Every year, Fortune publishes the Future 50, a ranking of the world’s largest public companies by their long-term growth prospects, co-developed with Boston Consulting Group (read more on the Future 50 and our methodology). In this series, we assess trends related to the future growth potential of businesses. Our previous articles outlined why technology will remain the economy’s growth engine and why companies need more age diversity in their leadership ranks.

Growth is key to long-term value creation, but identifying which sectors or regions—let alone companies—are positioned to grow is harder than ever. For example, the tech sector seemed to be on the ropes in 2022, with mass layoffs and corrections in valuations, only to come roaring back boosted by excitement around generative AI. China, hard-hit by the pandemic and a restrictive zero-COVID policy as well as a trade feud with the U.S., nonetheless ended 2023 with the second-highest GDP growth among OECD countries.

In 2024, geopolitical instability and wars, a shifting macroeconomic landscape, and elections in 40 countries around the globe will continue to cause turbulence. To help investors gauge where future growth will come from, Fortune and Boston Consulting Group have co-developed the Future 50, an annual ranking of public companies based on our proprietary, AI-driven measure of vitality. In this article, we dive deeply into the geographic distribution of growth potential by evaluating the 200 most vital firms around the globe.

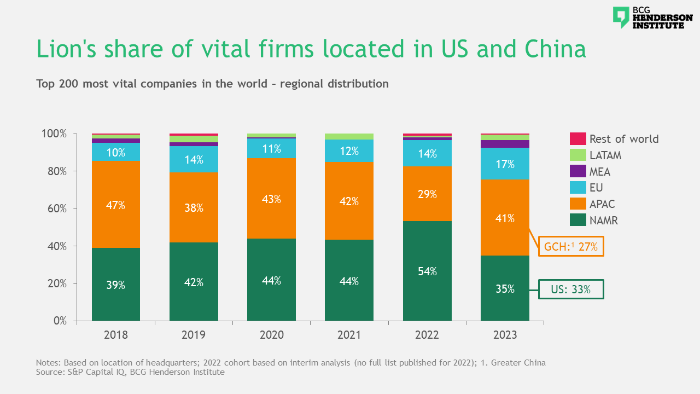

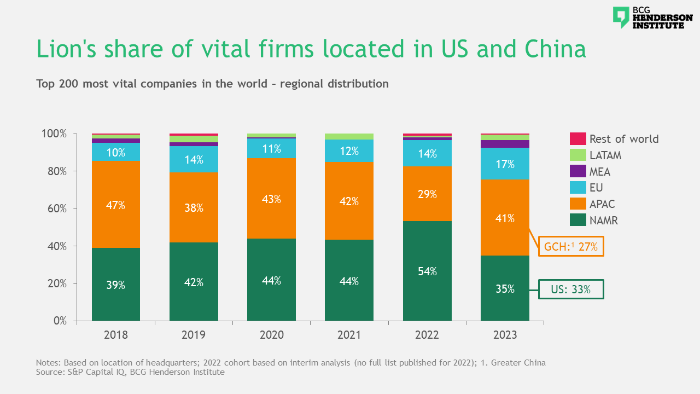

Where the lion’s share of growth potential lies: the U.S. & China

The greatest concentration of future corporate growth potential is in the U.S., which 33% of the 200 most vital firms in the world call home. Buoyed by a dominant tech sector and an economy that has successfully threaded the needle in 2023—achieving reductions in inflation and low unemployment rates in parallel to GDP growth—the U.S. remains the world’s economic growth engine.

The Greater China region follows close behind, capturing 27% of the top 200 spots. Finally, Europe continues to lag well behind on vitality, with structural weaknesses—including a fragmented consumer market and limited availability of venture funding—being exacerbated by the war on the continent. Among the 200 most vital firms, 17% are from Europe, and only three firms made it into the Future 50 ranking for 2023.