This article is the fifth in a series of publications offering practical guidance on business ecosystems. The first article addressed the question, “Do you need a business ecosystem?” The second reflected on “How do you ‘design’ a business ecosystem?” The third analyzed “Why do most business ecosystems fail?” And the fourth discussed the topic of ecosystem governance and asked, “How do you manage a business ecosystem?”

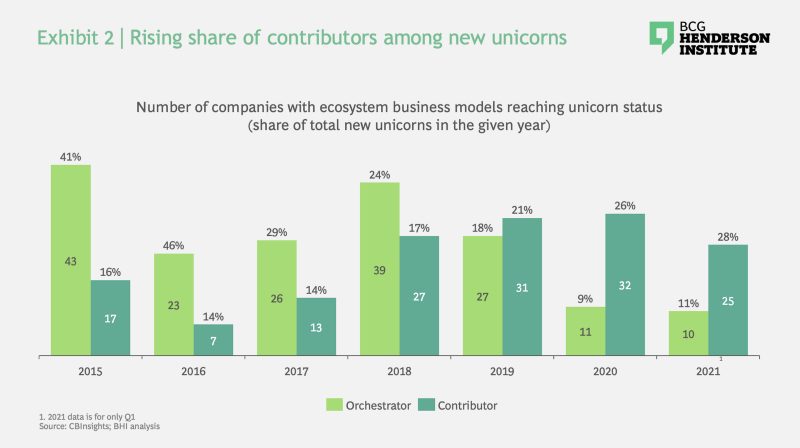

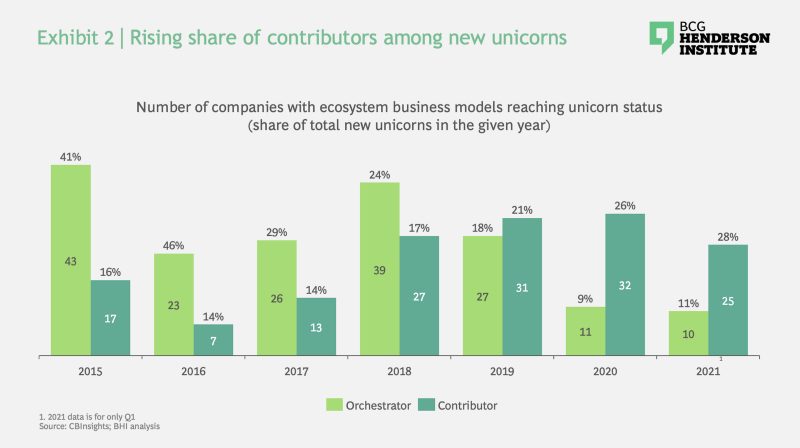

Business ecosystems are on the rise. While in 2000, just three among the S&P top100 global companies relied predominantly on ecosystem business models, in 2020 this number has grown to 22 companies, responsible for a combined 40% of total market capitalization.[1]Standard and Poor’s (S&P) 500 list (Capital IQ) that tracks the largest companies listed on the exchanges in the United States Among the 772 start-up firms that achieved unicorn status (a valuation of more than 1 bn US$) between 2015 and 2021, 179 (23%) were built on ecosystem business models.[2]CBInsights, as of March 31st, 2021

It is no wonder that many leaders of established companies are afraid of missing out on this trend and feel compelled to create their own business ecosystems. Among the 2020 S&P top100 global companies, more than 50% have already built or bought into at least one business ecosystem, most of them in the course of the last five years. In a recent BCG global survey, 90% of multinational companies indicated that they were planning to expand their activities in business ecosystems.[3]Unpublished global BCG survey of 206 heads of strategy of companies from 56 industries and 18 countries, with average revenues of more than 20 bn US$ (spring 2021)

Most of these incumbent firms seem to naturally assume that they need to and can become the orchestrators of their own ecosystems. However, not every company is in the position to play the role of an orchestrator. Fortunately, being a contributor to an ecosystem can be just as attractive. Remember that the biggest winners of the Californian gold rush in the mid-19th century were the suppliers of pots, pans and jeans. Acting as contributors to existing or emerging ecosystems presents huge and neglected business potential for many companies, and their leaders should be more strategic in exploiting these opportunities. In this article, we want to show what it takes to succeed as an ecosystem contributor.

The growing role of ecosystem contributors

Admittedly, most of the largest and best-known ecosystem players, such as Alibaba, Amazon, Apple, Facebook, GoJek, Grab, Tencent, or Yandex, have built their success on owning the platforms and being orchestrators of their ecosystem, which we define as a dynamic group of largely independent economic players that create products or services that together constitute a coherent solution. As orchestrators, they build the ecosystem, encourage others to join, define standards and rules, and act as arbiter in cases of conflict. However, a successful ecosystem needs not only orchestrators but also contributors. Actually, for every orchestrator there can be hundreds to thousands of contributors (as in smart-home ecosystems), or even up to several millions (as in large marketplaces or mobile operating systems).

Not every company is in a position or has the capabilities to be an orchestrator. You cannot unilaterally choose to be the orchestrator, but rather you need to be accepted by the other players in the ecosystem. As we have explained in an earlier article of this series, there are four requirements to qualify as ecosystem orchestrator. First, the orchestrator needs to be considered an essential member of the ecosystem and control critical resources, such as a strong brand, customer access, or key skills. Second, the orchestrator should occupy a central position in the ecosystem network, with strong interdependencies with many other players and a resulting high need and ability for effective coordination. Third, the orchestrator should be perceived as a fair partner by the other members, not as a competitive threat. And finally, the best candidate is likely to be the player with the highest net benefits from the ecosystem and thus a correspondingly high ability to shoulder the generally large upfront investments and risk which are required.

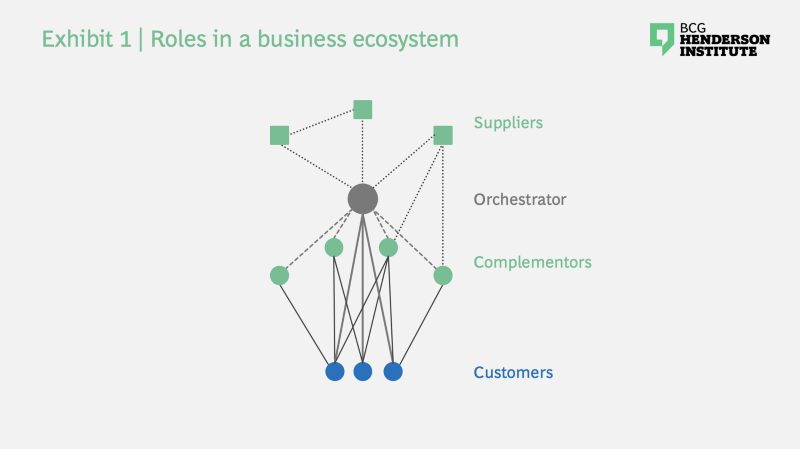

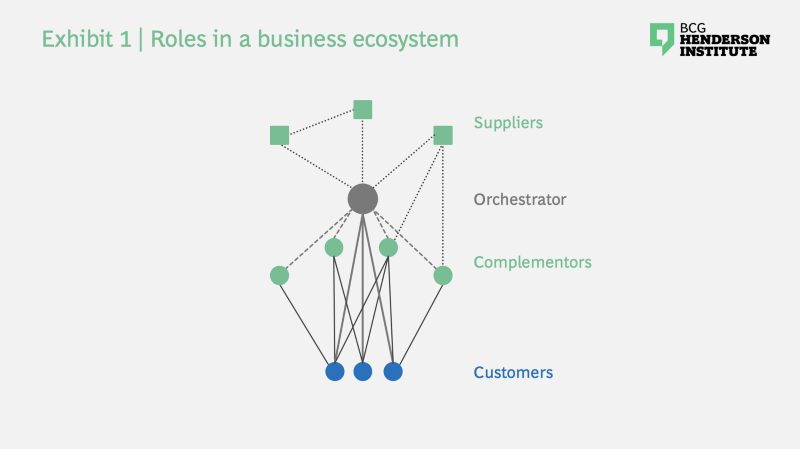

Besides orchestrators, there are two types of contributors to an ecosystem: complementors and suppliers (see exhibit 1). Complementors contribute to the ecosystem solution by directly providing customers with products or services that enhance the value of other components of the ecosystem. In this way, complementors grow the offering of the ecosystem, contribute to its variety and drive innovation. Customers can freely decide which complementor(s) they would like to engage with. Examples are vendors on a digital marketplace, weather data providers in a smart-farming ecosystem, or app developers for mobile operating systems. By contrast, ecosystem suppliers are upstream providers of products or services to other partners in the ecosystem. Suppliers may enable the entire ecosystem (for example, by providing the cloud or payment infrastructure) or serve individual players (for example, by offering cleaning services to Airbnb hosts). With their more generic offering, suppliers can serve ecosystems from different domains, but they typically do not have direct access to the ecosystem’s customers.

In the past, most start-ups and incumbents that considered engaging in ecosystems were attracted by the orchestrator role with its position of power as the rule maker, gatekeeper, allocator of profits, judge and jury of the ecosystem. By comparison, the contributor role seems much less appealing as contributors depend on an ecosystem that they have less ability to influence. They are exposed to a high level of uncertainty regarding the development of the scope, composition and governance of the ecosystem. Moreover, many potential contributors are afraid of being commoditized by the orchestrator because they may be forced to share critical data, may be cut off from the direct access to their customers and thus may lose their differentiation.

However, there are also substantial benefits from being a contributor to an ecosystem. For starters, contributors do not face the high upfront investment risk for building the ecosystem. The broad scope of the orchestrator role comes with the bulk of responsibility for ecosystem success and for the sustained level of investment that is required to get the ecosystem going. By contrast, contributors can typically choose among multiple competing ecosystems and join the most attractive one. What’s more, they can limit their exposure, hedge their bets, and increase their strategic flexibility by participating in more than one ecosystem at the same time. In this way, contributors may have a strong bargaining position vis-à-vis the orchestrator that wants to build and develop a successful ecosystem. In particular, if they provide essential or bottleneck components to an ecosystem, contributors can secure a substantial share of the overall profits.

Indeed, the contributor role can be financially as attractive as the orchestrator role, or even more so. For example, the mobility platform orchestrator Uber achieved an impressive annual revenue growth rate of 24% between 2016 and 2020, but it was clearly outperformed by one of its less well-known suppliers, the payment services provider Adyen, that achieved an annual growth rate of 43% over the same period. Moreover, Adyen earned a cumulative EBITDA of 1.1 bn US$ over these five years, whereas Uber accumulated losses of more than 20 bn US$. Adyen recently even surpassed Uber in terms of market capitalization, reaching 82.8 bn US$ (vs. Uber’s 81.3 bn US$).[4]Based on S&P Global Market Intelligence as of 30.07.2021; EUR-USD exchange rate: 1.1869 We observe similar trends in many industries and contributor domains. Several companies with a significant focus on ecosystem contributor plays are present among the S&P top100 global companies as well, such as smartphone manufacturer Samsung, streaming service pioneer Netflix, or software specialist Adobe.

Not surprisingly, ecosystem contributors increasingly attract the attention of investors, as reflected in the list of start-up firms that achieved unicorn status (exhibit 2): For many years, the share of ecosystem contributors among new unicorns has been on the rise, and in 2019, they surpassed the number of ecosystem orchestrators for the first time. This observation can be explained by two parallel trends. On the one hand, given the recent growth and proliferation of business ecosystems, the opportunity space for new ecosystem business models is shrinking. On the other hand, the emerging large platforms and their ecosystems, such as mobile operating systems, cloud platforms or digital marketplaces, open up new opportunities with considerable scale for contributors.

Even many of the large tech ecosystem orchestrators have started to pivot and increasingly take the role of contributors to their own or other ecosystems, such as Facebook moving into virtual reality headsets with its acquisition of Oculus, Amazon offering fulfillment services for its marketplace and moving into film production, and Google providing cloud infrastructure for an increasing number of newly emerging ecosystems.

Company leaders who reflect on how to expand their activities in business ecosystems should thus carefully consider the contributor role. However, this poses a number of new strategic challenges that companies may not be familiar with. As an ecosystem contributor, you need to build and develop robust relationships with the platform orchestrator and with other contributors. You need to find a good balance of cooperating to grow the pie and competing when dividing the pie. You need to solve potential conflicts regarding mutual commitment, customer access and data sharing. And the resulting complexity is amplified by the dynamic evolution of the ecosystem and the changes in scope, composition and governance which are commonplace.

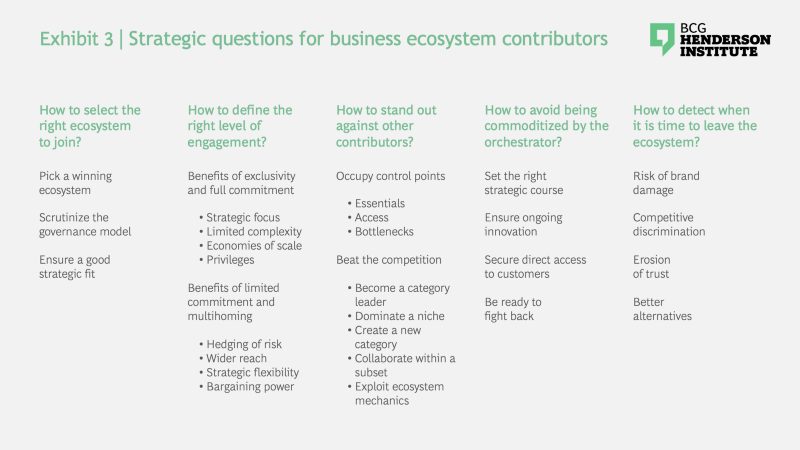

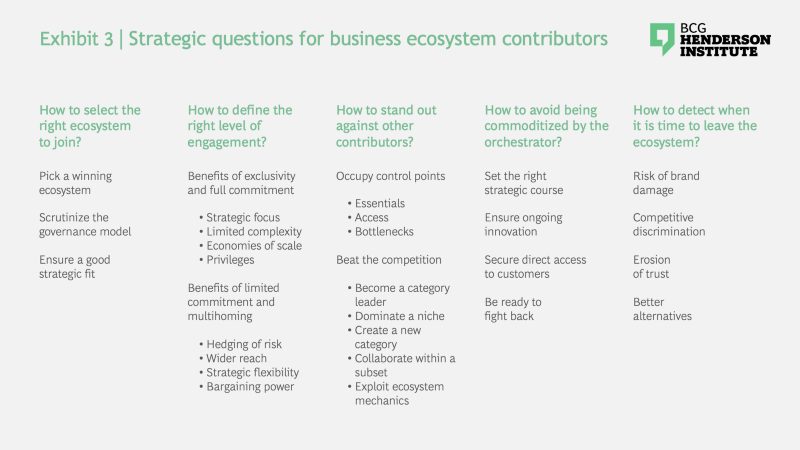

Many companies are insecure about how to deal with these new challenges. In our research and work with clients we have identified the following five key strategic questions that most companies struggle with and that we will address in this article:

- How to select the right ecosystem to join?

- How to define the right level of engagement?

- How to stand out against other contributors?

- How to avoid being commoditized by the orchestrator?

- How to detect when it is time to leave the ecosystem?

To help leaders find answers to these questions, we investigated nearly 300 ecosystem contributor strategies of companies from different industries, geographies and with different size and maturity. We analyzed successes and failures, and talked to founders and managers to derive the learnings from their experience (see sidebar: The research).

1. How to select the right ecosystem to join?

The first step of a successful contributor strategy is to select the right ecosystem to join. We identified three important considerations: Pick a winning ecosystem, scrutinize its governance model, and ensure a good strategic fit.

Competition between ecosystems is frequently characterized by winner-takes-all-or-most dynamics because direct or indirect network effects increase the advantage of the leading players and make it difficult for laggards to catch up. Contributors should thus carefully assess the competitive position of ecosystems they consider joining and pick those with a high likelihood of being among the winners in their respective domains. To this end, they should scrutinize the value proposition of potential candidates, their overall design and scalability, the strength of other contributors, their ability to defend their position against existing and new competitors, and their social legitimacy.

As we have shown in previous research, the specific metrics to assess the health of an ecosystem depend on its stage in the lifecycle. For example, during the launch phase of an ecosystem, red flags that contributors should look for include frequent changes of the core value proposition, essential partners not joining the ecosystem, or the wrong users subverting its value proposition. During the scaling phase, red flags could be persistent imbalances between participants on both sides of the market, declining quality indicators, or increasing complexity of the operating model. And during the mature phase, declining engagement levels of customers, the decamping of early adopters, or aggressive competition from copycats or niche competitors can be warning signs for contributors to stay away from an ecosystem.

The second important consideration is the governance model of a potential ecosystem because it will strongly influence how attractive the ecosystem is for the contributor. Ecosystem governance should be transparent, consistent, fair and predictable. Due diligence should include the following questions:

- How well does the purpose and culture of the ecosystem resonate with your own values and preferences?

- What kinds of commitments, such as exclusivity, and ecosystem-specific investments are required that may limit your future flexibility?

- Do you have the transparency and decision rights to understand and influence the development of the ecosystem?

- To what extent do regulations for input, process and output control limit your customer access and freedom to operate?

- Are regulations in place that ensure that you benefit in a fair way from the data, intellectual property and value that you contribute to the ecosystem?

Moreover, contributors should assess the risk of the orchestrator misusing its position of power. We will come back to this question when we discuss how to avoid being commoditized.

As a final consideration for selecting the right ecosystem to join, contributors should make sure that the ecosystem serves their strategic priorities. To this end, contributors need to be clear about what they want to achieve by entering an ecosystem. For example, they may pursue an ecosystem model to react to a new competitive threat, to gain access to new market segments, to enhance an existing offering, or to create new business opportunities. Depending on the specific strategic objective, different ecosystems may be the best partner.

In this context, contributors should also consider their own potential position in the targeted ecosystem. An ecosystem may be more attractive to join if the contributor faces only limited competition in the segment that it wants to serve, if it can establish a unique selling proposition in the ecosystem, or if it has an unfair competitive advantage due to the specific design of the ecosystem. For example, the insurance group Axa achieved an exclusive agreement with the ridesharing platform BlaBlaCar to develop an insurance offer for members of the BlaBlaCar ecosystem.[5]https://www.axa.com/en/magazine/axa-and-blablacar-launch-blablasure-the-first-insurance-offer-for-carsharers

Most likely, no single ecosystem will meet all desired criteria, so it is also a question of trade-offs and priorities. These trade-offs may be resolved by joining more than one ecosystem, which leads to the next question.

2. How to define the right level of engagement?

Contributors that ponder the right level of engagement in an ecosystem need to consider two questions: Should they exclusively commit to one ecosystem or “multihome” in multiple ecosystems at the same time? And should they bring the full breadth of their offering to the ecosystem or limit it to specific products and services, while reserving others for alternative sales channels? For example, a restaurant may decide to participate in one or multiple online food delivery platforms, and offer the full menu or only selected dishes on the platform.

There are some clear benefits from exclusive commitment to one ecosystem. It allows a contributor to strategically focus its efforts, limit the complexity of its operating model and realize economies of scale. This may be particularly relevant in solution ecosystems with a high need for co-specialization and co-innovation. For example, in the early days of the microcomputer Intel and Microsoft deliberately focused their research and development efforts on the IBM PC ecosystem rather than attempting to also contribute to competing platforms such as Apple’s.

Temporary exclusive commitment can also be a good way to test, learn and refine an ecosystem play. For example, McDonald’s opted to introduce food delivery service through exclusive platform agreements to be able to pilot the right approach through close cooperation.[6]https://www.eater.com/2017/10/24/16453444/mcdonalds-doubles-down-on-food-delivery-with-ubereats Once the model was proved and tested, the fast-food giant started to also join competing delivery ecosystems.

Many orchestrators incentivize their complementors for exclusive commitment and offer rewards or privileges in exchange, such as lower fees, additional services, access to privileged information, prominent positioning on the website, or even the right of exclusive offering in a certain category.

The risk of such an exclusive commitment was experienced by the toy retailer Toys ”R” Us when it entered the Amazon ecosystem. In 2000, the company gave up its efforts to establish its own online presence and announced a partnership with Amazon in which Amazon would create a Toys ”R” Us site on Amazon.com and handle all e-commerce activities for the company, including order fulfillment. Toys ”R” Us executives believed they would be the exclusive toy seller on Amazon. When they noticed that competitors were also selling toys on Amazon, they terminated the partnership. However, the resulting delay in developing a robust e-commerce strategy contributed to the company’s bankruptcy in 2017.[7]https://www.forbes.com/sites/joanverdon/2020/08/19/toys-r-us-amazon-are-linked-online-again-after-e-commerce-deal-with-target-ends/?sh=5969e2559128

The alternative to exclusive commitment is to multihome and participate in more than one ecosystem at the same time. In this way, contributors can hedge their bets by limiting their exposure to any individual ecosystem. They can also reach a wider customer base and improve their strategic flexibility to react to changes in competition, customer demand or technology. Moreover, by limiting their dependency on a single platform, they may be able to negotiate better deals with the ecosystem orchestrator and capture more of the value they contribute. For example, the video games company Electronic Arts (EA) develops games for all major consoles, including PlayStation, Xbox and Nintendo Switch, which increases its bargaining power with the platforms and allows it to achieve profitability levels at par with that of successful console providers.[8]Comparing EA’s average operating margins with the weighted average operating margins that of Sony Game & Network Services and Nintendo, based on official annual reports, over the period of … Continue reading

For most ecosystem suppliers multihoming is a strategic imperative. Suppliers of generic products or services frequently serve not only multiple competing ecosystems but also different industry verticals, such as sensor manufacturers that supply all kinds of IoT ecosystems or logistics providers that are active on all kinds of marketplaces. For example, the insurance start-up company Zego provides special on-demand insurance for a range of ride-hailing and delivery ecosystems (for example, Uber, Deliveroo, Stuart).[9]https://www.zego.com/ We could not identify any examples of successful suppliers that restricted themselves to only one ecosystem. For instance, the payment services provider Billpoint failed after it was acquired by eBay, taken offline and integrated into eBay’s auction platform. eBay learned from this failure, and after the acquisition of PayPal it kept PayPal operating as a generic payment service for all kinds of online transactions, targeting all marketplaces.[10]https://www.cnet.com/news/billpoint-failure-a-lesson-for-ebay/

For the second question on the scope of the offering to an ecosystem, similar considerations apply. Offering the full portfolio can improve focus and economies of scale and reduce operational complexity. On the other hand, restricting the ecosystem offering to specific products or services may limit exposure and dependency while improving strategic flexibility and bargaining position. For example, an effective strategy for sellers on a digital marketplace can be to use the platform as a showroom to test products and get access to new customers to direct them to their own website or other sales channels.[11]A. Hagiu and J. Wright: Don’t let platforms commoditize your business. Harvard Business Review, May 2021 A recent study found, that book publishers that participated in the Kindle ecosystem offered only about half of their printed book portfolios in their e-book portfolios. They mainly used the ecosystem to offer their high-demand products as e-books and benefit from logistical savings. However, in particular the larger publishers withheld their most profitable books to safeguard them from appropriation by the platform.[12]R.D. Wang and C.D. Miller: Complementors’ engagement in an ecosystem: A study of publishers’ e-book offerings on Amazon Kindle. Strategic Management Journal 2020 (41), 3–26

3. How to stand out against other contributors?

Competition within an ecosystem is different from competition in an open market because the rules of ecosystem competition are largely defined by the orchestrator, and they can change over time. For example, the orchestrator may initially restrict competition for certain complements by limiting access to the ecosystem, but at a later stage decide to open up the governance model. Moreover, the dynamics of coopetition in an ecosystem — partners collaborate to create value but compete to divide the value — establish new sources of competitive advantage, such as strong relationships with the orchestrator and other contributors and the ability to capitalize on the functionality of the ecosystem and to adapt to changing ecosystem governance.

There are some structural positions in an ecosystem that are more attractive than others because they can serve as control points. For starters, it helps to contribute a component to the ecosystem that is not optional (such as travel insurance on a booking platform) but essential for the ecosystem to function or to deliver its full value proposition (such as payment services on a digital marketplace). Contributors that offer such components can benefit from their central position in the network because other contributors depend on their cooperation.

Contributors that provide (physical) access to an ecosystem occupy an even stronger control point. They profit from directly interacting with the customer and frequently also influence the functionality of the overall solution. For example, handheld manufacturers in smartphone ecosystems specify near-field-communication (NFC) standards for payment functions and decide whether to provide fingerprint screeners for identity verification.

Finally, contributors should look for bottlenecks, those components that limit the performance, growth, or innovation of the ecosystem. Bottlenecks can shift over time and require a dynamic strategy. For example, IoT ecosystems were initially limited by the number of devices and sensors providing data; later, data aggregation and processing became the bottleneck; and today, connectivity seems to be the limiting factor.

Occupying such control points can be very attractive for ecosystem contributors because it increases their value added to the ecosystem and, at the same time, improves their bargaining position to capture this value. However, contributors must be aware that they will likely compete with the ecosystem orchestrator for these control points. We observe the large tech players and platform providers increasingly offering themselves the complements that are essential for the ecosystem (payment services, cloud infrastructure), control access (devices, app stores), and represent bottlenecks (fulfillment services, connectivity).

Beyond occupying control points, which strategies can ecosystem contributors use to stand out against competitors? We analyzed all 152 start-up firms with an ecosystem contributor strategy that reached unicorn status over the past five years and identified five successful strategies:

- Become a category leader: 26% of contributors beat their ecosystem rivals by focusing on one category and offering a product or service that outperformed their rivals in terms of quality or price. In this way, for example, the French game developer Voodoo came to dominate the category of “hyper-casual games” for iOS and Android, achieving 5 billion downloads and 300 million monthly active users.[13]https://appgrowthsummit.com/these-5-publishers-are-dominating-the-hyper-casual-games-market/; https://mobilefreetoplay.com/5-reasons-why-voodoo-beats-small-game-developers-on-the-app-store/; … Continue reading

- Dominate a niche: 18% of contributor unicorns were successful by differentiating their offering and catering to a specific, narrow customer segment. For example, the Californian software company Calm reached a 2 bn US$ valuation by focusing on sleep issues within the crowded segment of meditation apps.[14]https://www.publishersweekly.com/pw/by-topic/digital/Apps/article/80952-calm-is-sleeping-its-way-to-success.html

- Create a new category: Identifying an unmet customer need and establishing a whole new sub-category is a more challenging, but potentially very rewarding strategy. Only 16% of contributor unicorns accomplished this, such as the financial services company Robinhood that was the first to offer commission-free trades of stocks and exchange-traded funds via a mobile app and achieved a pre-IPO valuation of a whopping 40 bn US$.[15]https://www.businessinsider.com/robinhood-app-vlad-tenev-founder-free-stock-trading-valuation-2017-7

- Collaborate within a subset: 35% of contributor unicorns harnessed the network structure of the ecosystem by connecting a subset of complementors and tightly cooperating with them. For example, Zapier provides workflows to automatically coordinate the operation of more than 3,000 web applications, allowing consumers to integrate the apps they use.[16]https://zapier.com/ This strategy has been widely used among contributors to cloud platforms.

- Exploit the ecosystem mechanics: A small group of 5% of contributor unicorns based their success on deeply understanding the functionality of an ecosystem and tailoring their operating model to exploit it. For example, Thrasio became one of the fastest growing unicorns in our sample by acquiring successful Amazon third-party private-label businesses from small owners and integrating them into its proprietary operating platform to optimize and scale them for performance on the Amazon marketplace.[17]https://techcrunch.com/2021/04/01/thrasio-raises-100m-for-its-amazon-roll-up-play-appoints-retail-cfo-heavyweight-for-its-next-steps/

4. How to avoid being commoditized by the orchestrator?

One of the biggest fears of ecosystem contributors is to be commoditized by the orchestrator. And indeed, orchestrators of successful ecosystems may be tempted to increase their own value capture at the expense of their partners, in particular if their platform has achieved a leading market position and partners increasingly depend on it.

For example, orchestrators sometimes alter the rules of the ecosystem to their own favor by changing fees or prices, adapting ranking or matching algorithms, and restricting access to resources or information. They interfere with free competition by restricting competitive differentiation or privileging some players. Some orchestrators even directly compete with their contributors and integrate complementor offerings into the core platform or imitate their lucrative products or services, often exploiting the privileged information they possess as platform operators.

What can ecosystem contributors do to protect themselves against such threats? As a start, they need to set the right strategic course, as discussed above, and select the proper ecosystem to join, limit their dependency, and offer a superior product or service.

Second, innovation is a key to ongoing differentiation. It can even bring seemingly invincible platform orchestrators to their knees, as demonstrated by Google Chrome winning the browser war in the Windows ecosystem against the incumbent Internet Explorer.[18]https://medium.com/@adamjgordon24/browser-wars-episode-ii-the-wavering-of-a-titan-851dc57922fd Some successful contributors prevent commoditization by linking their R&D agenda to the orchestrator’s innovation roadmap, such as many software partners in the SAP ecosystem.

The importance of developing and protecting intellectual property is illustrated by Shazam, the sound recognition app. The algorithm was already developed at the turn of the century and launched as a service in 2002. After the advent of the smartphone, Shazam became one of the most downloaded apps of all time. In 2014, Apple integrated Shazam into its virtual assistant Siri, but Shazam managed to protect its technological edge against all competitive attacks until it was finally acquired by Apple in 2018 for a reported 400 m US$.[19]https://www.businesswire.com/news/home/20111129005983/en/Shazam-Reacquires-Intellectual-Property-and-Strengthens-Partnership-with-BMI; … Continue reading

A third success factor for contributors to avoid commoditization is to secure ongoing direct access to customers and their granular data. This is the only way to deepen customer relationships, understand their changing needs and improve their own offering. For example, having direct customer access and protecting the own brand is particularly important in the luxury segment. That is why large marketplaces like Amazon or Alibaba have struggled for many years to attract luxury fashion brands, despite serious attempts to crack down on counterfeit products. In contrast, Farfetch, a retail platform specializing in luxury fashion, even offers white-label solutions to luxury brands and retailers to build their own stores and seamlessly interact with their customers.[20]https://www.farfetchplatformsolutions.com/

Many contributors on digital marketplaces — from restaurants, hotels, service providers to retailers — are using a variety of practices like special discounts or targeted marketing to pull customers to their direct channels. As the underlying technology solutions are increasingly commoditized and offered by external vendors such as Shopify, contributors are given the chance to run their own webshops while still maintaining their presence on the leading platforms.

As a last resort, contributors that think that they are being taken advantage of by their orchestrator must be ready to fight back, which can even include lobbying the regulator, mobilizing public support, or initiating legal action. For example, Spotify, Epic Games and others have established the Coalition for App Fairness to fight what they perceive as unfair practices of the large app stores.[21]https://appfairness.org/ As a result, both Apple and Google rethought some of their policies and, for example, halved the fees for the first 1 m US$ in revenue on sales of apps and in-app-purchases each year.[22]https://www.bloomberg.com/news/articles/2020-11-18/apple-to-cut-app-store-fees-in-half-to-15-for-most-developers

5. How to detect when it is time to leave the ecosystem?

Joining a business ecosystem does not have to be a decision for life. Contributors should regularly review the decision and be open to reverse it. There are some indicators that suggest that leaving the ecosystem should be seriously considered.

Risk of brand damage: If the own brand is at risk, the long-term costs of being part of an ecosystem can be much higher than the short-term benefits. For example, Nike never managed to curb the sale of counterfeit or gray market products on Amazon marketplace. In November 2019, Nike thus decided to leave the platform and to focus instead on a smaller number of retail partners to keep full control of its brand.[23]https://www.forbes.com/sites/forbesbusinesscouncil/2020/01/22/why-nike-cut-ties-with-amazon-and-what-it-means-for-other-retailers/?sh=6a36b92a64ff Brand risks can also emerge if the negative image of an ecosystem impinges on its contributors. For instance, in 2017, following a Wall Street Journal report on how YouTube had failed to act against ads appearing next to hateful and offensive content, several advertisers, such as Walmart, PepsiCo and Starbucks, decided to boycott the platform. Only after serious steps made by Google to better monitor content did the companies eventually return.[24]https://www.theverge.com/2017/3/24/15053990/google-youtube-advertising-boycott-hate-speech

Competitive discrimination: If the orchestrator is not able to ensure fair competition within the ecosystem, or even systematically favors some contributors over others, the alarm bells should also ring. Microsoft appeared to alienate both HTC and Samsung early on as partners in its mobile operating ecosystem by seemingly favoring Nokia through a strategic partnership in 2011. Following the subsequent acquisition of the former mobile phone giant in 2014, neither HTC nor Samsung released any new phones supporting Windows Mobile. Samsung even entered in a legal battle with Microsoft, claiming that their previous agreement was allegedly rendered void due to this deal.[25]https://www.theverge.com/2017/10/10/16452162/windows-phone-history-glorious-failure [26]https://www.reuters.com/article/us-microsoft-samsung-elec-settlement-idUSKBN0LD2LA20150209 [27]https://www.cnet.com/tech/mobile/nokias-windows-phone-7-deal-with-microsoft-may-be-worth-1bn/

Erosion of trust: Business ecosystems are built on mutual trust, and lack or erosion of trust are major causes for ecosystem failure. A perceived breach of trust can make contributors leave an ecosystem, as in the exclusivity conflict between Toys ”R” Us and Amazon described above. But also a gradual erosion of trust should serve as a warning sign. In particular, if the orchestrator misuses its power and claims a disproportionate share of the value that is created by the ecosystem, relationships and culture may become toxic, and contributors should consider leaving.

Better alternatives: Finally, canny contributors should always look out for better alternatives to the existing ecosystem. New winners may emerge, ecosystems with a better strategy, better governance, or better strategic fit. Maybe even building an own ecosystem can be an attractive option, which has recently become much easier, as more and more companies offer supporting services. For example, Mirakl, a cloud-based software company that has recently joined the unicorn club, has helped hundreds of players in a variety of industries to set up their own marketplaces.[28]https://www.mirakl.com/

However, leaving an ecosystem should not be an unmindful decision. Being partners in a business ecosystem also means supporting each other, fighting and winning together. And the grass may always look greener on the other side of the fence. Even if a contributor eventually does not leave the ecosystem, just signaling the willingness to do so may already strengthen its position and resolve or improve some of the issues identified. But in the end, when an ecosystem is in true decline, it is one of the benefits of the role as a contributor that it can more easily jump ship.

Business ecosystems will continue to be on the rise in many sectors and geographies. Companies that want to benefit from this trend need to understand that they do not necessarily have to be orchestrators of their own ecosystems. Being a complementor or supplier to an ecosystem can be just as attractive — and brings some additional benefits. To succeed in such a contributor role, companies need to select the right ecosystem to join, define the right level of engagement, stand out against other contributors, avoid being commoditized by the orchestrator, and detect when it is time to leave the ecosystem.

Sidebar: The research

We conducted two systematic historical analyses to enable a comprehensive overview of ecosystem contributor plays and to observe their development over time. First, we analyzed the global top 100 most valuable private companies based on S&P Capital IQ from 2000 until 2020, in five years intervals. We observed their strategic moves building or entering business ecosystems as a contributor or as an orchestrator. We analyzed in detail the 72 players with relevant contributor plays. Second, we analyzed the 772 start-up companies that reached unicorn status (over 1 bn US$ valuation) between January 2015 and March 2021 based on CBInsights’ unicorn data base. We looked into their business models to identify the ones relying mainly on ecosystem business models. Among this group, we identified 152 ecosystem contributor companies. The systematic data set from these two sources was complemented by insights from 74 additional contributor plays of both established and start-up companies. The resulting total number of almost 300 analyzed ecosystem contributors was well balanced in terms of geography, industry, maturity, company size, and ownership. We further validated our findings with more than 20 interviews with founders and managers.