaptive or visionary models of change, rather than heavy-handed, top-down approaches.

Technical appendix: How to read and interpret decision trees?

Regression models in the form of tree structures are non-parametric method, where the data is broken down into smaller and smaller subsets through an associated decision tree. The nodes of the tree indicate the attributes or features which best explain the variance of the output variable and node hierarchy gives the relative importance of attributes for outcome prediction.

Gradient boosting algorithms iteratively refine the tree structure based on “error-correction” between observed data and modeled values and consequently find effective splits that minimize these errors.

The final tree represents the most important features that explain the variance in outcome variable. The topmost feature in the tree represents the feature that explains the highest variance. The tree nodes terminate at a specified maximum depth (max depth=3 was set in our case considering the quantity of data available).

In our case, the tree shows that preemption is the most important success factor. The data is then split: among preemptively transforming companies, R&D is the most important success factor. Among preemptively companies with high R&D, Capex comes out as the third factor. The same reasoning applies on the reactive side.