Given the uncertainties related to climate change, companies can’t just prepare for one future. The harsh reality is that no one knows what 2030 will look like—if we’ll see an uptick in green alliances or diminished international cooperation; a surge in green innovation or a backslide to fossil fuels. There are myriad possibilities.

To help companies stress-test their strategy and plans—and stretch their imagination—in the medium-term (~5 to 10 years), we’ve created five plausible-but-exaggerated future scenarios. They offer a springboard for leaders to consider climate risks, identify vulnerabilities, and develop strategies for their company’s businesses and geographies.

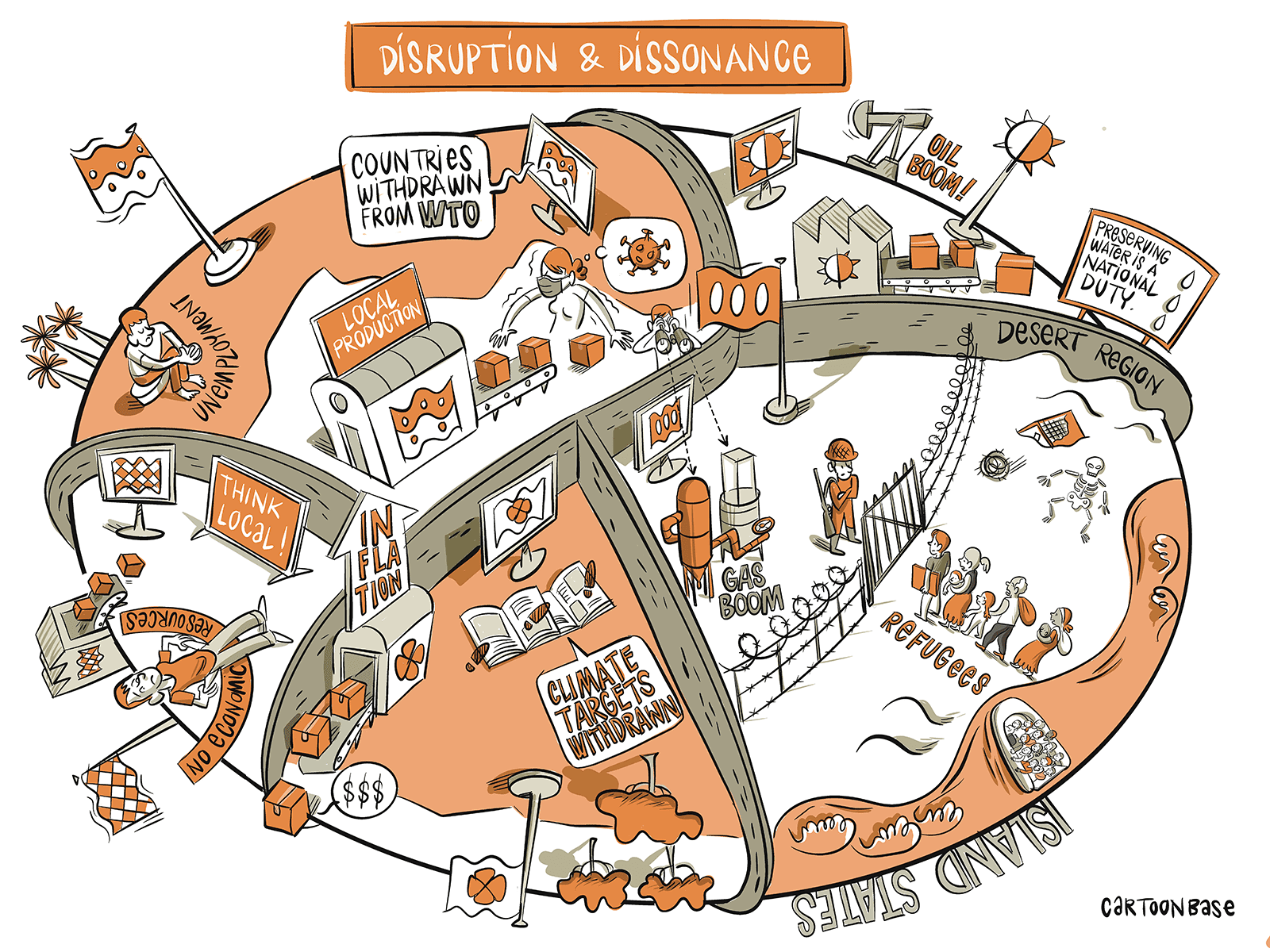

Disruption and Dissonance

Accelerated hyper-nationalism and diminished international cooperation result from geopolitical frictions.

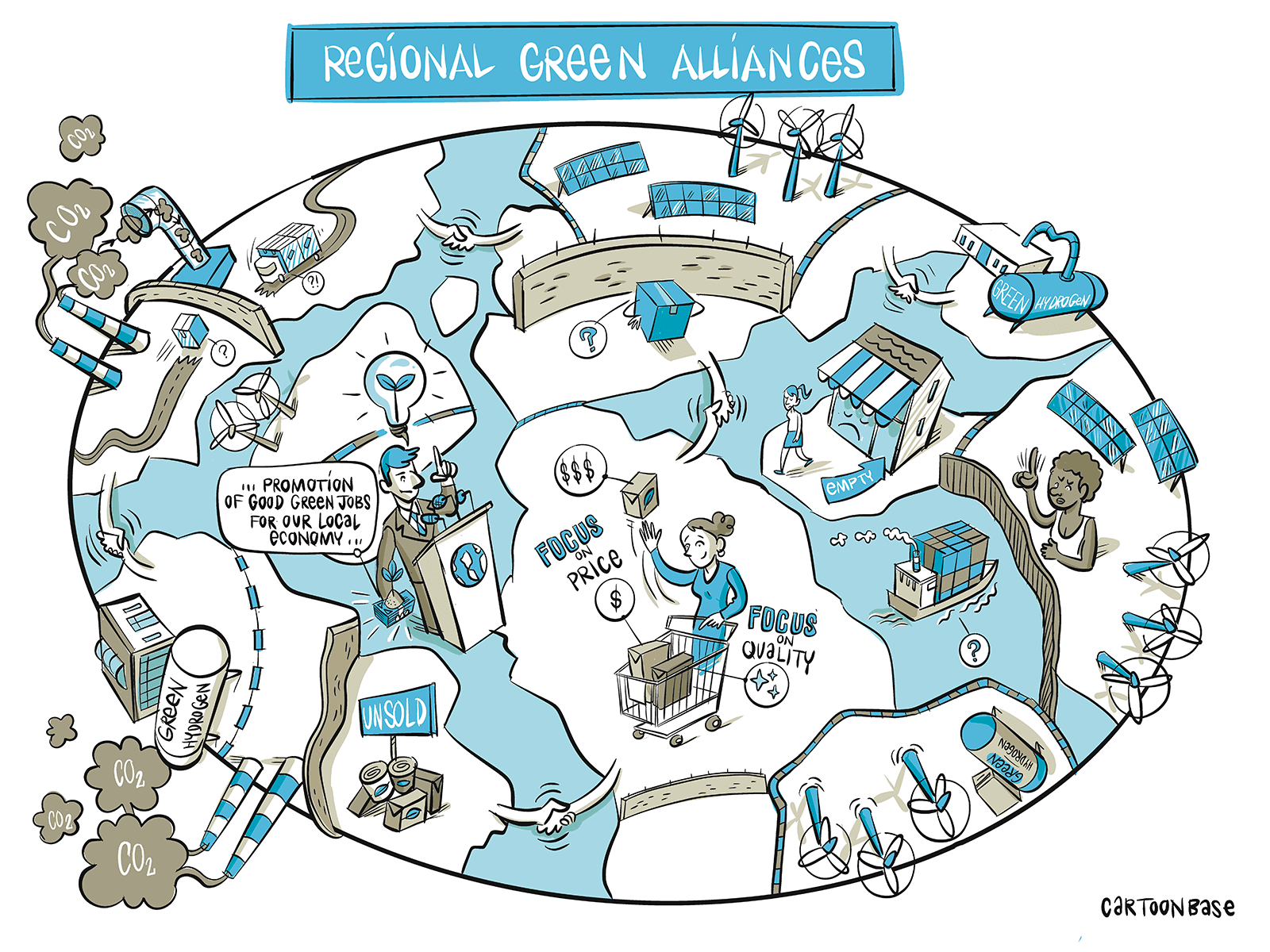

Regional Green Alliances

Regional powers expand their sphere of influence through green trade and infrastructure.

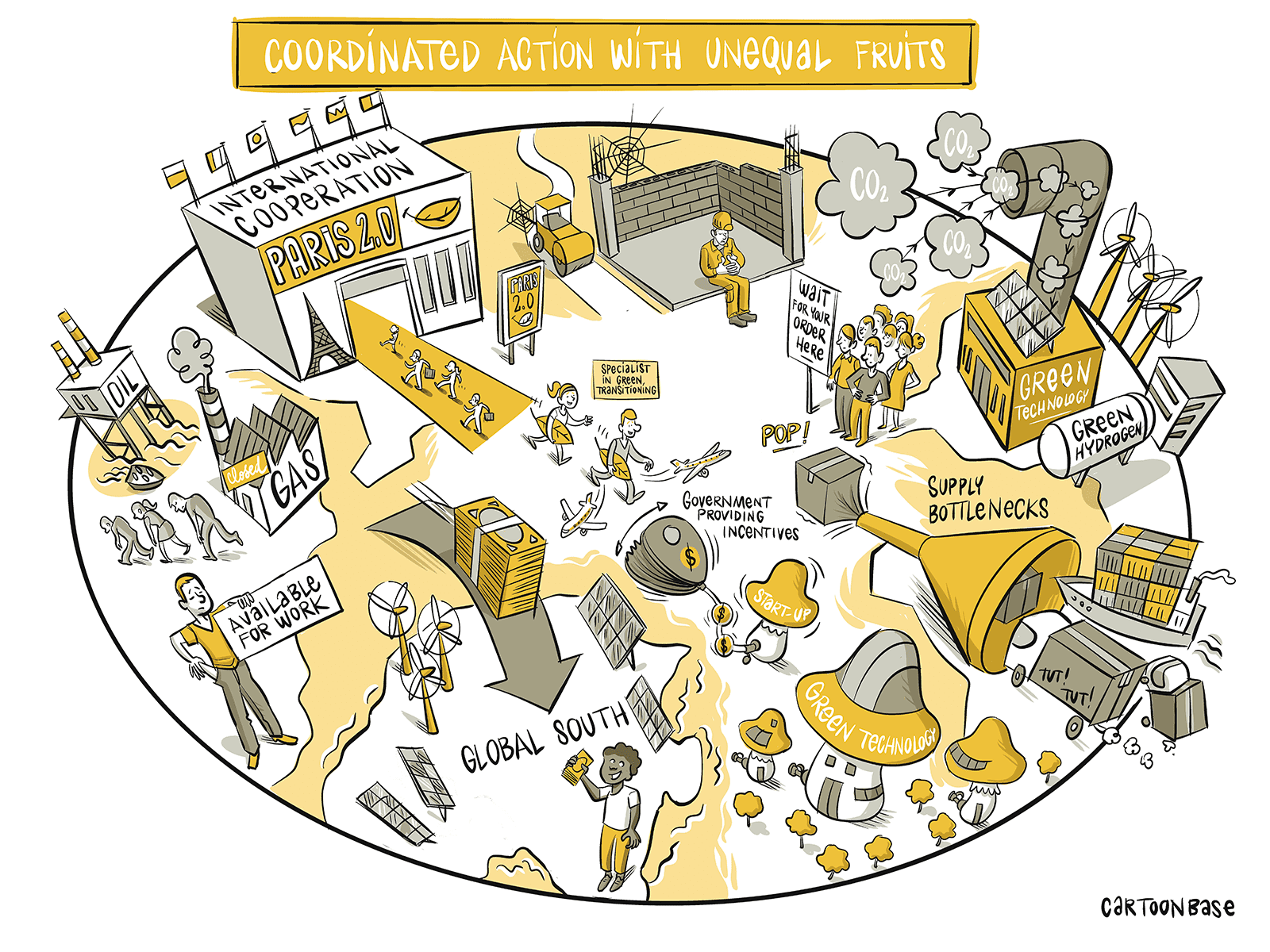

Coordinated Action with Unequal Fruits

Major powers see benefits in global cooperation and green growth.

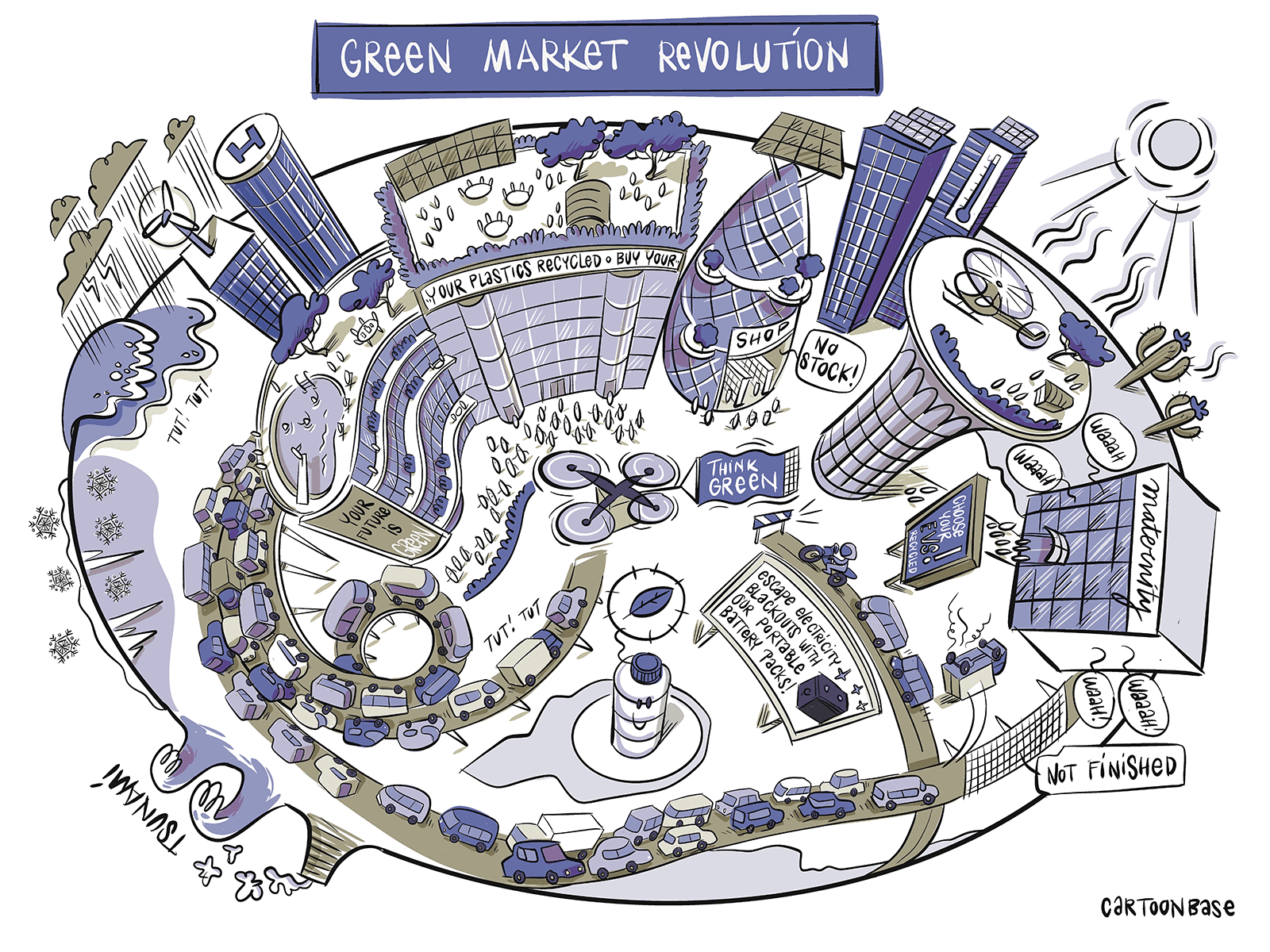

Green Market Revolution

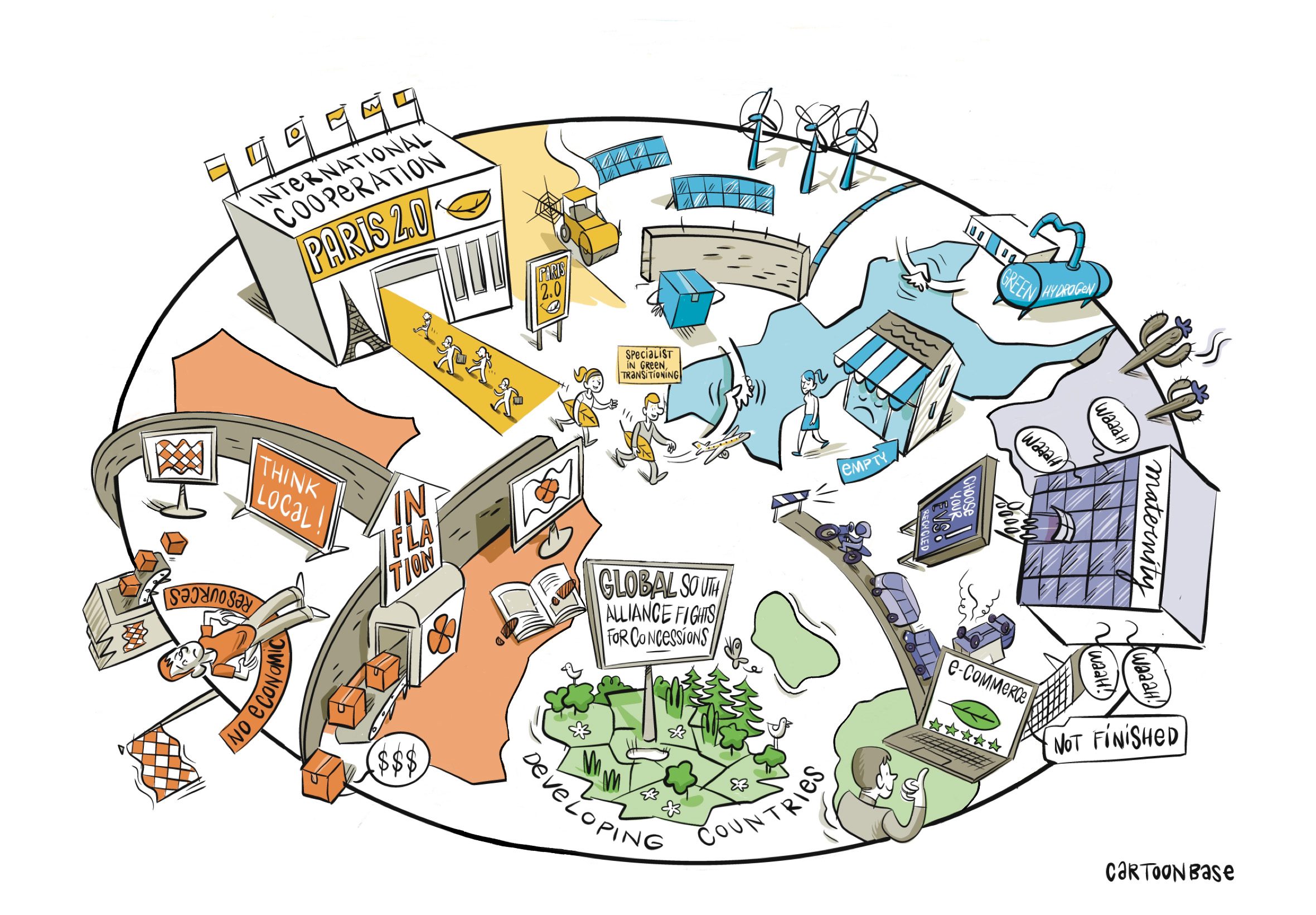

Market stakeholders lead the climate push, and political action takes a backseat.

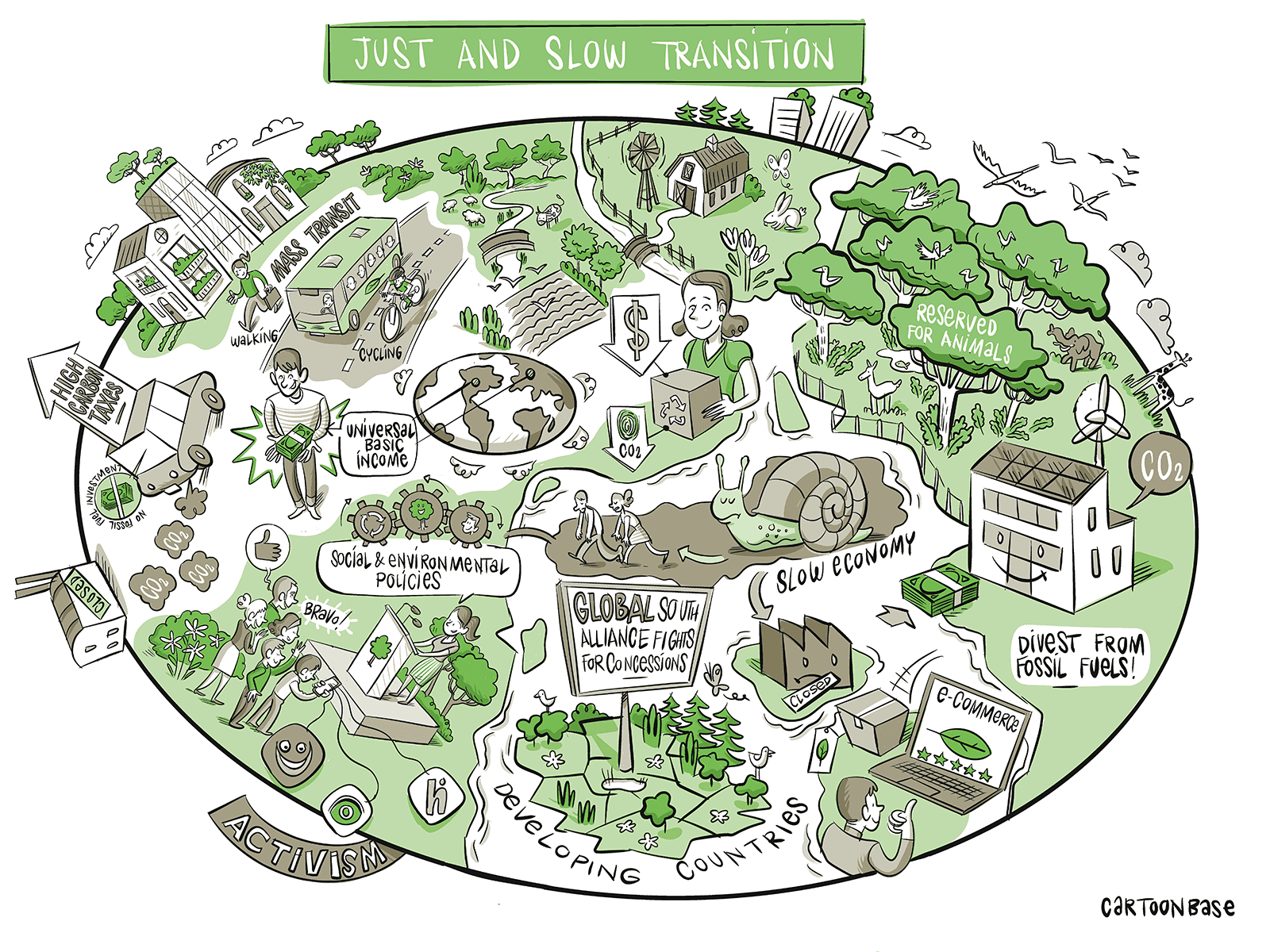

Just and Slow Transition

Climate and social activism leads to equitable green transition, but muted growth.

When engaging with each scenario, consider:

- What are the threats and opportunities for my organization?

- What capabilities would an organization like mine need to succeed?

- What specific actions would I take to prepare if I knew this was coming?

Then look across the full set and explore potential no-regret or big-bet moves, along with contingent moves—and the early warning indicators that would enable them.

Transcripts

Disruption and Dissonance

Imagine a world in which scarcity becomes more pronounced. Smaller reserves of critical earth minerals are discovered than expected or can be developed as quickly as needed leading countries to limit exports and strike exclusive trade agreements. Climate action falters as countries walk back from the Paris Agreement, leading to a resurgence in fossil fuel and related industries.

Accelerated droughts and extreme weather further disrupt supply chains across the globe and create millions of climate refugees and internally displaced people. Neighboring as well as developed countries close borders. We see accelerated hyper-nationalism and diminished international cooperation. Regions and countries turn inward, and tensions heighten as geopolitical frictions intensify. Tariffs and regulation stifle innovation and breakthroughs in industrial processes stagnate.

Countries with strong local markets and supply; strong production ecosystems with strategic capabilities; and large reserves of key green resources, such as lithium, are more positively positioned. But those with a strong reliance on foreign investment and trade are at a disadvantage.

Regional Green Alliances

Imagine a world in which regional powers expand their sphere of influence through green trade and infrastructure. Disputes over domestic green manufacturing subsidies and carbon-based border tariffs trigger trade conflicts that lead to withdrawal from the World Trade Organization. Global organizations, such as the World Bank and IMF, are replaced with regional analogs. Countries not aligned to a regional bloc face barriers to resources, and North–South cooperation on climate adaptation falters.

There is an increase in green manufacturing subsidies and green tech transfer within regional blocs. Nevertheless, there is continued support for fossil fuel, as politicians advocate to keep energy prices low by whatever means necessary.

Consumers put less emphasis on green production, caring more about price and quality amid supply chain disruptions. They call for better employment opportunities, free movement within regional blocks, and deepening cultural ties.

Connections to strong regional blocks and resource pools—whether raw materials, talent, land, and so on—provide a position of strength. Redundant supply chains and near-shoring enable global companies to operate amid a fragmented landscape. High reliance on global trade, weak government support, and weak regional ties become risk factors.

Coordinated Action with Unequal Fruits

Imagine a world in which negotiators align on Paris 2.0—a landmark climate agreement creating a global price on carbon and the first international accord on geo-engineering. Demand for green products skyrockets, shifting profit pools and driving innovation, while also leading to supply chain bottlenecks. The world experiences few climate-related shocks, allowing countries to rapidly expand clean energy development and innovative approaches to adaptation.

Major powers see benefits in global cooperation and green growth. The world breathes a sigh of relief as the war in Ukraine comes to an end and US–China tensions thaw. International cooperation is back in vogue.

Yet despite progress and relative stability, prosperity mirrors entrenched inequalities. Automation displaces jobs and few safety nets are offered to displaced workers, gender inequality persists, and marginalized communities bear disproportionate costs of the green energy transition.

Exporting economies and trade hubs, manufacturers of green tech, agile markets with low regulation, and countries with abundant resources are the winners. Vulnerabilities arise for countries and companies with an inability to decarbonize heavy industry, that have a higher labor cost, and that rely on traditional energy sources, both as exporters and users.

Green Market Revolution

Imagine a world in which market stakeholders lead the climate push, and political action takes a backseat.

A critical mass of green consumers support supply chain decarbonization by taking on green premiums. In response, investors call for increased ESG transparency and disclosure, and growth in the green bond market enables rapid decarbonization of the highest polluting companies. Advanced market commitments from the private sector catalyze investment in clean tech and help decarbonize supply chains. Pro-business sentiment, laissez-faire economic policies, and low taxes enable more investment. Open boarder policies facilitate labor-market flexibility.

The result? Innovation and major breakthroughs. However, high rates of consumption lead to quicker than expected biodiversity loss, water scarcity, and supply chain disruption. Increased EV adoption strains electricity grids and lead to worse road congestion. Growth in cross-border investment causes a boom in mineral extraction, but Global South exporters fail to capture downstream value and employment opportunities.

Regions with existing innovation and manufacturing hubs for green technologies receive continued investment. But heavy reliance on state support or traditional energy sources becomes a liability.

Just and Slow Transition

Imagine a world in which climate and social activism leads to equitable green transition, but muted growth. We see an activist resurgence and expansion of grassroots climate action, with green parties driven to power across multi-party democracies.

This mounting climate activism strengthens support for a low consumption lifestyle and renews the political will to address climate change. The World Bank is overhauled with a climate focus, and significant green financing delivers funds for loss and damage. Developed countries accept responsibility for historic emissions. A global carbon trading scheme is created, and we see stronger protection of forests and biodiversity.

Meanwhile, aging and shrinking populations in the Europe and East Asia result in slower economic growth. The workforce transition is managed through strong government intervention and

unemployment support, at the cost of a fiscal debt crisis in the West. Nevertheless, global power dynamics start to shift. Developing countries push for more domestic manufacturing investment and capture more value from production of green goods.

Having a strong workforce and mature green industries would provide an advantage, whereas countries dependent on extractive industries may not fare as well.