This is the second in a series of articles about the future of technology in Europe and the lessons from China to build its economic sovereignty.

There’s a growing consensus that in the field of Artificial Intelligence (AI), Europe lags behind the U.S. and China. Even European Commissioner Thierry Breton recently admitted that Europe missed the first wave of AI. During the first wave, AI was used mainly in consumer-facing applications, such as search engines and speech recognition. In the imminent second wave, industrial applications of AI — such as predictive maintenance and quality control based on image recognition — will spread through the global economy.

Although the European Commission has recently unveiled ambitious plans, notably Shaping Europe’s Digital Future: Strategies for Data and AI, policy-makers and business leaders alike believe that Europe won’t catch up with the global leaders in AI anytime soon. Two years ago, former Google China president, venture capitalist, and AI expert, Kai-fu Lee, bluntly stated that Europe wasn’t in the running for even a bronze in the global AI race. In another interview, Lee added that the U.S. will “continue its hegemony … in Western Europe” in AI.

That begs the question: Can Europe ever catch up?

The good news: Not all is lost. There’s enormous potential for the development and deployment of AI technologies in Europe because of its large number of global, industry-leading, and world-class industrial companies. As AI becomes more important in the post-Covid-19 world, only companies that adopt the new AI-based digital rules of competition are likely to thrive. Thus, Europe’s companies must incorporate AI into the core of their operational and business models.

However, far-reaching policy reforms, which will enable Europe’s industry players to use AI at scale in their operations, are essential if that is to happen. Europe holds several aces in its hand, but must play them right away.

How Europe Compares on AI Competitiveness

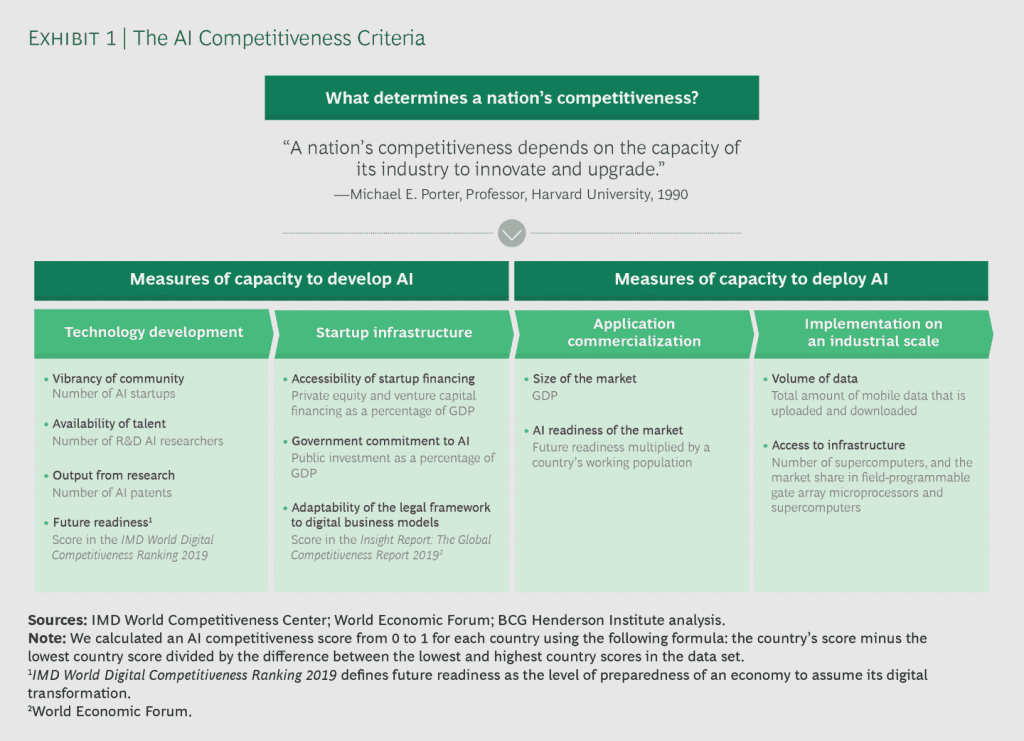

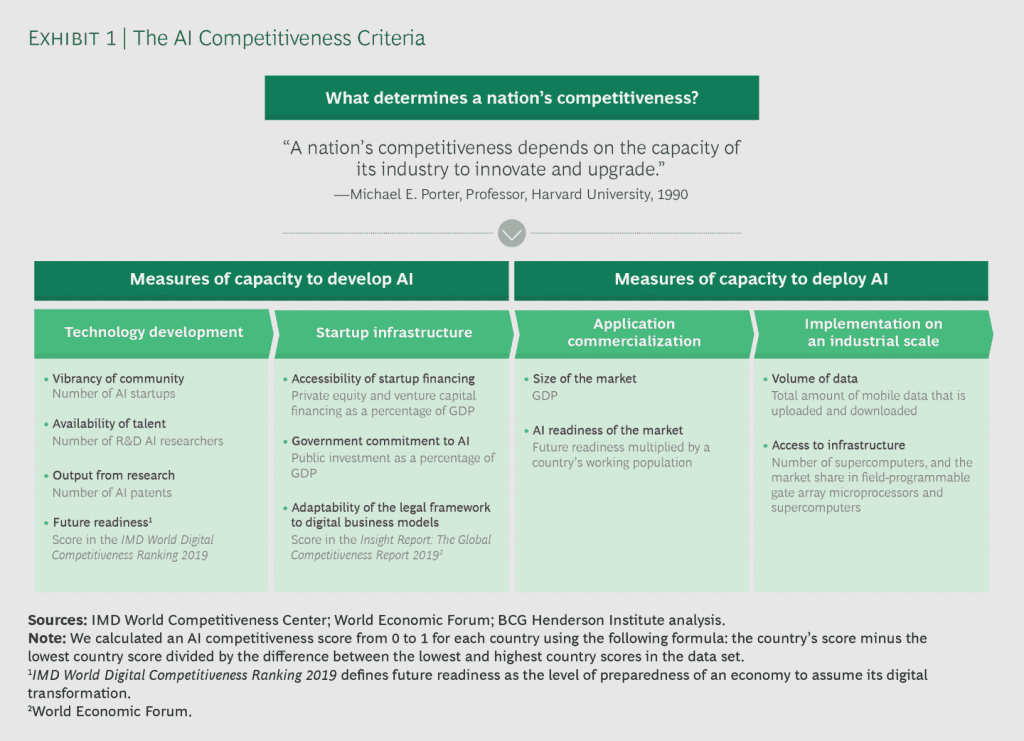

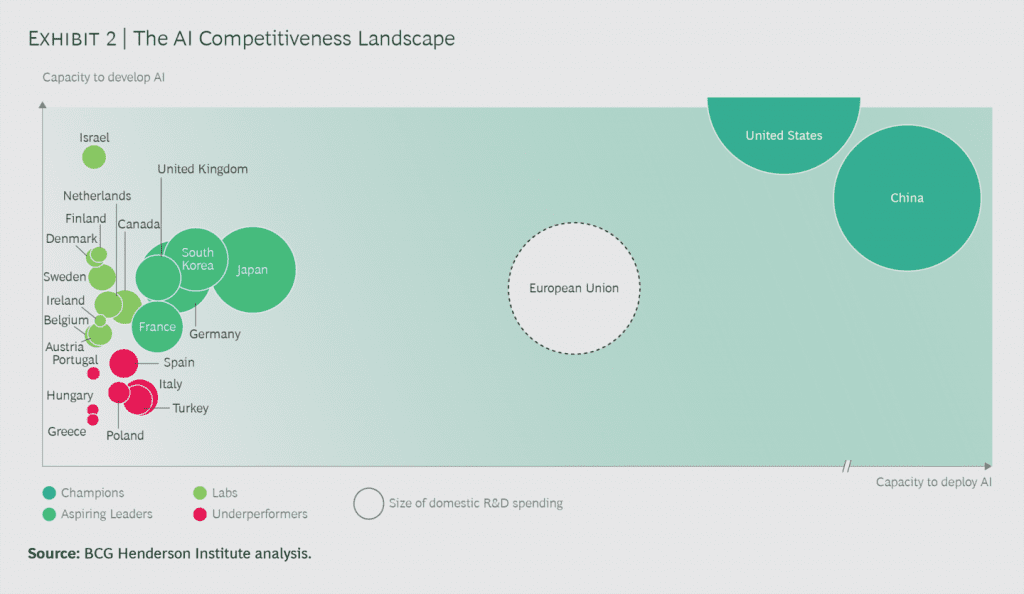

To understand how Europe compares with other countries, BCG Henderson Institute developed a measure for the AI competitiveness of several economies, drawing on Harvard University Professor Michael E. Porter’s definition that a nation’s competitiveness “depends on the capacity of its industry to innovate and (to) upgrade”. (See Exhibit 1) The objective was to create a snapshot that will help policy-makers and executives make decisions and take actions, so the focus is on AI’s economics — not its impact on areas such as the environment or the future of work.

There are two dimensions to the analysis. One, we studied if a country has put in place the business fundamentals for companies to innovate and develop AI technologies. That covered not just the ability to write algorithms, but also the factors necessary for the development of AI technologies by start-ups. It included the local availability of the right kind of talent and the facilitation by government or private sectors players to access to finance.

Two, we analyzed whether the country had created the conditions for companies developing AI applications to implement them at scale in local industries. That included having access to AI-ready companies, sufficient infrastructure, and sufficient local data to train algorithms so they can be used effectively.

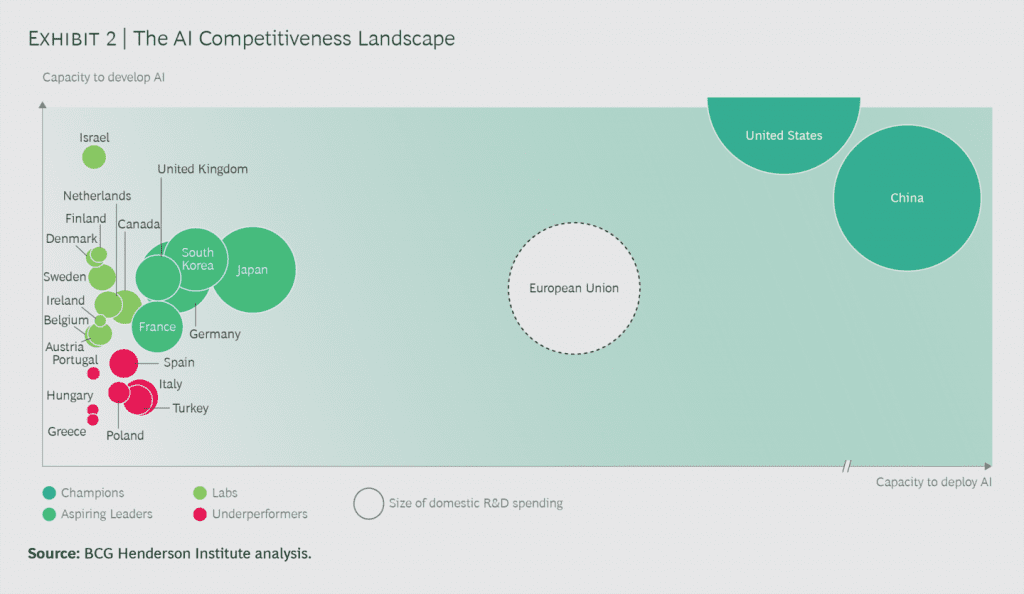

Using published data from reliable sources, we quantified the two dimensions. Our analysis shows that in terms of AI competitiveness, countries can be categorized into four groups: Champions, Aspiring Leaders, Labs, and Underperformers. (See Exhibit 2)

AI Champions. The US and China have developed enormous innovation capabilities and excel in using AI to make their companies more productive. They are light years ahead of every other country in the world.

AI Aspiring Leaders. Japan, South Korea, UK, France, and Germany have reached the threshold level of innovation capability, and, because of large domestic industries, they also possess the potential to upgrade them with AI. Importantly, treating Europe as one country — which it is not, as yet — brings it closer to the AI Champions.

AI Labs. The Nordic countries, Ireland, The Netherlands, and, in Europe’s proximity, Israel have all developed the capacity to innovate, with Israel at par with the AI Champions in this regard. However, industries in these countries don’t have the scale yet to fully benefit from the capabilities they’ve developed. Being entirely dependent on other countries to capitalize on the AI they’ve developed is unlikely to lead to AI competitiveness. These European countries will be able to become more competitive only by negotiating mutually beneficial partnerships with other companies and countries.

AI Underperformers. In Europe, most Southern and East European economies, including G20 members such as Italy, haven’t built their innovation capabilities to global levels yet. They possess a limited capacity to upgrade industries with AI.

Europe’s Paths

To catch up with the global leaders, Europe’s economies have to take different paths based on their current competitive positions.

First, the AI Underperformers must upgrade the fundamentals of business innovation, such as talent and finance, in their countries. Without those capabilities, they will find it difficult to develop industrial AI applications.

The silver lining is that innovation capabilities have been the priority of all the 18 national AI plans in Europe that we studied. That focus has yielded impressive results: Europe, with 5.7 million AI developers, leads both the US and China in numerical terms, according to Atomico. Still, Europe had spawned only a fraction of the Champions’ AI unicorns by the first quarter of 2020: 4 compared to 28 in the US and 11 in China, according to BCG Henderson Institute research.

Second, the Aspiring AI Leaders and AI Labs should strike global partnerships to expedite the business application of their technologies. These countries face a stiff challenge there; when companies around the world seek partnerships, digitally mature companies from the US and China are usually the most attractive options — not European ones. That’s because innovation capabilities are only one aspect of the challenge; companies’ ability to use AI at scale is equally critical — as China has clearly demonstrated.

Why China Excels — And Europe Lags

Although Europe has equally well-developed innovation capabilities, China has pulled ahead because of its capacity to upgrade its companies with AI technologies. In fact, it has become an AI Champion by creating all the requirements needed to deploy AI applications at scale.

China excels in commercializing AI, with the size of its economy creating a large market for AI applications. Coordinated government support has resulted in the rise of an adequate number of industrial ecosystems, neither too few nor too many, as in Europe. Importantly, these ecosystems, and the participants in them, are AI-ready, with China’s orchestrators, such as Alibaba, Tencent, and Haier, playing a key role in ensuring that. By proactively digitalizing small and medium enterprises, they exert a digital pull in many industries. For example, Alibaba.com and JD.com digitalized a third of China’s retail stores in less than two years’ time.

Vast amounts of the data required for machine learning are available in China because of public and private initiatives. For example, MBH, one of China’s largest data-labelling companies, already employs 300,000 data labelers, and, early in the year, hoped to grow its workforce by 50%. In addition, China has the largest number of supercomputers in the world, which is an advantage. It hosts around 40% of the 500 most powerful computers in the world, according to the 2019 Top 500 List, while the EU and even the US host only about 20% each.

By comparison, Europe has struggled to successfully commercialize AI at scale. The market is highly fragmented at present although a unified European market may be potentially large. Because the policy incentives in place strengthen national ecosystems, they result in the creation of subscale national monopolies rather than potential European champions. Brexit will only make it worse; the UK accounted for around 70% of AI investments in Europe between 2008 and 2019.

Moreover, European companies and industries aren’t AI-ready. They trail those in the US and China in terms of digitalization. One reason is the lack of direct pull from digital ecosystem orchestrators, as we recently argued in a recent article on digitalizing Europe’s industry. As a result, European companies have a long way to go before they will be AI-ready.

Access to data remains fragmented in Europe, and while language differences play a part, those can be overcome. The revised Public Sector Information directive and the recently-unveiled European Data Strategy will go a long way to ensure that government and companies share data, but much more needs to be done in this area.

Finally, Europe’s computing foundations are weaker than China’s. Most of the world’s quantum computing companies, cloud service-providers, and chip-manufacturers aren’t based on the continent. New European initiatives — such as the European Quantum Flagship, which plans to invest EUR 1 billion over 10 years to develop quantum computers — will help, but they risk being too research-focused. Even those efforts lack scale compared to, say, China’s $10-billion investment in a National Laboratory for Quantum Information Sciences.

Where Europe’s Policies Must Change

Europe is trying to catalyze the industrial application of AI at scale, but major shifts in thinking will be necessary to ensure that. The newly-installed European Commission has to shift policy dramatically in three ways:

- Expand Europe’s Digital Single Market. Europe has announced several initiatives to expand the Digital Single Market such as the creation of common European data spaces in strategic sectors. However, to foster an AI-enabling market, Europe has to bring about more sweeping changes. European countries must support the development of ecosystems at the European, rather than national, level. They must tackle the fears that competition will rise because of data integration and pool their national incentives. Without pan-European ecosystems, the Digital Single Market which is necessary to develop a unified market for goods and services, is unlikely to become a reality.

- Ensure AI Sovereignty. EU Commissioner Breton poses that “Europe cannot make its digital transition happen” without AI sovereignty, which implies access to the most advanced AI-enabling technologies and data at the global level, applied according to European rules and values, without being dependent on foreign players. While the European Commission’s data strategy, presented in February 2020, is a good first step, much more has to be done.

It’s critical for European governments to learn to dance with the world’s digital titans, but they must do so only on their terms. Cooperating on Europe’s terms with companies that are more committed to European AI sovereignty is the only way Europe can become more AI competitive. - Drive Scale in AI Usage. Europe’s policy-makers have proposed many industrial programs such as the Important Projects of Common European Interest in 2018, and the need to screen foreign direct investments to provide a fillip to the upgrading of its industries through AI. While these programs play an important role, they can easily turn protectionist, at least in terms of global perception. With the world’s attitude towards globalization changing, Europe has to walk a fine line, so that it ensures a level playing field for its companies without becoming protectionist.

How European Business Must Lead the Charge

If Europe is to become more AI competitive, European companies will have to play a pivotal role tomorrow. European companies must work with foreign corporations not only because it is a necessity, but also because they will prove to be mutually beneficial relationships.

Europe’s automotive sector is proof of all that its industry has to offer. The automobile manufacturers, such as Volkswagen Group, Daimler-Benz, and Fiat-Chrysler-PSA own the connection to the customer, the manufacturing capacity, the industrial data, and the production ecosystem. While AI hardware and software players from around the world, such as Intel Mobileye and Google Waymo, are taking the lead in developing autonomous driving technologies, on their own, they will not make much headway in Europe. That’s why Waymo has teamed up with Fiat and Tesla had tied up with Daimler. The European auto majors are in a position to demand partnerships on an equal footing. Rather than sticking to the transactional level, they should strike relationships that include long term knowledge and data sharing.

To do that, European companies have to change their mindsets. They have to become more AI-ready if they are to be regarded as attractive partners for companies from the US and China. They can draw inspiration from Amazon’s legendary Bezos Mandate. In 2002, Amazon founder and CEO Jeff Bezos sent a note insisting that the company’s software teams would share data, functionality, and communications only through service interfaces, and that all service interfaces, without exception, would have to be designed so they could be shared with developers in the outside world. That’s the kind of radical thinking that’s needed today if Europe Inc. is to come from behind and win the AI race.