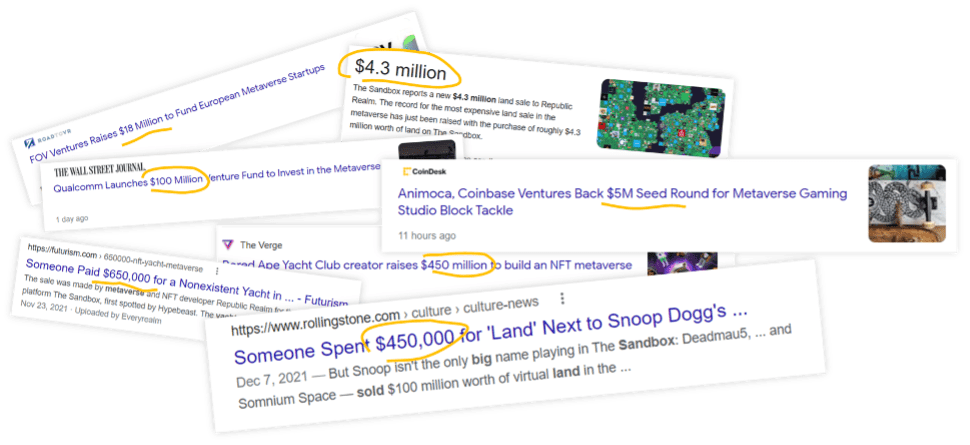

While being denounced by many investors, the digital assets bubble continues to inflate. The Sandbox, for instance, recorded over $350 million in sales volume in 2021. The price of its plots rose from an average of $1,200 to over $14,000 between October 2021 and January 2022, and the number of partnerships it signed with brands nearly quadrupled over the past 12 months. That’s a blessing and a curse for companies benefitting from it.

As opposed to spatial computing metaverse companies relying heavily on external financing, Web3 metaverse companies¹ can add the sales of crypto-assets – be it tokens, NFTs, lands, and the like – to VC funds and postpone the need to attract a large pool of users. Decentraland, for example, has fewer than 5 million users. Because of this, these players are under far less pressure to tailor their products to end-users – a reality confirmed by their clumsy navigation, simplistic graphic interfaces, and limited killer use cases to date.

This bubble – fuelled by today’s virtual assets frenzy – will most likely, as bubbles always do, deflate in a few months or whenever the current hype dies down. When that happens the continued flow of money will become conditional to actually attracting and keeping a crowd in the metaverse. Turning the leeway offered by this bubble to ignore user adaption into a curse!